IASbaba's Daily Current Affairs Analysis

Archives

(PRELIMS & MAINS Focus)

Syllabus

- Prelims – Current Affairs

Context: Recently the third edition of the ‘pan-India’ coastal defence Exercise ‘Sea Vigil-22’ is conducted by the Indian Navy.

About Operation Sea Vigil:

- Sea Vigil is a national-level coastal defence exercise which was conceptualised in 2018 for enhancing maritime security since ‘26/11’ Mumbai terror attack.

- The exercise is being conducted by the Indian Navy in coordination with the Coast Guard and other ministries involved in maritime activities.

- The exercise will be undertaken along the entire 7516-km coastline and Exclusive Economic Zone of India.

- The exercise involves all the Coastal States and Union territories along with other maritime stakeholders, including the fishing and coastal communities.

- Sea Vigil and TROPEX together will cover the entire spectrum Maritime Security challenges.

- Theatre Level Readiness Operational Exercise (TROPEX) is an inter-service military exercise conducted every two years.

Additional Information:

- An Automatic Identification System (AIS) was made compulsory for all vessels above 20 metres after the 2008 terrorist attacks in Mumbai.

- A project to install transponders on small fishing vessels, under 20 metres in length was planned and the pilot started in Tamil Nadu.

- The transponders with positioning navigation systems have been modified into a two-way communication system in this pilot.

Source: The Hindu

Syllabus

- Prelims – Science and Technology

Context: Union Minister of state for Science and Technology recently dedicated Indian Biological Data Centre (IBDC) to the nation.

About Indian Biological Data Centre:

- The Indian Biological Data Centre is India’s first national repository for life science data.

- It will store all life science data generated from publicly funded research in the country.

- It operates with the assistance from the Department of Biotechnology (DBT).

- In long-term, IBDC seeks to become a major data repository for all life science data originating from India.

- It was established at the Regional Centre of Biotechnology (RCB) in Faridabad, Haryana.

- It has a data “disaster recovery” site in National Informatics Centre (NIC) in Bhubaneshwar.

- It has a data storage capacity of around 4 petabytes.

- It hosts the ‘Brahm’ High Performance Computing (HPC) facility.

The objectives of IBDC:

- Provide IT platform for archiving of biological data originating from India.

- Develop standard operating procedures for storing and sharing of life sciences data based on FAIR (Findable, Accessible, Interoperable and Reusable) principle.

- Perform quality control and curation of data, maintain data backup and manage data life cycle.

- Develop web-based tools/APIs for data sharing or retrieval

- Organize training programme for analysing of large data and create awareness about the benefits of data sharing.

Significance:

- At present, most Indian researchers depend on the European Molecular Biology Laboratory (EMBL) and National Centre for Biotechnology Information databases for storing biological data. ‘Indian Biological Data Bank’ will reduce our dependency on them.

- TB Bacteria sequences will help not only in understanding the spread of multi-drug and extremely drug resistant TB in the country, but also aid the search for targets for new therapies and vaccines.

- With genomes of humans, animals, and microbes present in the same database, it will also help researchers in studying zoonotic diseases, that is, diseases that jump from animals to humans.

Source: PIB

Syllabus

- Prelims – Environment

In news: The latest Climate Change Performance Index has put India eighth amongst a group of 59 countries and the European Union (which account for 92% of the total GHG emissions)

- Denmark and Sweden have been assessed to be the top performers this year as well.

- The UK has been ranked 11, Germany 16, while China and the United States are placed at 51st and 52nd ranks respectively (China has dropped 13 places).

About CCPI:

- Published annually since 2005, it tracks countries’ efforts to combat climate change.

- Germanwatch, the NewClimate Institute and the Climate Action Network publish the index.

- It aims to enhance transparency in international climate politics and enables comparison of climate protection efforts and progress made by individual countries.

