IASbaba's Daily Current Affairs Analysis

Archives

(PRELIMS & MAINS Focus)

Syllabus

- Prelims – Defence

Context: Recently, the 10th edition of IN-SLN bilateral maritime exercise SLINEX-23 was scheduled to take place in Colombo.

About SLINEX-23:-

- It is an India -Sri Lanka Bilateral Maritime Exercise.

- This is the 10th edition of the exercise.

- It is scheduled to take place in Colombo, Sri Lanka.

- Indian Navy is being represented by INS Kiltan.

- INS Kiltan: it is an indigenous Kamorta class ASW Corvette and

- INS Savitri: an Offshore Patrol Vessel.

- The Sri Lanka Navy is represented by SLNS Gajabahu and SLNS Sagara.

MUST READ: India-Sri Lanka relations

SOURCE: PIB

PREVIOUS YEAR QUESTIONS

Q.1) Consider the following statements (2020)

- The value of Indo-Sri Lanka Trade has consistently increased in the last decade.

- Textile and textile articles constitute an important item of trade between India and Bangladesh

- In the last five years, Nepal has been the largest trading partner of India in South Asia

Which of the statements given above is/are correct?

- 1 and 2 only

- 2 only

- 3 only

- 1,2, and 3

Q.2) With reference to ‘Indian Ocean Rim Association for Regional Cooperation (IOR-ARC)’, Consider the following statements: (2015)

- It was established very recently in response to incidents of piracy and accidents of oil spills

- It is an alliance meant for maritime security only

Which of the following statements given above is/are correct?

- 1 only

- 2 only

- Both 1 and 2

- Neither 1 nor 2

Syllabus

- Prelims –Art and Culture

Context: Mahavir Jayanti was celebrated recently.

About Jainism:-

IMAGE SOURCE: PPT – What is Jainism? PowerPoint Presentation, free download – ID:177736 (slideserve.com)

- The word Jain comes from the term Jina, meaning conqueror.

- According to Jain tradition, Mahavira was preceded by 23 Tirthankaras.

- The most important idea in Jainism is that the entire world is animated and even stones, rocks and water have life.

- According to Jain teachings, the cycle of birth and rebirth is shaped through karma and asceticism and penance are required to free oneself from the cycle of karma.

- This can be achieved only by renouncing the world.

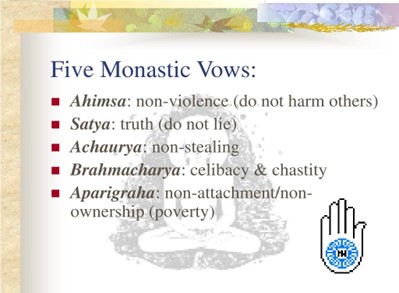

- In order to do so, Jain monks and nuns had to take the five vows.

- Seven Tattvas (elements) of Jain Philosophy are:-

- Jiva: living substance

- Ajiva: matter or non-living substance

- Asrava: an influx of Karmic matter in the soul

- Bandha: bondage of soul by Karmic matter

- Samvara: stopping of Asrava

- Nirjara: gradual removal of Karmic matter

- Moksha: attainment of perfect freedom or salvation

Spread of Jainism:-

- Over hundreds of years, it spread to different parts of north India and to Gujarat, Tamil Nadu and Karnataka.

Literature:-

- Jain scholars produced a wealth of literature in a variety of languages namely Prakrit, Sanskrit and Tamil.

- Jain literature is classified into two major categories

- Agam Literature: This consists of original scriptures compiled by Ganadhars and Srut-Chehalis.

- They are written in the Prakrit language.

- Non-Agam Literature: This consists of commentary and explanation of Agam literature and independent works, compiled by elder monks, nuns, scholars, etc.

- These are written in many languages such as Prakrit, Sanskrit, Old Marathi, Gujarati, Hindi, Kannada, Tamil, German and English.

About Lord Mahavira:-

- Mahavira was born in the village Kundgrama near Vaishali in Bihar.

- His father Siddhartha was the head of the jnathrika Kshatriya clan under Vajji of Vaishali

- His mother Trishala was the sister of Chetaka, the king of Vaishali.

- Mahavira was also related to Bimbisara, the ruler of Magadha.

- Mahavira was married to Yashoda.

