IASbaba's Daily Current Affairs Analysis

IASbaba’s Daily Current Affairs (Prelims + Mains Focus)- 15th February 2018

Archives

(PRELIMS+MAINS FOCUS)

Centre studying plea to ban PFI

Part of: GS Mains III (Internal Security)

(You can skip this article, but recommended to know the issue, especially if you are an IPS aspirant)

In News:

The proposal to ban Popular Front of India (PFI), a Muslim political organisation predominantly operating out of Kerala, has been gaining momentum over the last few months.

Kerala has asked for a ban on PFI and the Centre is collecting more facts and evidence about the activities of the outfit before declaring it an “unlawful association”.

The involvement of alleged members of the organisation in political killings, religious conversions and terror activities have been projected as the reason for the ban.

Genesis of PFI:

Even though PFI as an organization came to existence in 2006, the origins of the PFI dates back to 1993.

Following the demolition of the Babri Masjid, a political organization by the name NDF (National Development Front) was created in Kerala – to protect the interests of the Muslim community in the state.

Over the years NDF claimed to be an organization working for the socio-economic welfare of the state’s Muslim community. However, the extremist nature of the organization came to light, after some of its members were arrested for rioting and murdering eight Hindus in Kazhikode in 2003.

NDF’s activities were limited to Kerala. However, a decision was made to create a unified organization, merging like-minded organizations from Kerala, Karnataka and TN.

Thus in 2006, PFI was formed merging NDF with Karnataka Forum for Dignity and Maintha Neethi Pasarai in TN. Later organizations from other states merged.

Despite the representations from different states, the activities of the PFI remain strongest in Kerala.

There is also criticism and allegations that there has been strong association between PFI and SIMI.

Other organizations which were banned earlier:

- Organizations like SIMI (Students’ Islamic Movement of India) and Indian Mujahideen – have been banned.

SIMI started with the aim of working for the welfare of Muslim youth, there was a radical shift in its ideology in the 1980s.

SIMI functions on three principles — governing human life on the basis of Quran, propagation of Islam and Jihad for the cause of Islam. It is against ‘western ideals’ and rejects secularism, democracy and nationalism. Some of its oft-repeated objectives are restoration of the ‘khilafat’, (caliphate), emphasis on ‘ummah’ (Muslim brotherhood), and the need for a Jihad to establish the supremacy of Islam.

Things to do:

- Try to know the genesis of Indian Mujahideen (IM) and why it is banned?

- For reference: https://www.thequint.com/explainers/explainer-why-government-wants-pfi-banned-popular-front-of-india

Article link: Click here

Special Category Status

Part of: Prelims and GS Mains II – Indian Polity and Governance; Centre-State Relations

A growing clamour for Special Category Status in Andhra Pradesh has led to State-wide protests, and heated debates in Parliament.

Understanding basics:

What is the special category status?

- The Constitution does not include any provision for categorisation of any State in India as a Special Category Status (SCS) State.

- ‘Special category’ status is a classification given by Centre to assist in development of those states that face geographical & socio-economic disadvantages. (Given below)

- The classification came into existence in 1969 as per the suggestion given by the Fifth Finance Commission, set up to devise a formula for sharing the funds of Central govt. among all states.

The National Development Council (NDC) granted this status based on a number of features of the States which included:

- hilly and difficult terrain,

- low population density or the presence of sizeable tribal population,

- strategic location along international borders,

- economic and infrastructural backwardness and non-viable nature of State finances.

What kind of assistance do SCS States receive?

The SCS States used to receive block grants based on the Gadgil-Mukherjee formula, which effectively allowed for nearly 30 per cent of the Total Central Assistance to be transferred to SCS States as late as 2009-10.

Following the constitution of the NITI Aayog (after the dissolution of the Planning Commission) and the recommendations of the Fourteenth Finance Commission (FFC), Central plan assistance to SCS States has been subsumed in an increased devolution of the divisible pool to all States (from 32% in the 13th FC recommendations to 42%) and do not any longer appear in plan expenditure.

Centre bears 90% of the state expenditure (given as grant) on all centrally-sponsored schemes and external aid while rest 10% is given as loan to state. For general category, the respective grant to loan ratio is 30:70 where as external aid is passed on in the same ratio as received at the centre.

Unspent money does not lapse and gets carry forward.

What other States are seeking SCS status?

- Apart from Andhra Pradesh which is in the news lately, Bihar and Odisha had recently demanded SCS status but they have not been granted the same as they did not meet the criteria.

Things to do:

- Try to find out which states have been accorded SCS status.