- The national performances are assessed based on 14 indicators in the following four categories:

- GHG emissions (weighting 40%)

- Renewable energy (weighting 20%)

- Energy use (weighting 20%)

- Climate policy (weighting 20%)

About India’s performance:

- India moved up two ranks.

- India earns a high rating in the GHG Emissions and Energy Use categories, with a medium for Climate Policy and Renewable Energy.

- The country is on track to meet its 2030 emissions targets (compatible with a well-below 2-degree Celsius scenario). However, the renewable energy pathway is not on track for the 2030 target.

- India’s upgraded NDC (nationally determined contributions)

- net zero target for 2070.

- at least 50 per cent of its electricity generation in 2030 from renewable energy sources (up from 40 per cent earlier)

- cuts in emissions intensity, 45 per cent from 2005 levels by 2030, instead of the 33-35 per cent which was the earlier target.

- India’s climate actions were still not consistent with the 1.5-degree Celsius goal since India has plans to increase its oil and gas production by over 5 per cent by 2030.

Source: Indian Express

Syllabus

- Prelims – Geography

In News: The Supreme Court of India has ruled in favour of residents of four Odisha villages (Tumulia, Jhupuranga, Ratansara and Kirpsara) whose land had been acquired by Mahanadi Coalfields Ltd (MCL) in 1988.

- The landowners will be given compensation per the Rehabilitation and Resettlement Act, 2013 (which replaced the old Land Acquisition Act, 1894)

- This is the first time the State has been obligated to ensure that resettlement and rehabilitation were provided in addition to compensation.

- Compensation by MCL includes developing housing plots, one-time cash settlements of Rs 25 lakh and to provide employment to two members of the displaced families with other monetary and tangible benefits.

About Mahanadi:

- It is a major river in East Central India.

- It arises from Raipur district of Chhatisgarh and flows for about 851 km through the states of Chhattisgarh and Odisha and finally merged with Bay of Bengal.

- Its tributaries include Seonath, the Jonk, the Hasdeo, the Mand, the ib, the Ong and the Tel.

- Hirakud Dam is located on the river.

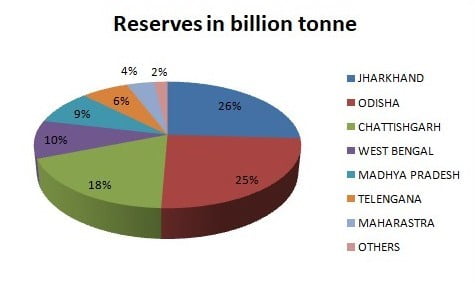

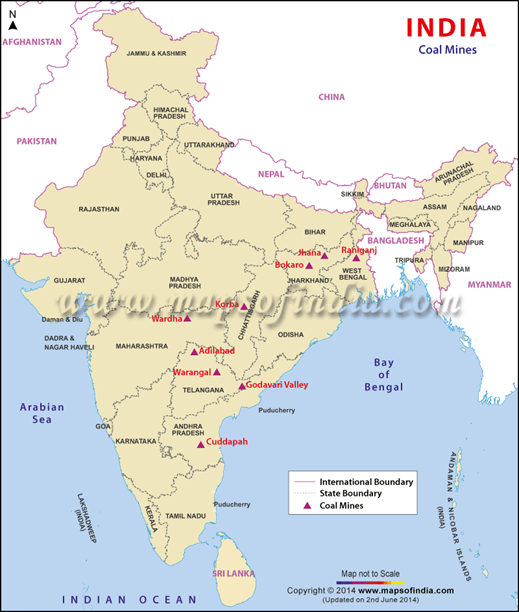

About Coal reserves in India:

- India ranks 5th in terms of coal reserves in the world.

- A total of 326.49 Billion tonnes of reserves estimated as in 2019 by Geological Survey of India.

- India has 50 Gondwana coalfields (250 mn years old) and 18 Tertiary coalfields (15-60 mn years old).

