IASbaba's Daily Current Affairs Analysis

Archives

(PRELIMS & MAINS Focus)

Syllabus

- Prelims –GOVERNMENT INITIATIVES

Context: Recently, Minister Bhupendra Yadav launched the National Transit Pass System (NTPS).

Background:-

- It is a unified system for forest goods’ transport across India.

About National Transit Pass System:-

- Launched: 29 DEC 2023.

- Ministry: Ministry of Environment, Forest and Climate Change.

- Objective: to facilitate the seamless transit of timber, bamboo, and other forest produce across the country.

Salient Features:-

- National Transit Pass System (NTPS) pan-India to facilitate the seamless transit of timber, bamboo, and other forest produce across the country.

- Currently, transit permits are issued for the transport of timber and forest produce based on state-specific transit rules.

- The NTPS is envisioned as a “One Nation-One Pass” regime, which will enable seamless transit across the country. (Green Tug Transition Programme)

- This initiative will streamline the issuance of timber transit permits by providing a unified, online mode for tree growers and farmers involved in agroforestry across the country, contributing to the ease of doing business.

Key Features:-

- It is a role-based and workflow-based application available as a desktop-based web portal as well as a mobile application.

- Online registration and submission of the applications for Transit Permit (TP) or No Objection Certificate (NOC) through web portal and mobile app.

- Online application for Species grown on private land which are exempted from the transit pass regime and Online application submission for Species grown on private land which are not exempted from transit pass regime.

- Online generation of Transit Permit or NOC on the basis of category of species.

- E-payment system: Payment can be made online through the mobile app/web portal before downloading T.P.

Benefits:-

- Expedite issuance of transit permits for timber, bamboo and other minor forest produce without physically going to forest offices.

- Replace manual paper-based transit system with online transit system.

- One permit for the whole of India for transit of timber, bamboo and other minor forest produce for ease of doing business.

- Seamless movement across state borders from origin to destination through the help of a Mobile App. (North-East Cane and Bamboo Development Council (NECBDC))

- Promotion of agro-forestry activities.

- Saving of transportation costs and time .

MUST READ: National Rail Plan for Infrastructure Capacity Enhancement

SOURCE: THE INDIAN EXPRESS

PREVIOUS YEAR QUESTIONS

Q.1)Which one of the following best describes the term “greenwashing”? (2022)

- Conveying a false impression that a company’s products are eco-friendly and environmentally sound

- Non-inclusion of ecological/ environmental costs in the Annual Financial Statements of a country

- Ignoring the consequences of disastrous ecological while infrastructure development undertaking

- Making mandatory provisions for environmental costs in a government project/programme

Q.2) With reference to organic farming in India, consider the following statements (2018)

- The National Programme for Organic Production (NPOP) is operated under the guidelines and ‘directions of the Union Ministry of Rural Development.

- ‘The Agricultural and Processed Food Product Export Development Authority ‘(APEDA) functions as the Secretariat for the implementation of NPOP.

- Sikkim has become India’s first fully organic State.

Which of the statements given above is/are correct?

- 1 and 2 only

- 2 and 3 only

- 3 only

- 1, 2 and 3

Syllabus

- Prelims –ECONOMY

Context: India’s Goods and Services Tax (GST) revenues crossed ₹1,64,800 crore in December 2023 as per recent reports.

Background:-

- December’s GST kitty, for transactions undertaken in November 2023, is about 1.8% lower than the nearly ₹1.68 lakh crore collected a month earlier, which marked the third highest monthly receipts from the tax that was launched in July 2017.

About Goods and Services Tax (GST):-

- Launched:2017.

- Ministry: Ministry of Finance.

Historical Background:-

- The idea of a Goods and Services Tax (GST) for India was first mooted during the Prime Ministership of Shri Atal Bihari Vajpayee.

- In March 2011, the Constitution (115th Amendment) Bill, 2011 was introduced in the Lok Sabha to enable the levy of GST. However, due to a lack of political consensus, the Bill lapsed after the dissolution of the 15th Lok Sabha in August 2013.

- On 19th December 2014, The Constitution (122nd Amendment) Bill 2014 was introduced in the Lok Sabha and was passed by Lok Sabha in May 2015.

- The Constitutional amendment was notified as Constitution (101st Amendment) Act 2016 on 8th September, 2016.

- The Constitutional amendment paved the way for the introduction of Goods and Services Tax in India.

Salient Features:-

- Goods and Services Tax is an indirect tax used in India on the supply of goods and services.