- He had a daughter Anonja Priyadarshini whose husband Jamali, became the first disciple of Mahavira.

- At the age of 30, after the death of his father, he renounced his family, became an ascetic and proceeded in search of truth.

- He was accompanied by Makkhali Gosala.

- Makkhali Gosala, later left him and founded the Ajivika sect.

- At the age of 42, under a sal tree at fab Jambhikagrama on the bank of river Rijupalika, Mahavira attained Kaivalya (supreme knowledge).

- He was called:-

- Kevalin: perfect learned

- Jina or Jitendriya: one who conquered his senses

- Nrigrantha: free from all bonds

- Arhant: the blessed one

- Mahavira: the brave and

- His followers were named Jain.

- He delivered his first sermon at Pava to his 11 disciples.

- Later, he founded a Jain Sangha (Jain commune) at Pava.

- At the Age of 72 in 468 BC, he passed away at Pavapuri near Biharsharif in Bihar.

Principles of Jainism as Preached by Mahavira:-

- Rejected the authority of the Vedas and Vedic rituals

- Did not believe in the existence of God.

- Believed in Karma and the transmigration of the soul

- Laid great emphasis on equality.

MUST READ: Sittanavasal Jain Heritage Site

SOURCE: THE HINDU

PREVIOUS YEAR QUESTIONS

Q.1) With reference to Indian history, consider the following texts: (2022)

- Nettipakarana

- Parishishtaparvan

- Avadanashataka

- Trishashtilakshana Mahapurana

Which of the above are Jaina’s texts

- 1,2 and 3

- 2 and 4 only

- 1,3 and 4

- 2, 3 and 4

Q.2) With reference to Indian history, consider the following pairs: (2022)

Historical person Known as

- Aryadeva Jaina scholar

- Dignaga Buddhist scholar

- Nathamuni Vaishnava scholar

How many pairs given above are correctly matched?

- None of the pairs

- Only one pair

- Only two pairs

- All three pairs

Syllabus

- Prelims – Geography

Context: Recently, Chhattisgarh’s Nagri Dubraj rice variety, Basohli Painting of Jammu, Banarasi Paan, and Langda mango were accorded the geographical indication tag.

About Nagri Dubraj Rice:-

- It is known as the Basmati of Chhattisgarh because of its fragrance.

- It is produced by a women’s self-help group “Maa Durga Swasahayata Samuh“.

- The grain finds reference in Valmiki Ramayana.

- It is an indigenous variety and has small grains, is very soft to eat after cooking.

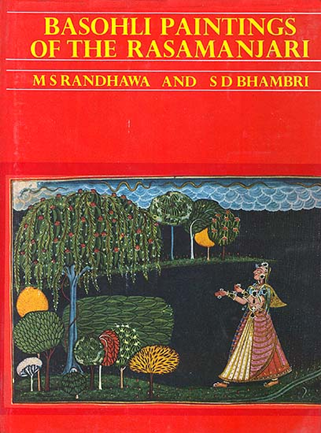

About Basohli Painting:-

IMAGE SOURCE: Basohli Paintings of the Rasamanjari | Exotic India Art

- Basohli painting belongs to the Kathua district of Jammu.

- It belongs to the Pahari School of Paintings.

- It has a unique style of miniature paintings that have a fusion of mythology and traditional folk art.

- The characteristic features of these paintings were the use of bright and bold colours like red, yellow, and blue in the borders, as well as for the generally flat background.

- The other distinguishing part was the facial features- a prominent nose and lotus-shaped eyes.

- The female figures can be categorised into three types according to their attire.

About Banarasi Paan:-

- It is made in Banaras, UP.

- It is known for its delicious taste.

- It is made using special ingredients in a unique way.

- It is an exotic combination of areca nuts, catechu (kattha) of fresh betel leaf, tobacco, and slaked lime.

- Other ingredients like rose petals (gulkand), silver foil (Parekh) etc. are added to it.

About Langda mango:-

- Langra aam is believed to have originated in Banaras (now Varanasi).

- It maintains its green colour after it gets ripe, while other mangoes change into yellow-reddish colour.

- This pulpy fruit is cultivated in mid-season in states including Uttar Pradesh, Bihar, Gujarat, Haryana, Himachal Pradesh, Jharkhand, Madhya Pradesh, Orissa, Punjab, West Bengal and Rajasthan

About GI Tag:-

- It is used for products which have specific geographical origins or have qualities that can be attributed specifically to the region.