- Gondwana coal fields make up 98% of the total coal reserves and 99% of total coal production in India.

- Talcher coalfield, Odisha, is having the pride of highest geological reserve of 51.220 BT in the country.

- Distribution of coal in India is as follows:

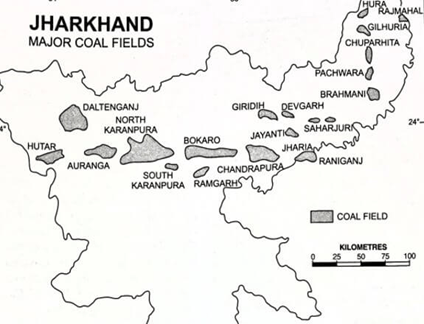

- Jharkhand coal fields are as follows:

About Mahanadi Coalfields Limited (MCL):

- It is one of the eight subsidiaries of Coal India Limited.

- It was carved out of South Eastern Coalfields Limited in 1992 with its headquarters at Sambalpur.

- In 2019, it got Miniratna status.

- Joint Ventures of MCL include Mahanadi Basin Power Limited (SPV), MJSJ Coal Limited, MNH Shakti Limited, Mahanadi Coal Railway Limited.

Source: Down To Earth

Previous Year Question

Q.1) Consider the following rivers: (2021)

- Brahamani

- Nagalwali

- Subarnarekha

- Vamsadhara

Which of the above rise from the Eastern Ghats?

- 1 and 2

- 2 and 4

- 3 and 4

- 1 and 3

Syllabus

- Prelims – Economy

In News: The report released by World Bank, titled ‘Financing India’s Infrastructure Needs: Constraints to Commercial Financing and Prospects for Policy Action’, estimated that India would need $840 billion over the next 15 years to meet the needs of the growing urban population

- India needs to increase its annual investment in city infrastructure from an average of $10.6 billion a year in the past decade to an average of $55 billion a year for the next 15 years.

Findings of the report:

- By 2036, 600 million people will be living in urban cities in India, representing 40% of the population.

- Currently, the central and state governments finance over 75% of city infrastructure, while urban local bodies (ULB) finance 15% through their own surplus revenues.

- About half of the investment needed – $450 billion – in the next 15 years was in the basic municipal services sector, while most of the remaining amount was to address urban transport requirements.

- Private sector participation in urban infrastructure investments is only 5%.

- As per ULBs of Tamil Nadu and Gujarat

- Over 3/4th of the total urban capital expenditure was from the Union and state governments.

- State governments share = 70% in Tamil Nadu and 55% in Gujarat

- Commercial financing share = only 1% in Gujarat, while 12% in Tamil Nadu

- Commercial financing means primarily loans from state-controlled financial institutions.

- Between 2011 and 2018, urban property tax stood at 0.15% of GDP compared to an average of 0.3-0.6% of GDP for low and middle-income countries.

- Low service charges for municipal services also undermines their financial viability and attractiveness to private investment.

- Recommendations of the World Bank

- Making the transfer of funds to cities formula-based and unconditional and increasing the mandates of city agencies gradually

- removing market frictions that cities face in accessing private financing.

Source Indian Express

Syllabus

- Prelims – Science and Technology

In News: The Third Ministerial ‘No Money for Terror (NMFT)’ Conference will be hosted by the Ministry of Home Affairs, with representatives of 75 countries and global bodies.

- Previous conferences were held in Paris (in 2018) and Melbourne (in 2019).

About NMFT conference:

- Aim: To discuss key issues including use of dark web, virtual assets, crowdfunding platforms, Money Transfer Service Scheme and hawala networks by terrorist entities

- To discuss global trends in terrorism and terrorist financing, the use of formal and informal channels of funding terrorism, emerging technologies and terrorist financing, and requisite international cooperation to address related challenges

- The declaration acknowledged the “essential” role of the Financial Action Task Force (FATF) in this regard and asked member states to enhance the traceability and transparency of financial transactions.