- It is a value-added tax levied on most goods and services sold for domestic consumption.

- It was launched as a comprehensive indirect tax for the entire country.

- It is of three types:-

- CGST: levied by the Centre

- SGST: levied by the States and

- IGST: levied on all Inter-State supplies of goods and/or services.

GST Council:-

- The 101st Amendment Act of 2016 (122nd Amendment Bill), paved the way for the implementation of GST. (GST Appellate Tribunal)

- The GST Council is a joint forum of the Centre and the states under Article 279-A of the constitution.

- Article 279-A. gives the President the authority to appoint a GST Council by executive order.

- The members of the Council include the Union Finance Minister (chairperson), and the Union Minister of State (Finance) from various states.

- As per Article 279, it is meant to “make recommendations to the Union and the states on important issues related to GST, like the goods and services that may be subjected or exempted from GST, model GST Laws”.

- It also decides on various rate slabs of GST.

Benefits of GST:-

- Automated tax ecosystem: It helped the country in transitioning to an automated indirect tax ecosystem.

- Better Compliance: GST helped in achieving better tax compliance by subsuming multiple taxation and reducing in taxation burden in the last four years.

- E-invoice and More Revenue: The E-invoicing system helped reduce fake invoicing.

- Lesser transaction costs: After the introduction of GST, there has been a significant reduction in transaction costs.

- Cooperative Federalism: The customs portals are linked with the GST portal for credit availing on imports constitution of the GST Council and ensuring Centre-State partnership in the decision-making process.

Challenges of GST:-

- Refund delay issues.

- Lack of Dispute redressal mechanism

- Constant amendments confused the taxpayer and the tax administrators which created misunderstandings and misconceptions.

- Adaption and Technical Issues by Small and medium businesses.

MUST READ: GST- Five years on

SOURCE: THE HINDU

PREVIOUS YEAR QUESTIONS

Q.1) In India, the Central Bank’s function as the “lender of last resort” usually refers to which of the following? (2021)

- Lending to trade and industry bodies when they fail to borrow from other sources

- Providing liquidity to the banks having a temporary crisis

- Lending to governments to finance budgetary deficits

Select the correct answer using the code given below

- 1 and 2

- 2 only

- 2 and 3

- 3 only

Q.2) What is/are the most likely advantages of implementing ‘Goods and Services Tax (GST)’? (2017)

- It will replace multiple taxes collected by multiple authorities and will thus create a single market in India.

- It will drastically reduce the ‘Current Account Deficit’ of India and will enable it to increase its foreign exchange reserves.

- It will enormously increase the growth and size of the economy of India and will enable it to overtake China in the near future.

Select the correct answer using the code given below:

- 1 only

- 2 and 3 only

- 1 and 3 only

- 1, 2 and 3

Syllabus

- Prelims –GOVERNMENT SCHEMES

Context: Recently, The government has extended the tenure of Production Linked Incentive (PLI) Scheme for Automobile and Auto Components by one year with partial amendments.

Key highlights of amendments:-

- In a statement, Ministry of Heavy Industries said that under the amended scheme, the incentive will be applicable for a total of five consecutive financial years, starting from the financial year 2023-24.

- These amendments, effective from the date of publication in the Official Gazette, aim to provide clarity and flexibility to the scheme.

- The disbursement of the incentive will take place in the following financial year 2024-25.

- The scheme also specifies that an approved applicant will be eligible for benefits for five consecutive financial years, but not beyond the financial year ending on March 31, 2028.

- Furthermore, the amendments state that if an approved company fails to meet the threshold for an increase in Determined Sales Value over the first year’s threshold, it will not receive any incentive for that year.

- However, it will still be eligible for benefits in the next year if it meets the threshold calculated on the basis of a 10% year-on-year growth over the first year’s threshold.

- This provision aims to ensure a level playing field for all approved companies and safeguard those who prefer to front-load their investments.

- The amendment also includes changes to the table indicating the incentive outlay, with the total indicative incentive amounting to Rs. 25,938 crore.

About PLI scheme Automobile and Auto Components:-

- Launched:2021.

- Ministry: Ministry of Heavy Industries.

- Objective : to overcome the cost disabilities of the industry for the manufacture of Advanced Automotive Technology products in India.

Salient Features:-

- Union Cabinet approved the PLI-Auto Scheme on 15.09.2021 with budgetary outlay of Rupee 25,938 crore for a period of 5 years (FY2022-23 to FY2026-27).