- The GI tags are issued as per the Geographical Indications of Goods (Registration and Protection) Act, of 1999.

- It is a part of the intellectual property rights that comes under the Paris Convention for the Protection of Industrial Property.

- This tag is valid for a period of 10 years following which it can be renewed.

MUST READ: GI Tag for Mithila Makhana

SOURCE: BUSINESS STANDARD

PREVIOUS YEAR QUESTIONS

Q.1) System of Rice Intensification” of cultivation, in which alternate wetting and drying of rice fields is practised, results in: (2022)

- Reduced seed requirement

- Reduced methane production

- Reduced electricity consumption

Select the correct answer using the code given below:

- 1 and 2 only

- 2 and 3 only

- 1 and 3 only

- 1, 2 and 3

Q.2) Among the following, which one is the least water-efficient crop? (2021)

- Sugarcane

- Sunflower

- Pearl millet

- Red gram

Syllabus

- Prelims –Science and Technology

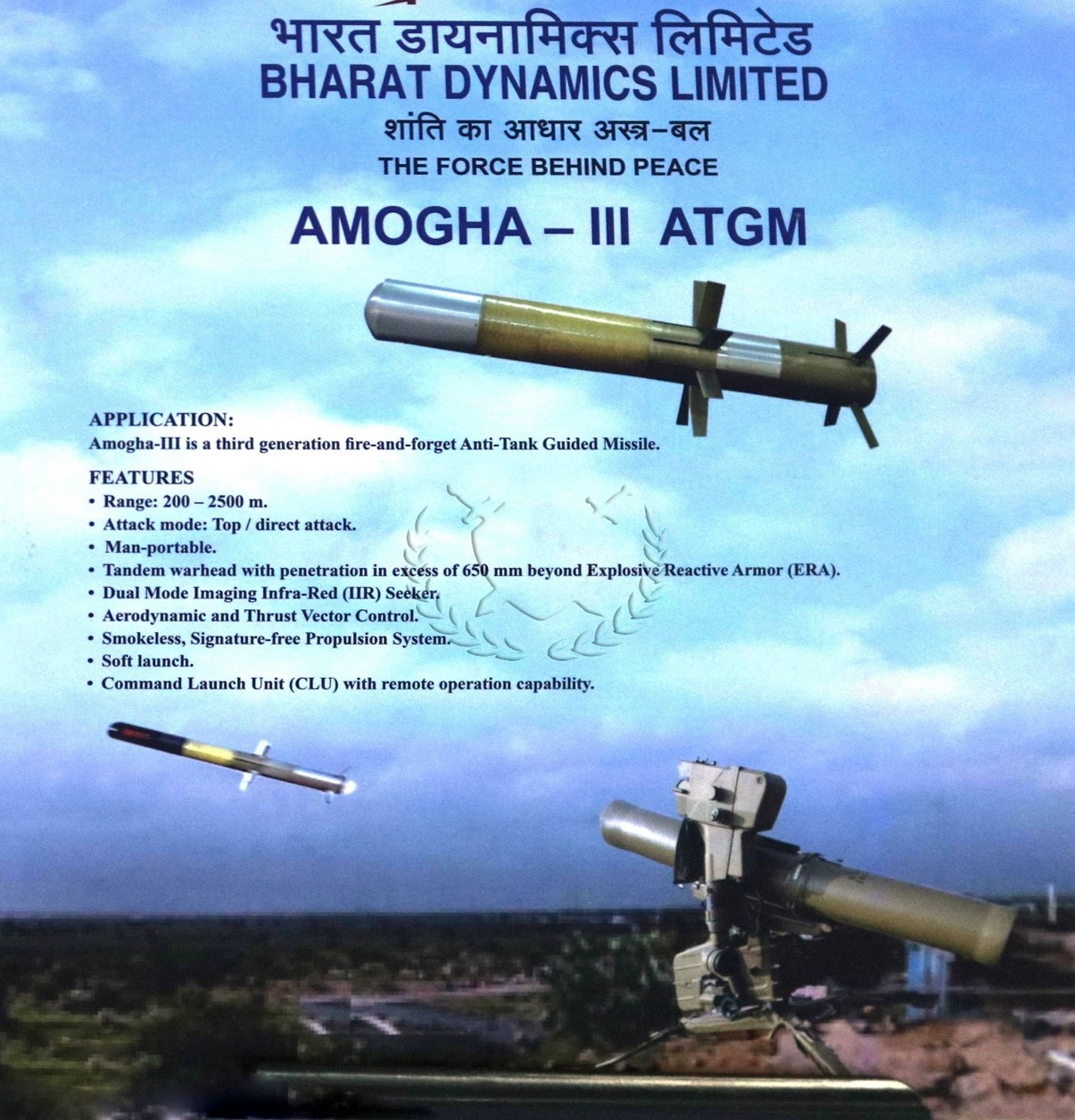

Context: Recently, the indigenous Anti Tank Guided Missile, Amogha-III tests were announced as successful.

About Amogha-III:-

IMAGE SOURCE: Defence Decode® on Twitter: “AMOGHA-III ATGM by India’s #BDL https://t.co/4G4fRbQQFD” / Twitter

- Amogha-III is an indigenous missile.

- It is developed under the Integrated Guided Missile Development Programme (IGMDP).

- It has a fire-and-forget capability.

- Fire-and-forget capability: meaning it does not require external intervention after launch.

- The missile features dual-mode Imaging Infra-Red (IIR) Seeker systems with a range of 200 to 2500 meters.

- It showcases a tandem warhead, consisting of two separate explosive charges that are detonated in sequence.

- The first charge, known as the precursor charge, penetrates the target’s armour, creating a hole.

- The second charge or the main charge then detonates inside, maximizing damage inflicted on the target.

- One of the unique features of the missile is it has both top and direct attack modes.

MUST READ: Helina Missile

SOURCE: FINANCIAL EXPRESS

PREVIOUS YEAR QUESTIONS

Q.1) Which one of the following statements best reflects the idea behind the “Fractional Orbital Bombardment System” often talked about in media? (2022)

- A hypersonic missile is launched into space to counter the asteroid approaching the Earth and explode it in space.

- A spacecraft lands on another planet after making several orbital motions.