India-Iran: India’s multi-dimensional engagement with West Asia

Part of: Prelims and Mains GS Paper II: India-Iran relations; India and the World

In News:

- Iranian President Hassan Rouhani will visit India from February 15 to 17.

- Rouhani coming exactly a month after Israel Prime Minister Benjamin Netanyahu (Iran’s biggest rival)

- Rouhani visit signals India aims for balance in its ties in West Asia.

India-Iran ties:

- Will seek to iron out issues on trade, connectivity, banking and energy.

- Access to Central Asia: Iran is not just important for India’s energy needs but also its only route for access to Central Asia.

- Chabahar Port project: progress of the $500-million Beheshti port project in Chabahar.

- Rupee-Rial Mechanism: The two sides are now discussing the possibility of a “rupee-rial mechanism”, in addition to the current channel through UCO Bank for rupee payments.

- Discussions on pending negotiations over the Farzad-B gas and oil fields that India has expressed its interest in.

FATF meeting

- Iran is likely to seek India’s support at the upcoming meeting of the UN’s Financial Action Task Force, where Iran is hoping to exit a blacklist on money laundering and terror finance, even as India hopes to see Pakistan put on a “grey-list” at the meeting.

Do you know?

- India is already routing a consignment of 1.1 million tonnes of wheat to Afghanistan through the existing facilities at Chabahar.

- European banks have refused to support the trade, given the uncertainty over fresh sanctions from the U.S.

Things to do:

- Know about – Significance of Chabahar port (Click here) and UN’s Financial Action Task Force (Click here)

- Revise 13th Feb DNA (Growing importance of West Asia) – Click here

Article link: Click here

India-Iraq: India offers support for reconstruction of Iraq

Part of: Prelims and Mains GS Paper II: India-Iraq relations; India and the World

In News:

- India has called for a comprehensive political settlement and reconciliation in Iraq, at the International Conference for Reconstruction of Iraq in Kuwait.

- The Conference was attended by major world powers to chalk out a plan of recovery for the country.

India’s support to Iraq:

- Iraq is yet to raise the resources for recovery from the destruction from years of foreign invasion and war with the Islamic State.

- Since the outbreak of the war in 2003, India had frequently responded to the humanitarian needs in Iraq and contributed in several ways, including providing $10 million in aid towards the International Reconstruction Fund Facility for Iraq (IRFFI) for investments, reconstruction and development in Iraq.

- India plays crucial part in the reconstruction and called for an end to global terrorism.

- Major projects – petrochemicals, health, education, infrastructure and other sectors.

Do you know?

- Like UAE, Iraq also supports India’s proposed Comprehensive Convention on International Terrorism in the United Nations.

Things to do:

- Know about Comprehensive Convention on International Terrorism (CCIT) – Click here

Article link: Click here

(MAINS FOCUS)

GOVERNANCE

TOPIC: General Studies 2:

- Issues related to welfare schemes

- Government policies and interventions for development in various sectors and issues arising out of their design and implementation.

- Welfare schemes for vulnerable sections of the population by the Centre and States and the performance of these schemes; mechanisms, laws, institutions and bodies constituted for the protection and betterment of these vulnerable sections

Economic Survey 2016-17 on Misallocation of centrally sponsored schemes (CSS)

Introduction:

Economic Survey 2018 has highlighted the weakness of existing welfare schemes which are riddled with misallocation, leakages and exclusion of the poor. It has pushed the case for implementing UBI to weed out these problems.

The below article analyzes the following –

- Weakness in resource allocation of centrally sponsored schemes (CSS) – especially misallocation of the government’s resources across different districts.

- What explains this misallocation of resources across districts?

- What are the consequences of such misallocation of resources?

District-wise spending of the below provided six top CSS (for FY16) which accounts for more than 50% of total CSS spending has been analyzed in order to check if indeed there is misallocation of the government’s resources.

- Mahatma Gandhi National Rural Employment Guarantee Scheme (MGNREGS)

- Sarva Shiksha Abhiyan (SSA)

- Mid Day Meal Scheme (MDM)

- Pradhan Mantri Gram Sadak Yojana (PMGSY)

- Pradhan Mantri Awas Yojana (PMAY) and

- Swachh Bharat Mission (SBM)

Outcome of the result:

The survey has found the following –

Misallocation of resources across districts

- There is poor welfare-spending per person in different districts. In other words, the poor belonging to a poor district receive less welfare spending than the poor from richer districts.