- The Scheme is focused on Zero Emission Vehicles (ZEVs)e. Battery Electric Vehicle and Hydrogen Fuel Cell Vehicle.

- Base year: Financial Year 2019-20.

- The scheme has two components:-

- Champion OEM Incentive scheme: It is a ‘sales value linked’ scheme, applicable to Battery Electric Vehicles and Hydrogen Fuel Cell Vehicles of all segments.

- Component Champion Incentive Scheme: It is a ‘sales value linked’ scheme, applicable on pre-approved Advanced Automotive Technology components of all vehicles. Pre-approval of the eligible products will be done by Testing Agency.

- The incentive under the scheme is applicable from FY 2022-23 to FY 2026-27 (5 years’ period) and the disbursement is applicable in the subsequent financial year i.e. from FY 2023-24 to FY 2027-28.

- Eligibility: The scheme is open to existing Automotive companies as well as new Non-Automotive investor companies (who are currently not in the automobile or auto component manufacturing business).

- A minimum 50% domestic value addition will be required to avail of incentives under the scheme.

- The incentive will be applicable to the Determined Sales Value, which is defined as the incremental eligible sales of a particular year over the base year.

Benefits:-

- This scheme will also help to facilitate and promote deep localization for AAT products and enable the creation of domestic as well as global supply chains.

- The PLI-AUTO Scheme will boost manufacturing of Advanced Automotive Technology (AAT) Products. (Atmanirbhar Bharat 3.0)

MUST READ: Electric Vehicles

SOURCE: AIR

PREVIOUS YEAR QUESTIONS

Q.1) Consider the following actions: (2023)

- Detection of car crash/ collision which results in the deployment of airbags almost instantaneously.

- Detection of accidental free fall of a laptop towards the ground which results in the immediate turning off

- of the hard drive.

- Detection of the tilt of the smartphone which results in the rotation of display between portrait and landscape mode.

In how many of the above actions is the function of the accelerometer required?

- Only one

- Only two

- All three

- None

Q.2) With reference to Ayushman Bharat Digital Mission, consider the following statements: (2022)

- Private and public hospitals must adopt it.

- As it aims to achieve universal health coverage, every citizen of India should be part of it ultimately.

- It has seamless portability across the country.

Which of the statements given above is/are correct?

- 1 and 2 only

- 3 only

- 1 and 3 only

- 1, 2 and 3

Syllabus

- Prelims –POLITY

Context: The sale of Electoral Bonds began recently.

Background:-

- It will be sold through 29 authorised branches of SBI till the 11th of this month.

About Electoral Bonds:-

- An Electoral Bond is like a promissory note that may be purchased by a person who is a citizen of India or incorporated or established in India.

- A person being an individual can buy Electoral Bonds, either singly or jointly with other individuals.

- The bonds are like banknotes that are payable to the bearer on demand and are interest-free.

Historical Background:-

- The electoral bonds system was introduced in 2017 by way of a Finance bill.

- It was implemented in 2018.

Salient Features:-

- Electoral Bonds serve as a means for individuals and entities to make donations to registered political parties while maintaining donor anonymity.

- State Bank of India (SBI) issues the bonds in denominations of Rs 1,000, Rs 10,000, Rs 1 lakh, Rs 10 lakh, and Rs 1 crore.

- It is payable to the bearer on demand and interest-free.

- It is purchased by Indian citizens or entities established in India.

- It can be bought individually or jointly with other individuals.

- It is valid for 15 calendar days from the date of issue.

- The State Bank of India (SBI) is the authorized issuer.

- Electoral Bonds are issued through designated SBI branches.

- Electoral Bonds can be purchased digitally or through cheques.

- Encashment only through an authorized bank account of the political party.

- Political Parties must disclose their bank account with the Election Commission of India (ECI).

Eligibility:-

- Only the Political Parties registered under Section 29A of the Representation of the People Act (RPA), 1951 and which secured not less than one per cent of the votes polled in the last General Election to the House of the People or the Legislative Assembly of the State, shall be eligible to receive the Electoral Bonds.

Advantages of Electoral Bonds:-

- Ensures Accountability

- Discourage Cash

- More Transparency

- Maintains Anonymity

Disadvantages of Electoral Bonds:-

- Hindering Right to Know

- Unauthorized Donations

- Leads to Crony-Capitalism

MUST READ: Supreme Court Ruling on Electoral Bonds

SOURCE: AIR

PREVIOUS YEAR QUESTIONS

Q.1) Consider · the following statements in respect of the Constitution Day : (2023)

Statement-I :

Constitution Day is celebrated on 26th November every year to promote constitutional values among citizens.