- A missile is put into a stable orbit around the Earth and deorbits over a target on the Earth.

- A spacecraft moves along a comet with the same surface. speed and places a probe on its

Q.2) Which one of the following is a reason why astronomical distances are measured in light-years? (2021)

- Distance among stellar bodies does not change

- The gravity of stellar bodies does not change

- Light always travels in a straight line

- The speed of light is always the same

Syllabus

- Prelims –Economy

Context: Recently, the NFRA has pulled up a section of India Inc, including “a large listed firm”, for not complying with Indian Accounting Standards (Ind AS).

About The National Financial Reporting Authority (NFRA):-

- It was constituted in 2018 under section 132 (1) of the Companies Act, 2013.

- It is an independent regulator.

- It works under the Ministry of Corporate Affairs.

- It comes under the Ministry of Corporate Affairs.

- Objective: to continuously improve the quality of all corporate financial reporting in India.

Composition:-

- Chairperson: a Chartered Accountant and a person of eminence having expertise in accountancy, auditing, finance or the law (appointed by the Central Government) and a maximum of 15 members.

Functions and Duties:-

- It recommends accounting and auditing policies and standards to be adopted by companies for approval by the Central Government.

- It monitors and enforces compliance with accounting standards and auditing standards

- It oversees the quality of service of the professions associated with ensuring compliance with such standards and suggests measures for improvement in the quality of service.

Powers:-

- It has the same powers as the Civil Court.

- To debar the member/firm from practice as a member of ICAI between 6 months to 10 years as may be decided.

- To investigate matters of professional or other misconduct.

Jurisdiction:-

- Companies listed in India

- Unlisted Companies whose:

- Net worth ≥ Rs. 500 crore; or

- Paid up Capital ≥ Rs. 500 crore; or

- Annual turnover ≥ Rs. 1000 crore (As on 31st March of the preceding financial year); OR

- Companies whose securities are listed outside India.

MUST READ: Financial Services Institutions Bureau (FSIB)

SOURCE: FINANCIAL EXPRESS

PREVIOUS YEAR QUESTIONS

Q.1) Consider the following statements: (2022)

- In India, credit rating agencies are regulated by the Reserve Bank of India.