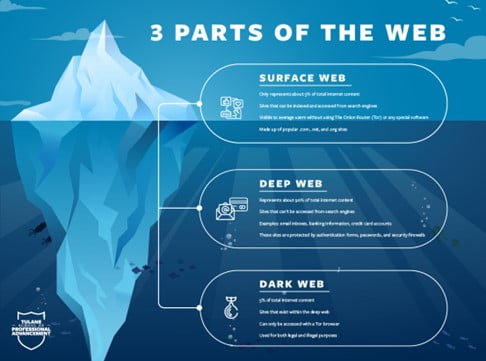

About Dark Web:

- The dark web is the part of the World Wide Web (or the Internet) that isn’t indexed by search engines.

- It uses a technology called “onion routing,” which protects users from surveillance and tracking through a random path of encrypted servers.

- Such as , when users access a site through Tor, their information is routed through thousands of relay points that cover the user’s tracks and make their browsing virtually impossible to trace.

- People use the dark web for both legal and illegal purposes.

- Illegal uses include buying and selling of illegal drugs, weapons, passwords, and stolen identities, as well as the trading of illegal pornography and other potentially harmful materials as well as malware, DOS attacks, espionage, etc.

- The dark web’s anonymity has also led to cybersecurity threats and various data breaches.

MUST READ: FATF

Source: Indian Express

Previous Year Question

Q.1) With reference to Web 3-0, consider the following statements: (2022)

- Web 3-0 technology enables people to control their own data.

- In Web 3-0 world, there can be blockchain based social networks.

- Web 3-0 is operated by users collectively rather than a corporation.

Which of the statements given above are correct?

- 1 and 2 only

- 2 and 3 only

- 1 and 3 only

- 1, 2 and 3

Syllabus

- Mains – GS 3 (Economy) and GS 3 (Environment)

Context: The Government and the RBI have decided to issue sovereign green bonds during Q4 of FY23. The finance minister in her Budget 2022 speech announced the government’s promise to issue a sovereign green bond to boost green investment.

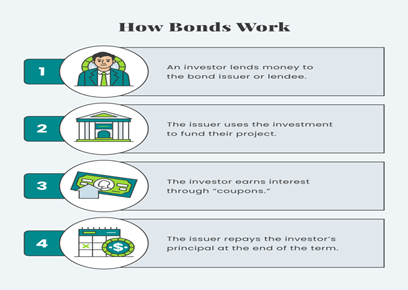

About Bond:

- A bond is a fixed-income instrument that represents a loan made by an investor to a borrower (typically corporate or governmental).

- A bond could be thought of as an (I owe you) I.O.U. between the lender and borrower that includes the details of the loan and its payments.

- Bonds are used by companies, municipalities, states, and sovereign governments to finance projects and operations.

- Owners of bonds are debtholders, or creditors, of the issuer.

About Sovereign Green Bonds:

- It is a type of fixed-income instrument that is specifically earmarked to raise money for climate and environmental projects.

- The first green bond was issued in 2007 by the European Investment Bank, the EU’s lending arm.

- This was followed a year later by the World Bank. Since then, many governments and corporations have entered the market to finance green projects.

- As a part of the Government’s overall market borrowings in 2022-23, sovereign green bonds will be issued for mobilising resources for green infrastructure.

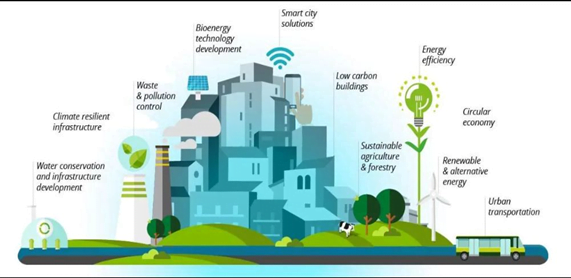

- A project is classified “green” on the basis of four key principles. These include:

- encouraging energy efficiency in resource utilisation,

- reducing carbon emissions and greenhouse gases,

- promoting climate resilience and

- improving natural ecosystems and biodiversity, especially in accordance with SDG (Sustainable Development Goals).