Statement-II:

On 26 November 1949, the Constituent Assembly of India· set up a Drafting Committee under the Chairmanship of Dr. B. R. Ambedkar

to prepare a Draft of the Constitution of India.

Which one of the following is correct in respect of the above statements?

- Both Statement-I and Statement-II are correct and Statement-II is the correct explanation for Statement-I

- Both Statement-I and Statement-II are correct and Statement-II is not the correct explanation for Statement-I

- Statement-I is correct but Statement II is incorrect

- Statement-I is incorrect but Statement II is correct

Q.2) If a particular area is brought under the Fifth Schedule of the Constitution of India, which one of the following statements best reflects the consequence of it? (2022)

- This would prevent the transfer of land from tribal people to non-tribal people.

- This would create a local self-governing body in that area.

- This would convert that area into a Union Territory.

- The State having such areas would be declared a Special Category State.

Syllabus

- Prelims –INTERNAIONAL RELATIONS/DEFENSE

Context: Recently, divers discovered the wreckage and remains of crew members from a crashed US Air Force CV-22B Osprey aircraft off southwestern Japan.

Background:-

- Search and rescue operations are underway after a US special operations aircraft crashed off the shore of Japan’s Yakushima Island.

About CV-22B Osprey Aircraft:-

- It was developed to fulfil the needs of the U.S. Marine Corps, U.S. Air Force and U.S. Navy operational requirements worldwide.

- It is built by Boeing, an American aerospace company.

- It is a multi-engine, dual-piloted, self-deployable, medium-lift aircraft.

- It is used for a wide range of missions, including long-range infiltration, exfiltration, medium-range assault, special operations, VIP transport, resupply, disaster relief, search-and-rescue, medical evacuation, and humanitarian missions.

- It combines the vertical takeoff, hover, and vertical landing qualities of a helicopter with the long-range, fuel efficiency, and speed characteristics of a turboprop aircraft.

- It is equipped with dual Rolls-Royce Liberty AE1107C engines.

- Up to 24 personnel can sit inside the aircraft.

MUST READ: Advanced Medium Combat Aircraft (AMCA)

SOURCE: TIMES OF INDIA

PREVIOUS YEAR QUESTIONS

Q.1) Recently, India signed a deal known as ‘Action Plan for Prioritization and Implementation of Cooperation Areas in the Nuclear Field’ with which of the following countries? (2019)

- Japan

- Russia

- The United Kingdom

- The United States of America

Q.2) Consider the following in respect of the Indian Ocean Naval Symposium (IONS): (2017)

- Inaugural IONS was held in India in 2015 under the chairmanship of the Indian Navy.

- IONS is a voluntary initiative that seeks to increase maritime cooperation among navies of the littoral states of the Indian Ocean Region.

Which of the above statements is/are correct?

- 1 only

- 2 only

- Both 1 and 2

- Neither 1 nor 2

Syllabus

- Prelims –ENVIRONMENT AND ECOLOGY

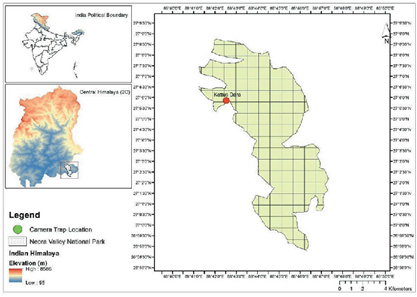

Context: Recently, the Royal Bengal Tigers was spotted at 10,509 feet in Neora Valley National Park.

Background:-

- The fresh image of a Royal Bengal Tiger, taken via trap cameras at the Neora Valley National Park in the hills of West Bengal, has confirmed the presence of the big cats at an altitude of 10,509 feet above sea level, according to a senior forest department official.

About Neora Valley National Park:-

IMAGE SOURCE: RESEARCHGATE

- Location: West Bengal, India.

- It is situated in the Eastern Himalayas.

- It is nestled between the Neora River and the Kalimpong hills.

- The Neora Valley National Park is bordered by the Pangolakha Wildlife Sanctuary of Pakyong District of Sikkim in the north and Toorsa Strict Reserve of Bhutan in the east.

- The highest point of the park is Rachela Pass.

- It consists of the characteristics of all the three sub-regions, namely Himalayan Montane System, Indian Peninsular Sub-region and the Malayan sub-region.