- The rating agency popularly known as ICRA is a public limited company.

- Brickwork Ratings is an Indian credit rating agency.

Which of the statements given above is correct?

- 1 and 2 only

- 2 and 3 only

- 1 and 3 only

- 1, 2 and 3

Q.2) Consider the following statements: (2021)

- The Governor of the Reserve Bank of India (RBI) is appointed by the Central Government.

- Certain provisions in the Constitution of India give the Central Government the right to issue directions to the RBI in the public interest.

- The Governor of the RBI draws his power from the RBI Act.

Which of the above statements is correct?

- 1 and 2 only

- 2 and 3 only

- 1 and 3 only

- 1, 2 and 3

Syllabus

- Prelims – International Relations

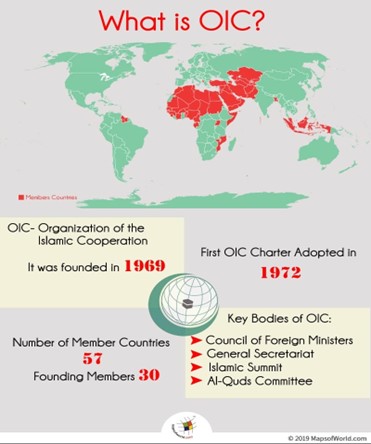

Context: The Indian Government slammed OIC for its comments on the Ram Navami violence recently.

About the Organisation of Islamic Cooperation (OIC):-

IMAGE SOURCE: What is the Organization of the Islamic Cooperation? – Answers (mapsofworld.com)

- It was established upon a decision of the historical summit which took place in Rabat, Kingdom of Morocco in 1969.

- Headquarters: Jeddah, Saudi Arabia.

- It is the second largest intergovernmental organization after the United Nations (UN).

- It has a membership of 57 states.

- Objectives:-

- It is the collective voice of the Muslim world.

- It endeavours to safeguard and protect the interests of the Muslim world.

- It aims to promote international peace and harmony among various people of the world.

- India is not a member of the OIC.

MUST READ: India-UAE and FTA

SOURCE: THE HINDU

PREVIOUS YEAR QUESTIONS

Q.1) What is the importance of developing the Chabahar Port by India? (2017)

- India’s trade with African countries will enormously increase.

- India’s relations with oil-producing Arab countries will be strengthened.

- India will not depend on Pakistan for access to Afghanistan and Central Asia.

- Pakistan will facilitate and protect the installation of a gas pipeline between Iraq and India

Q.2) Recently, a series of uprisings of people referred to as the ‘Arab Spring’ originally started in (2014)

- Egypt

- Lebanon

- Syria

- Tunisia

Syllabus

- Prelims – Economy

Context: Gross Direct Tax collections for the Financial Year 2022-23 registered a growth of over 20 per cent.

About Direct Taxes:-

- A direct tax is one that is levied directly on the taxpayer.

- It is paid directly to the government by those who are subjected to it.

- The Central Board of Direct Taxes is responsible for levying and collecting direct taxes as well as formulating other direct tax policies.

- Examples of Direct Tax: Income Tax, Corporation Tax, Minimum Alternate Tax, Capital Gain Tax etc.

Advantages of Direct Tax:-

- Economic Balance: The tax rate is set according to the country’s economic position.

- Ensures equality: Individuals and businesses with larger profits must pay higher taxes.

- Gives Certainty: The direct tax provides both the government and the taxpayers with a sense of certainty because the amount of tax that must be paid and collected is known to both the taxpayer and the government.

- During periods of high inflation, the government raises taxes in order to limit the demand for goods and services, resulting in a fall in inflation.

- It ensures that the government is held accountable.

Disadvantages of Direct Tax:-

- It can be easily evaded.

- Taxes are set arbitrarily by the Finance Minister if they are progressive.

- High taxes disincentivize people from saving and investing, causing the country’s economy to suffer.

- Paying direct taxes is quite inconvenient.