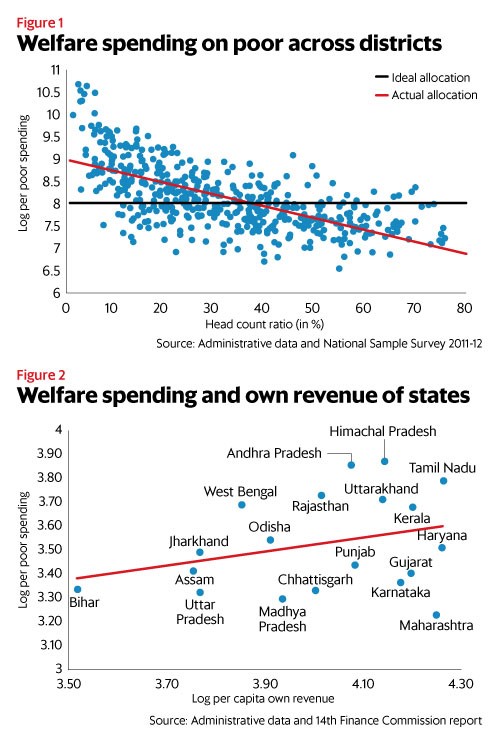

- This can be observed in Figure 1 below. It shows the scatter plot of district-wise per poor spending under these six schemes against head count ratio.

- Ideally, “per poor” spending should be the same across districts (black line). It should not matter whether the poor person is a resident of district A or district B, welfare spending per person should be the same. However, the actual per poor spending is downward sloping (red line).

Pic link: http://www.livemint.com/r/LiveMint/Period2/2018/02/15/Photos/Processed/g_oped_web.jpg

What explains this misallocation of resources across districts?

- It is important to note that States have to provide for a matching grant to get funds from the Centre for CSS.

- States such as Bihar and Jharkhand have often represented that they have limited resources and are not able to provide the state’s share to enable them to access the required funds under CSS.

- Another important factor leading to this situation is the inefficient administrative capacity of poor districts leading to poor implementation of schemes.

Economic Survey 2016-17 has observed that –

- Since richer districts have better administrative capacities, they implement schemes effectively. Their spending on welfare schemes is relatively greater than poor districts. (Fig2 explains this)

- As the own tax revenue (OTR) of states goes up, their per poor spending also goes up. Their capability to contribute towards matching the grant for CSS goes up because of which they can get more CSS funding from the Centre.

What are the consequences of such misallocation of resources?

According to the Survey, misallocation of funds may lead to exclusion error.

For instance, in MGNREGA scheme –

- If a district’s share of total spending is greater than its share of total poor, it is classified as a “surplus district”, otherwise a “deficit district”.

- In this scheme because of misallocation, many of the rich districts are in “surplus”, while majority of the poor districts are in “deficit”.

Economic Survey has observed that –

- In the “deficit” districts, the Head Count Ration (HCR) is 38% but the active to registered workers ratio is just 33%.

- On the other hand, in “surplus” districts, HCR is just 22% but the ratio of active to registered workers is 50% (numbers for 2015-16).

- The lower active-registered worker ratio in poorer districts implies that the chances of exclusion error are higher. The same trend is observed in other schemes as well.

The way ahead:

First, there is a need to rationalize existing welfare schemes.

- The Union government at present runs hundreds of social welfare schemes (675 Central sector schemes as per Budget 2017-18).

- A large majority of these are small in terms of allocation with the top six to seven schemes accounting for about 50% of total welfare spending.

- On top of this there are thousands of other schemes that different state governments run.

- Implementing such a large number of schemes efficiently, specially by states with weak administrative capacity, puts a tremendous burden on states.

The B.K. Chaturvedi committee report (2011) had observed that –

- Welfare and other such schemes should either be weeded out or merged for convergence with larger sectoral schemes or be transferred to states, which can then continue with these schemes based on their requirements.

- Small outlays anyway do not achieve the objective of making an impact across the states.

Second, Economic survey proposes for UBI, in place of many of the existing schemes.

Connecting the dots:

- Can UBI fix the weakness of existing welfare schemes which are riddled with misallocation, leakages and exclusion of the poor? Critically examine.

(or)

- Critically examine the need for rationalizing existing welfare schemes and implementation of UBI to weed out weakness of existing welfare schemes such as misallocation, leakages and exclusion of the poor.

NATIONAL

TOPIC:

General Studies 3:

- Issues related to direct and indirect farm subsidies and minimum support prices

- Inclusive growth and issues arising from it.