- Vegetation: Dry Mixed Forest, Wet Mixed Forest, Lauraceous Forest, Bak-Oak Forest, High level oak Forest, Coniferous Forest and Himalayas Moist Temperate Forest.

- Flora: rhododendron , bamboo, oak, ferns, sal etc.

- Fauna: Red Panda, Himalayan Tahr, Himalayan Black Bear, Sambar, Barking Deer, Serow, Goral, Dhole and Gaur etc. (Re-wilding programme of red pandas)

- The Neora Valley National Park is famous for its Red Panda

MUST READ: Kanchenjunga Biosphere

SOURCE: THE TELEGRAPH

PREVIOUS YEAR QUESTIONS

Q.1) With reference to India’s Desert National Park, which of the following statements are correct? (2020)

- It is spread over two districts.

- There is no human habitation inside the Park.

- It is one of the natural habitats of Great Indian Bustard.

Select the correct answer using the code given below:

- 1 and 2 only

- 2 and 3 only

- 1 and 3 only

- 1, 2 and 3

Q.2) If you want to see gharials in their natural best habitat, which one of the following is the best place to visit? (2017)

- Bhitarkanika Mangroves

- Chambal River

- Pulicat Lake

- Deepor Beel

Syllabus

- Prelims –SCIENCE AND TECHNOLOGY

Context: Recently, WHO prequalified a second malaria vaccine manufactured by the Serum Institute of India.

Background:-

- In October 2023, WHO recommended its use for the prevention of malaria in children, following the advice of the WHO Strategic Advisory Group of Experts (SAGE) on Immunization and the Malaria Policy Advisory Group.

About R21 vaccine:-

- Developed by: Oxford University and manufactured by Serum Institute of India.

- It is the world’s second WHO-recommended malaria vaccine, after RTS, S/AS 01.

- The new vaccine will be sold under the brand Mosquirix.

- It is the first vaccine to achieve more than 75% effectiveness.

- It has been approved for use in children aged 5-36 months, the age group at highest risk of death from malaria.

- Ghana became the first African country which gave approval for the vaccine.

Advantages:-

- High efficacy.

- Low cost.

- Mass production ability

MUST READ: iNCOVACC

SOURCE: THE HINDU

PREVIOUS YEAR QUESTIONS

Q.1) In the context of vaccines manufactured to prevent the COVID-19 pandemic, consider the following statements: (2022)

- The Serum Institute of India produced a COVID-19 vaccine named Covishield using an mRNA platform.

- The Sputnik V vaccine is manufactured using a vector-based platform.

- COVAXIN is an inactivated pathogen-based vaccine.

Which of the statements given above is correct?

- 1 and 2 only

- 2 and 3 only

- 1 and 3 only

- 1, 2 and 3

Q.2) With reference to recent developments regarding ‘Recombinant vector Vaccines’, consider the following statements: (2021)

- Genetic engineering is applied in the development of these vaccines.

- Bacteria and viruses are used as vectors.

Which of the statements given above is/are correct?

- 1 only

- 2 only

- Both 1 and 2

- Neither 1 nor 2

Practice MCQs

Q1) Consider the following pairs:

| DISEASE | CAUSED BY |

| Chickenpox | Pasteurella pestis |

| Plague | Varicella zoster virus (VZV) |

| Zika | Zika viruses |

How many of the above pairs are correctly matched?

- Only one

- Only two

- All three

- None

Q2) Consider the following statements

Statement-I :

The Neora Valley National Park is famous for its Red Panda population.

Statement-II :

It is located in Assam.

Which one of the following is correct in respect of the above statements?

- Both Statement-I and Statement-II are correct and Statement-II is the correct explanation for Statement-I

- Both Statement-I and Statement-II are correct and Statement-II is not the correct explanation for Statement-I

- Statement-I is correct but Statement II is incorrect

- Statement-I is incorrect but Statement II is correct

Q3) With reference to the CV-22B Osprey Aircraft, consider the following statements:

- It is a single-engine aircraft.

- It is equipped with dual Rolls-Royce Liberty AE1107C engines.

- Up to 14 personnel can only sit inside the aircraft.

How many of the statements given above is/are correct?

- 2 only

- 1, 2 and 3 only

- 2 and 3 only

- 1 only

Comment the answers to the above questions in the comment section below!!

ANSWERS FOR ’ 2nd January 2024 – Daily Practice MCQs’ will be updated along with tomorrow’s Daily Current Affairs.st

ANSWERS FOR 1st January – Daily Practice MCQs

Q.1) – b

Q.2) – c

Q.3) – a