MUST READ: Tax-GDP ratio

SOURCE: AIR

PREVIOUS YEAR QUESTIONS

Q.1) Which among the following steps is most likely to be taken at the time of an economic recession? (2020)

- Cut in tax rates accompanied by an increase in interest rate

- Increase in expenditure on public projects

- Increase in tax rates accompanied by reduction of interest rate

- Reduction of expenditure on public projects

Q.2) Consider the following statements (2018)

- The Fiscal Responsibility and Budget Management (FRBM) Review Committee Report has recommended a debt-to-GDP ratio of 60% for the general (combined) government by 2023, comprising 40% for the Central Government and 20% for the State Government.

- The Central Government has domestic liabilities of 21% of GDP as compared to that of the war of GDP of the State 2 Governments.

- As per the Constitution of India, it is mandatory for a State to take the Central Government’s consent for raising any loan if the former owes any outstanding liabilities to the latter.

Which of the statements given above is/are correct?

- 1 only

- 2 and 3 only

- 1 and 3 only

- 1, 2 and 3

Syllabus

- Prelims –Environment and Ecology

Context: Recently, Bandipur completed 50 years as Project Tiger Reserve.

About Project Tiger:-

- The Indira Gandhi government launched Project Tiger in 1973 from the Jim Corbett National Park in Uttarakhand.

- The tiger is a globally endangered species. India had a tiger population ranging from 20000 to 40000 at the turn of the twentieth century.

- A group of conservationists and researchers applied sustained pressure on the Indian government around 1970.

- As a result, the Wildlife Protection Act was drafted in 1972, effectively ending all hunting in India and legally protecting individual species.

- In 1973, Project Tiger was launched.

- Dr. Kailash Sankhla was named the first Director of Project Tiger in India.

About Bandipur Tiger Reserve:-

- It was established in 1973 under Project Tiger.

- In 1985, by including adjacent areas from Venugopala Wildlife Park, it was enlarged and named as Bandipur National Park.

- It is situated in two contiguous districts (Mysore and Chamarajanagar) of Karnataka.

- It is located in the tri-junction area of the States of Karnataka, Tamil Nadu and Kerala.

- It forms a part of the Nilgiri Biosphere Reserve.

- It lies in one of the richest biodiversity areas of the country.

- It is surrounded by

- Mudumalai Tiger Reserve (Tamil Nadu) in the South,

- Wayanad Wildlife Sanctuary (Kerala) in the South-west &

- The Kabini Reservoir separates the Bandipur and Nagarahole Tiger Reserve on the North-west.

- The park is located between the Kabini River in the north and the Moyar River in the south.

- The Nugu River runs through the park.

- The highest point in the park is on a hill called Himavad Gopalaswamy Betta.

MUST READ: Tiger Estimation

SOURCE: THE HINDU

PREVIOUS YEAR QUESTIONS

Q.1) With reference to Indian laws about wildlife protection, consider the following statements : (2022)

- Wild animals are the sole property of the government.

- When a wild animal is declared protected, the such animal is entitled to equal protection whether it is found in protected areas or outside.

- Apprehension of a protected wild animal becoming a danger to human life is sufficient ground for its capture or killing.

Which of the statements given above is/are correct?

- 1 and 2

- 2 only

- 1 and 3

- 3 only

Q.2) Certain species of which one of the following organisms are well known as cultivators of fungi? (2022)

- Ant

- Cockroach

- Crab

- Spider

Syllabus

- Mains – GS 2 (Governance)

Context: Recently, Rajya Sabha passed the Competition Amendment Bill, 2023.

- The bill seeks to amend the Competition Act, 2002 which regulates competition in the Indian market and prohibits anti-competitive practices such as cartels, mergers and acquisitions that may have an adverse effect on competition.

About Competition Act, 2002:

- The Competition Act, 2002, regulates competition in the Indian market and prohibits anti-competitive practices such as cartels, abuse of dominant market position, and mergers and acquisitions that may have an adverse effect on competition.

- The Act has been amended by the Competition (Amendment) Act, 2007.

- The Competition Commission of India (CCI) is responsible for implementing and enforcing the Act.

- The Competition Appellate Tribunal is a statutory body created in accordance with the Competition Act, 2002 to hear and regulate on appeals against any rules made, decisions made, or orders made by the Competition Commission of India.

- The government replaced the Competition Appellate Tribunal with the National Company Law Appellate Tribunal (NCLAT) in 2017.