Aims and Objectives of SGB:

- They are aimed at energy efficiency, pollution prevention, sustainable agriculture, fishery and forestry, the protection of aquatic and terrestrial ecosystems, clean transportation, clean water, and sustainable water management.

- They also finance the cultivation of environmentally friendly technologies and the mitigation of climate change.

How are they different from conventional government bonds?

- Government bonds or government securities (G-Secs) are normally categorised into two — Treasury Bills and Dated or Long-Term Securities.

- Treasury Bills have a maturity of less than one year and they do not carry coupon rates. These are issued at a discount, while redeemed at face value.

- Dated Or Long-term securities are issued for a period above 1 year and up to 40 years. These bonds carry coupon rates and are tradable in the securities market.

- SGB is one form of dated security. It will have a tenor and interest rate. Money raised through SGrB is part of overall government borrowing.

- SGB may carry lower interest rate than that for regular government borrowings.

- The government and the RBI decided to borrow ₹5.92 lakh crore in H2 FY23 through dated securities, including ₹16,000 crore through issuance of SGBs.

Benefits of investing in Sovereign green bonds:

- Environmental causes: green bonds provide a way to help environmental causes through investing.

- Buying a green bond might be too costly for retail investors: Still there are green bonds that make it easy to invest in baskets of green bonds.

- Exemption from taxes: green bonds provide you with a way to earn income that is exempt from taxes.

- No Harm: The money that is being invested is being used in a way that is not harmful.

- Fight climate change: The green angle attracts a growing number of people who are more aware of and want to act to help fight climate change.

- Higher demand for green bonds equals lower cost of money which means reduced spending for business: These savings are passed on to the investor in the form of a dividend or used to lower the cost of funds thus increasing profitability.

- Some issuers also use the money to help restore water habitats and biomes and to take steps to reduce carbon output: These bonds tend to carry the same credit rating as other debts issued by the same firm.

- Longer maturities can lower the borrowing cost for green projects: Sovereign green bonds have been issued with an average tenor of 14 years the longest being 40 years issued by the Chilean government in 2021 drawing long-term investors like pension funds, insurers and those with a focus on environmental, social and governance (ESG) issues.

Challenges associated with Sovereign Green Bonds:

- Borrowing programme: The government has a gross borrowing programme of around 14.95-lakh crore. But in this case, there will be earmarking of the amount raised to specific targeted projects. Therefore, the crux is that the recipients of such funds should be compliant.

- Monitoring challenge: There would be a challenge with respect to monitoring how this green grading performs. This will be a challenge until such time the system of evaluation is streamlined as deviations from the norm are hard to capture.

- Pricing issue: Should they be lower than the regular bond or higher is the major question here. Ideally, it needs to be higher; this is because investors need to be rewarded for choosing to promote ESG goals.

- On the other side it can be argued that the rates can be lower than normal because investors like to reward green projects, anyway.

- Overseas launch: The downside is that once the government goes global, then credit rating will matter a lot as all bonds issued globally need to be rated.

- Once one is rated by them, there is constant scrutiny on domestic policies. Presently, this does not matter because the government of India does not borrow from the overseas market.

Way Forward:

- Centre’s approval to the framework for sovereign green bonds will definitely solidify India’s commitment towards its Nationally Determined Contribution targets.

- The flows from green bonds could be derailed for some time due to the war between Ukraine and Russia but over the long term we should be moving ahead fast in reshaping the climate debate and ensuring more funding for climate friendly initiatives.

- Developing markets, including Serbia, Nigeria, Egypt, Colombia, Fiji, Indonesia and Benin, have also issued sovereign green bonds.