General Studies 2:

- Government policies and interventions for development in various sectors and issues arising out of their design and implementation.

- Welfare schemes for vulnerable sections of the population by the Centre and States and the performance of these schemes; mechanisms, laws, institutions and bodies constituted for the protection and betterment of these vulnerable sections

Reducing Agrarian Distress: Budget 2018

Background:

In recent years, the Centre has taken several initiatives such as the Pradhan Mantri Fasal Bima Yojana (PMFBY), electronic National Agricultural Market (e-NAM), soil health card, neem-coated urea and so on to reduce agrarian distress.

Such initiatives have definitely helped, but more needs to be done to truly address the issue of agrarian distress.

Multiple dimensions to agrarian distress:

- Input costs have gone up significantly recently while the farm gate prices of agricultural produce have continued to remain subdued.

(The farm gate price is the price received by farmers for their produce at the location of farm. Thus, the costs of transporting from the farm gate to the nearest market and market charges for selling the produce are not included.)

- The bulk of farming activities in India is undertaken by marginal farmers, share-croppers or landless agricultural labourers with limited access to institutional finance.

- The value chain in the agricultural sector has been exploitative as only one-third of the retail prices paid by final consumers reach the producers, unlike two-thirds in case of milk.

- The public distribution system does not have the capacity to undertake procurement operations for 24 crops for which minimum support price (MSP) is announced.

- Although PDS is inefficient, an alternative mechanism is yet to emerge, which can ensure MSP to farmers during a period of bumper harvest.

- Post-harvest technology is underdeveloped and farmers’ participation in such activities is limited.

- Monsoon dependency is very high, limiting crop diversification to a great extent.

- Agrarian distress in recent times has been aggravated despite India’s farm output being at its peak.

This is a clear case of market failure for which farmers do not have any cover. PMFBY provides protection against crop failure.

No such protection is currently available to farmers for distress sale.

Government interventions:

- Lending to agriculture is a major component of priority sector lending in India.

The target for bank lending to agriculture has been revised upwards every year.

Lending cost to agriculture has been subsidised through interest rate subvention. - The Government also provides fertiliser subsidy year after year besides food subsidy through PDS.

Budgetary decisions:

- Diminishing the financial burden:

- The most vulnerable section in the farming community are marginal farmers, share-croppers and landless agricultural laborers.

- Having limited access to institutional finance they borrow from the informal sector leading to financial burden.

- Loan waiver hardly helps this group.

Budget:

This year’s budget has indicated that the NITI Aayog would devise modalities for extending credit to this segment of people from the formal sector.

- The budget has proposed to raise the MSP by at least 1.5 times the cost of production.

- Covering agricultural produce beyond the scope of MSP:

- Farmers produce several commodities that are outside the MSP.

Budget FY19 has proposed the introduction of ‘Operation Greens’ for perishable commodities such as potato, tomato and onion to stabilise their prices, which can benefit both producers and consumers.

- Agricultural Marketing reforms:

- As proposed last year, the remaining APMCs will be linked to e-NAM by March 2018.

As a part of revamping the agricultural marketing system, the idea is to upgrade 22,000 haats (local markets) to Gramin Agricultural Markets so that farmers can directly sell their produce to consumers without middlemen.

- As a part of diversification, sizeable allocations has been made for forestry, animal husbandry and the restructured National Bamboo Mission.

Way ahead:

- In order to double farmers’ income, there is a need to involve them in post-harvest technology through innovative programmes.

The value addition is large in the case of consumer products such as ketchup, jam, wafers, pickles and so on. Farmers can participate in this process through farmer producers companies (FPCs).

- In order to avoid distress sale farmers must be encouraged and trained to use the commodity market for hedging.

Procurement too should be extended to crops other than major ones like paddy/rice and wheat, sometimes cotton, oil seeds, and pulses.

Conclusion:

Budgetary decisions if implemented effectively can help break the vicious cycle of agrarian distress. As the focus is on sustaining structural reforms rather than providing short-term relief through loan waivers, input subsidies and the like.

Connecting the dots:

- In order to reduce agricultural distress, the focus should be on sustaining structural reforms rather than providing short-term relief through loan waivers, input subsidies and the like. Comment.

- In Budget 2018 the government has made important decisions related agricultural reforms. If implemented effectively can help break the vicious cycle of agrarian distress. Analyze.

MUST READ

Can sanitation reduce stunting

The ratings illusion

India in a corner

Misallocation of welfare schemes resources

NHPS will not help its intended beneficiaries

Maldives: India must wait and watch

India’s defence industry lacks fire power