Amendments:

- Penalties: The Bill seeks to defines ‘turnover’ for the purpose of penalty as global turnover derived from all the products and services by a person or an enterprise

- The idea is to levy a penalty as a percentage of global turnover of the offending company, moving away from the current practice of levying a part of the local or relevant market turnover as penalty.

- Decriminalisation: The Bill decriminalises certain offences under the Act by changing the nature of punishment from imposition of fine to civil penalties.

- These offences include failure to comply with orders of the CCI and directions of the Director General related to anti-competitive agreements and abuse of dominant position.

- Expands CCI’s Scope: The new provisions expand the scope of CCI’s merger regulation by bringing deals worth more than Rs. 2,000 crore requiring regulatory clearance.

- Settlement Mechanism: The amendment introduces a scheme for commitment and settlement which is meant to reduce litigation by way of negotiated settlements.

- This scheme is available to cases of anti-competitive agreements and abuse of dominance, but not to cartels.

- Reducing US monetary Policy Influence: By reducing the use of the US dollar, countries can reduce the influence of US monetary policy on their own economies.

Significance:

- Enhancing Transparency: The inclusion of global turnover in the definition of “turnover” aims to enhance transparency and accountability in the Indian market.

- The amendment ensures that companies cannot escape penalties for competition law violations by shifting their revenue to other countries.

- Promoting Ease of Doing Business: The amendments to the Competition Act aim to reduce regulatory hurdles and promote ease of doing business in India.

- The amendments are expected to provide greater clarity to businesses operating in India and reduce the compliance burden for companies.

Way Forward:

India should focus on promoting free and fair competition by focusing on competitive neutrality i.e. creating level playing field between all private and public sectors and gradual opening of sectors such as mining, ports, railways, and electricity towards true competition.

The recent government initiatives to introduce limited privatisation of Indian Railways by introducing 109 pairs of routes for private train operations for passenger train services indicate India’s growing realization of the importance of introducing competition in the public sector.

Source: NewsOnAir

Syllabus

- Mains – GS 2 (Governance)

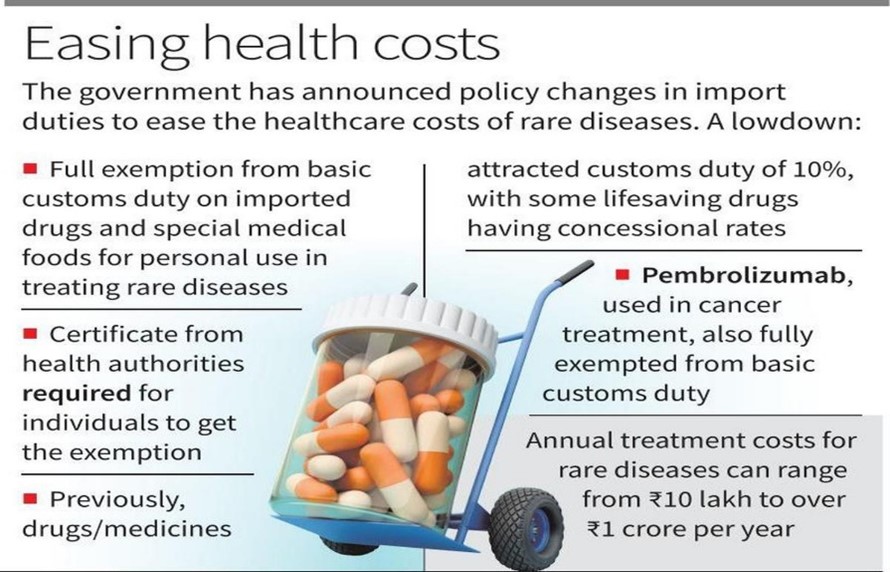

Context: The Union Government has given full exemption from basic customs duty on all drugs and food for special medical purposes imported for personal use for treatment of all Rare Diseases listed under the National Policy for Rare Diseases 2021.

- The exemption has been granted by the Central Board of Indirect Taxes and Customs (CBIC) by substituting “Drugs, Medicines or Food for Special Medical Purposes (FSMP)” instead of “drugs or medicines”.

Source: The Hindu

About Rare Diseases:

- Rare diseases (also called “Orphan” diseases) are broadly defined as diseases that infrequently occur in a population and three markers are used (the total number of people with the disease, its prevalence, and the availability/non-availability of treatment options).