- The proceeds were allocated to climate mitigation or adaptation projects.

Source: The Hindu

Previous Year Question

Q.1) With reference to the India economy, what are the advantages of “Inflation-Indexed Bonds (IIBs)”?

- Government can reduce the coupon rates on its borrowing by way of IIBs.

- IIGs provide protection to the investors from uncertainty regarding inflation.

- The interest received as well as capital gains on IIBs are not taxable.

Which of the statements given above are correct? (2022)

- 1 and 2 only

- 2 and 3 only

- 1 and 3 only

- 1, 2 and 3

Syllabus

- Mains – GS 2 (Governance)

Context: In recent times, Judicial accountability and judicial independence are seen as the opposite concept but it is necessary to ensure a balance between them.

Meaning of Judicial Accountability:

- The term judicial accountability means that the judges are responsible for the decisions they deliver. It also means that Judges be held accountable for their conduct.

- The Judiciary is not subjected to the same level of accountability as the Executive or the Legislative wings of the Government.

- The reason is that the principles of Judicial Independence and Accountability are sometimes regarded as fundamentally opposed to one another.

- Judicial independence is considered ‘an essential pillar of liberty and the rule of law’. So, if Judiciary is made accountable to the Legislature or the Executive it will impact its Independence. So special provisions have been provided to ensure judicial accountability.

Provision of Judicial Accountability:

- The Constitution of India provides for the removal of the judges of the Supreme Court of India (Article 124 of the Indian Constitution) and the High Courts (Article 124) for misbehaviour and incapacity by means of impeachment.

- Article 235 of the Constitution provides for the ‘control’ of the High Court over the subordinate judiciary.

- It provides an effective mechanism to enforce the accountability of the lower judiciary.

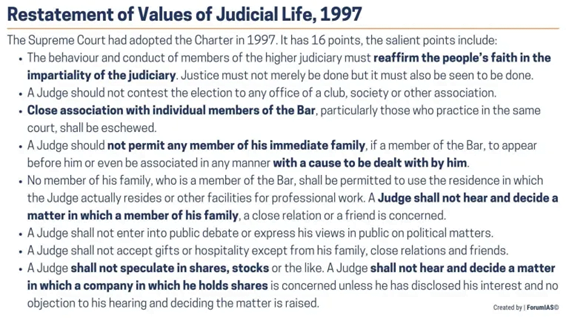

- In 1997, the Supreme Court of India adopted a Charter called the Restatement of Values of Judicial Life.

- The behavior and conduct of members of the higher judiciary must reaffirm the people’s faith in the impartiality of the judiciary.

Need to Enhance Judicial Accountability:

- Speedy Justice: Speedy justice is not only our fundamental right but also a prerequisite for maintaining the rule of law and delivering good governance.

- Impartial Functioning: It will help in ensuring an impartial functioning that would augment public trust in the institution of the judiciary.

- No Legal Obligation: Unlike the executive, the judiciary is not under any legal obligation to prepare annual reports or table them before Parliament or the State Legislature.

- Guardian of the Constitution: Judicial accountability is more important, as the derogation of values in the judiciary is far more dangerous than in any other wing of the government as the judiciary has to act as the guardian of our constitution.

- Narrow scope of the RTI: The scope of information which the courts are willing to share under RTI is not too wide.

- Public Confidence: The judiciary as an institution needs to preserve its independence, and to do this it must strive to maintain the confidence of the public in the established courts.

- Not under the direct control of SC: Under our constitutional scheme the high courts are autonomous constitutional bodies not subject to administrative directions of the Supreme Court.

Challenges in enhancing Judicial Accountability:

- The most important challenge for the regulation of judicial accountability is that the judiciary is an independent organ and the independence of the judges cannot be done away with.

- Any attempt to make the Judiciary accountable to the Legislature or Executive will make it susceptible to external pressure. It is very difficult to balance the Judicial Accountability vis-a-vis Judicial Independence.

- There exists no other way in which a judge can be removed except through impeachment and the process is long and complex.

- Due to this, it is difficult to augment judicial accountability. Again, the process can’t be diluted as it will impinge on judicial independence.

- Moreover, the SC and HC have the power of contempt that prevent imposition of anything on the judiciary without their consent.

- The judiciary is the final interpreter of laws, policies, rules etc. and can easily strike down anything as per its will.

Way Forward:

- The Supreme Court should be entrusted with direct responsibility for the functioning of the high courts.

- Only then can the highest court be an effective apex court, only then can the Supreme Court be made answerable, as it should be, for judicial governance for the entire country.

- Judges of the court must make annual financial disclosure statements, not privately to their respective chief justices, but publicly as done by the world’s oldest democracy, the USA.

- Judges must set an example for ministers, central and state, for members of Parliament and of state legislatures, and for all high officials of government, to follow.

- Judicial accountability should be ensured by enacting a law on the lines of the American model.

- Lot of care needs to be exercised so that the anti-corruption measures taken do not undermine the independence of the judiciary.

The actual challenge is to grant as much judicial independence as is necessary to have cases adjudicated impartially and neutrally. Maintaining this equilibrium between accountability and independence is the real task at hand.

Source: Indian Express

Previous Year Question

Q.1) With reference to Indian Judiciary, consider the following statements.

- Any retired judge of the Supreme Court of India can be called back to sit by the Chief Justice of India with prior permission of the President of India.

- A High court in India has the power to review its own judgement as the Supreme Court does.

Which of the statements given above is/are correct?

- 1 only

- 2 only

- Both 1 and 2

- Neither 1 nor 2

Syllabus

- Mains – GS 3 Economy, Science and Technology

Context:

- The use of technology in financial inclusion stands to be pertinent in today’s context as it paves the way towards inclusive growth through the upliftment of disadvantaged sections of society.

- Globally, from 51 percent in 2011, over 76 percent of adults now have a bank or mobile account. In addition, more than 80 nations have introduced digital financial services, some of which have attained a sizable market, including those utilising mobile devices.

- As a result, millions of formerly excluded clients are switching from only using cash for formal financial transactions to using digital banking services over mobile phones or other devices.

What is financial inclusion:

- Financial inclusion refers to the availability to both individuals and companies of useful and cost-effective financial goods and services.

- This includes payments, transactions, savings, credit, and insurance, that are sustainably and ethically provided.

- It allows social mobility and empower individuals and foster communities.

- It aids in promoting economic growth by launching and grow enterprises through utilising credit and insurance.

- Enhance overall quality of life by making investments in their children’s or own health or education, manage risk, and recover from financial setbacks, all of which can

Impediments to financial inclusion:

- Urban-Rural Digital Divide:

- Only 4.4% rural families have computers, compared to 14.4% of urban households and 14.9 percent of rural homes have internet connectivity, compared to 42 percent of families in metropolitan regions.

- Only 13 percent of adults in rural regions have access to the internet, compared to 37 percent in metropolitan areas.

- Nearly 80% of the population has a bank account but Indians are still not fully integrated into the formal banking system.

- Almost 18 percent (81.38 million) of bank accounts are inoperative, having “zero balance”

- 38 percent of accounts are inactive, which means that there have been no deposits or withdrawals in the past year

- more than 310 million individuals needing a basic cell phone which prevents account holders from receiving crucial information, such as details relating to account transactions.

- Increasing dependency on local agents because financial institutions are less willing to deliver messages for transactions of small quantities.

- Complicated banking procedures such as requiring identity credentials and maintaining a specific balance in an account.

- Access to credit is low

- small-time lenders charge high-interest rates in rural regions.

- Government programmes are yet to reach more remote areas to improve loan availability efficiently.

- Individuals find that online loans need more options from reliable financial institutions or digital lending.