- The World Health Organisation (WHO) defines a rare disease as having a frequency of less than 6.5-10 per 10,000 people.

- Example: Lysosomal Storage Disorders (LSD), Pompe disease, cystic fibrosis, muscular dystrophy, spina bifida, haemophilia etc.

- About 95% rare diseases have no approved treatment and less than 1 in 10 patients receive disease-specific treatment.

National Policy for Rare Diseases, 2021

- It categories ‘rare disease’ into three groups:

- Group 1: Disorders amenable to one-time curative treatment.

- Group-2: Diseases requiring long term/lifelong treatment having relatively lower cost of treatment and benefit has been documented in literature and annual or more frequent surveillance is required.

- Group 3:- Diseases for which definitive treatment is available but challenges are to make optimal patient selection for benefit, very high cost and lifelong therapy.

- The government would notify selected Centres of Excellence at premier government hospitals for comprehensive management of rare diseases.

- Provision for financial support of up to Rs. 50 lakhs to the patients suffering from any category of the Rare Diseases and for treatment in any of the Centre of Excellence (CoE) mentioned in NPRD-2021, outside the Umbrella Scheme of Rashtriya Arogaya Nidhi.

- In order to receive financial assistance for treatment of rare disease, the patient of the nearby area may approach the nearest Centre of Excellence to get him assessed and avail the benefits.

- Eight (08) Centres of Excellence (CoEs) have been identified for diagnosis, prevention and treatment of rare diseases.

- Five Nidan Kendras have been set up for genetic testing and counselling services.

Preventive measures adopted by the policy

The preventive measures adopted by the National Policy for Rare Diseases are as follows:

- Preventing birth of an affected child.

- Prenatal Screening

- Prenatal Screening by invasive testing

- New born screening

- Early postnatal diagnosis and treatment

Constitutional Provisions in the context of the new policy for rare diseases

- Article 38 says that the state will secure a social order for the promotion of welfare of the people.

- Providing affordable healthcare is one of the ways to promote welfare.

- Article 41 imposes duty on state to provide public assistance in cases of unemployment, old age, sickness and disablement etc.

- Article 47 makes it the duty of the State to improve public health, securing of justice, human condition of works, extension of sickness, old age, disablement and maternity benefits and also contemplated.

Challenges to be addressed by the policy

The National Policy for Rare Diseases, 2021, will address the following challenges:

- The research and development for majority of rare diseases is less as very little is known about pathophysiology of these diseases.

- The patient pool of rare diseases is less.

- Lack of availability and accessibility of medicines to rare diseases.

- Cost of treatment of rare disease is highly expensive.

Way Forward:

There is an immediate need to create awareness amongst the general public, patients & their families and doctors, training of doctors for early and accurate diagnosis. As resources are limited and have multiple uses, the policy makers have to make a choice of prioritizing certain set of interventions over others. There should be policy measures for supporting R&D and drug development for rare diseases.

Source: The Hindu

Practice MCQs

Q.1) Consider the following statements and Identify the tiger reserve:

- It was established in 1973 under Project Tiger.

- It is located in the tri-junction area of the States of Karnataka, Tamil Nadu and Kerala.

- It forms a part of the Nilgiri Biosphere Reserve.

Select the correct answer using the code given below:

- Mudumalai tiger reserve

- Bandipur tiger reserve

- Kaval tiger reserve

- Sathyamangalam tiger reserve

Q.2) With reference to India, consider the following:

- Income Tax

- Service Tax

- Minimum Alternate Tax

- Capital Gain Tax

Which of the above are examples of direct taxes?

- 1 2 and 4 only

- 2 3 and 4 only

- 1 3 and 4 only

- 1 2 3 and 4

Q.3) Consider the following pairs:

GI Tag item and State

- Basohli Painting – Bihar

- Nagri Dubraj Rice – Odisha

- Langda mango – Uttar Pradesh

How many pair/s given above is/are correctly matched?

- One pair only

- Two pairs only

- All three pairs

- None

Comment the answers to the above questions in the comment section below!!

ANSWERS FOR ’ 5th April 2023 – Daily Practice MCQs’ will be updated along with tomorrow’s Daily Current Affairs.st

ANSWERS FOR 4th April – Daily Practice MCQs

Q.1) – a

Q.2) – b

Q.3) – c