- Limited access to computer and communication technologies due to low affordability and knowledgeable to utilise the internet.

- Lack of financial literacy causes low potential to maximise technological interventions.

- About 266 million adults are illiterate.

- Financial cyber-crimes are peaking in proportion to the growing distrust among rural residents, leading to lower adoption rates and a 6-percent jump in cybercrimes in the same year.

- Burden of providing diversified content across different regions, as individuals across India have different mother tongues.

- Personal Identifiable Information (PII) guidelines are not strictly enforced, causing large quantities of data readily accessible to numerous parties, raising serious concerns about data privacy.

- This includes Mobile numbers and Know Your Customer (KYC) Data.

- Few business correspondents’ (BCs) agents secretly record biometric information in clay, where they would subsequently recreate it for fraudulent purposes.

Suggestions towards inclusion:

- Technological advancements through various e-governance schemes such as GeM portal.

- Robust policy framework focused on the needs of citizens and the disadvantaged:

- Information and Communication Technology policies are primarily top-down and supply-focused.

- These policies should focus on digital inclusion strategies to ensure that rural areas can access proper internet connectivity.

- To ensure digital financial inclusion

- encourage the middle-aged bracket to educate themselves in reading and writing to use the various facilities they provide.

- Government websites to have information in multiple tongues, keeping in mind the language barrier and access to technology.

- To combat financial fraud, implementing a one-to-one Management of Financial Services (MFS) agent mentorship programme that focuses on vulnerable populations and teaches them the fundamentals of mobile and online interaction is possible.

- Removing barriers to financial service access for low-income persons by reducing transaction costs could facilitate increased participation, as observed in Nepal, where free and easily accessible accounts were more prevalent among women.

Way forward:

- The inability of the country to adapt to robust telecommunication infrastructure with a stable broadband internet connection and lack of access to technology has widened social exclusions already present and deprive people of necessary resources.

- The digital divide affects every area of life, including literacy, wellness, mobility, security, access to financial services, etc.

- Therefore, for a fast-growing nation such as India, the focus needs to shift from simple economic growth to equitable and inclusive growth.

Source ORF Online

Baba’s Explainer – Importance of agri exports

Syllabus

- GS-3: Agriculture; transport and marketing of agricultural produce and issues and related constraints

- GS-3: Effects of liberalization on the economy

Context: India’s agriculture exports have grown 16.5% year-on-year in April-September, and look set to surpass the record $50.2 billion achieved in 2021-22 (April-March).

- Interestingly, even commodities whose exports have been subjected to curbs — wheat, rice and sugar — have shown impressive jumps in shipments.

Read Complete Details on Importance of agri exports

Daily Practice MCQs

Q.1) With reference to “Climate Change Performance Index,” consider the following statements:

- It is released by the New Climate Institute and the Climate Action Network.

- It is a biannual publication which was first released in 2005.

- India is ranked 10th in the latest CCPI.

Which of the following statements are correct?

- 1 only

- 1 and 2 only

- 2 and 3 only

- 1, 2 and 3

Q.2) The report “Financing India’s Urban Infrastructure Needs” is published by the

- International Monetary Fund

- United Nations Conference on Trade and Development

- World Economic Forum

- World Bank

Q.3) Consider the following statements regarding Indian Biological Data Centre’ (IBDC):

- The Indian Biological Data Centre is India’s first national repository for life science data established in Bengaluru.

- It operates with the assistance from the Department of Biotechnology (DBT).

Which of the statements given above is/are correct?

- 1 only

- 2 only

- Both 1 and 2

- Neither 1 nor 2

Comment the answers to the above questions in the comment section below!!

ANSWERS FOR ’16th November 2022 – Daily Practice MCQs’ will be updated along with tomorrow’s Daily Current Affairs.st

ANSWERS FOR 15th November – Daily Practice MCQs

Q.1) – b

Q.2) – a

Q.3) – c