IASbaba's Daily Current Affairs Analysis

Archives

(PRELIMS + MAINS FOCUS)

Restructuring of Railways

Part of: Prelims and GS III – Infrastructure

Context The Indian Railways is heading for a major restructuring plan that could lead to the closure of key establishments, merger of organisations and private participation in running of its schools and hospitals.

- The recommendations were proposed by the Principal Economic Adviser Sanjeev Sanyal as part of the Rationalisation of Government Bodies and Proposal for the Ministry of Railways.

- The Indian Railways is the country’s largest employer and transporter.

What were the Major recommendations?

- Winding up (closing) the Central Organisation for Railway Electrification (CORE), the Central Organisation for Modernisation Of Workshops (COFMOW), the Centre for Railway Information Systems (CRIS) and the Indian Railways Organisation for Alternative Fuel (IROAF)

- IROAF was recently closed.

- RailTel would be merged with the IRCTC.

- RailTel is one of the largest telecom infrastructure providers in the country that focuses on modernising operations and safety systems through optic fibre networks that exist along railway tracks.

- Rail Vikas Nigam Ltd. (RVNL) to be merged with the Indian Railway Construction Limited (IRCON), a specialised infrastructure construction organisation.

- RVNL implements projects relating to creation and augmentation of railway infrastructure.

- Merging of railway schools with Kendriya Vidyalayas or handing them over to the respective State governments

- Establish Central Public Sector Enterprises to bring eight production units under its fold.

- Merger of the Central Training Institutes with the National Rail and Transportation Institute after upgrading the latter into a Central University and an Institute of National Importance.

- Roping in private participation for investments to enhance healthcare facilities of railway hospitals and polyclinics

News source: TH

45th GST Council Meeting

Part of: Prelims and GS-III- Economy

Context The 45th GST Council meeting was chaired by union finance minister in Lucknow recently

Key decisions by the council

- Petroleum products will be out of the GST regime.

- Consumers will continue to pay the Compensation Cess along with GST levied on products like automobiles, tobacco products and aerated water till March 2026.

- Concessional tax rates on COVID-19 essential medicine like Tocilizumab, Amphotericin B and Remdesivir extended till December 31st.

- Muscular atrophy drugs like a Zolgensma and Viltepso that cost around ₹16 crore are exempted from GST.

- Import of leased aircraft exempted from IGST.

- 5% GST to be levied on food delivery apps.

- Tax on fortified rice kernels for ICDS scheme reduced from 18% to 5%.

- GST on cancer drugs like Keytruda was cut from 12% to 5%.

- GST on footwear costing less than Rs.1000 and ready-made garments and fabrics have increased to 12% from 5%. It will come in effect from January 1st

- Bricks would attract GST at the rate of 6% without input tax credits under the scheme, or 12% with input credits.

Formation of two group of ministers

- The Council has decided to form two groups of ministers (GoMs) To shore up GST revenues.

- They have to recommend measures within two months.

- The first one has been tasked with reviewing tax rate rationalisation issues to correct anomalies in the rate structure.

- The other will look to tap technology to improve compliance and monitoring. This will look at e-way bills, Fastags, compliance and composition schemes to plug loopholes.

News source: TH

Global Methane Pledge

Part of: Prelims and GS – II – International relation and GS -III – Climate change

Context U.S. President Joe Biden recently announced the Global Methane Pledge, a U.S.–EU led effort to cut methane emissions by a third by the end of this decade.

- The announcement was made at the Major Economies Forum on Energy and Climate (MEF), hosted virtually by the White House recently, in which leaders from several countries and the EU, as well as UN Secretary General António Guterres and (India’s) Environment Minister participated.

Key takeaways

- The pledge will help in rapidly reducing the rate of global warming.

- It will also produce a very valuable side benefit, like improving public health and agricultural output.

About Methane

- Methane is a greenhouse gas.

- It is 80 times more potent than carbon dioxide in terms of its global warming capacity.

- Approximately 40% of methane emitted is from natural sources and about 60% comes from human-influenced sources, including livestock farming, rice agriculture, biomass burning and so forth.

Do you know?

- 26th Conference of the Parties (COP26), the UN climate conference in Glasgow, Will be held in November 2021.

- The objective is to review progress since the Paris Agreement (2015) on climate, with some countries making commitments to achieve net zero emissions by 2050.

- The Paris deal seeks to maintain temperature rises to under 2 degrees Celsius (and pursue the goal of limiting rises to below 1.5 degrees Celsius) above pre-industrial levels by getting countries to commit to emission cuts.

News source: TH

WTO’s Agreement on Agriculture pact

Part of: Prelims and GS III – Economy

Context G-33 Virtual Informal Ministerial Meeting was recently held.

- In the meeting, the Indian commerce and industry ministry has recently pointed out that the agreement on Agriculture at the World trade organisation (WTO) is riddled with deep imbalances, which favour the developed countries and have tilted the rules against many developing countries.

What is G-33?

- The G33 (or the Friends of Special Products in agriculture) is a coalition of developing countries.

- It was established prior to the 2003 Cancun ministerial conference.

- The group has coordinated during the Doha Round of WTO negotiations, specifically in regard to agriculture.

- Dominated by India, the group seeks to limit the degree of market opening required of developing countries, especially with regard to agriculture.

- There are currently 47 member nations.

What is Agreement on Agriculture?

- The Agreement on Agriculture (AoA) is an international treaty of the World Trade Organization.

- It was negotiated during the Uruguay Round of the General Agreement on Tariffs and Trade, and entered into force with the establishment of the WTO on January 1, 1995.

- The Agreement has been criticised by civil society groups for reducing tariff protections for small farmers, a key source of income in developing countries, while simultaneously allowing rich countries to continue subsidizing agriculture at home.

News source: TH

Mura-Drava-Danube: World’s First ‘Five-Country Biosphere Reserve’

Part of: Prelims and GS III – Conservation

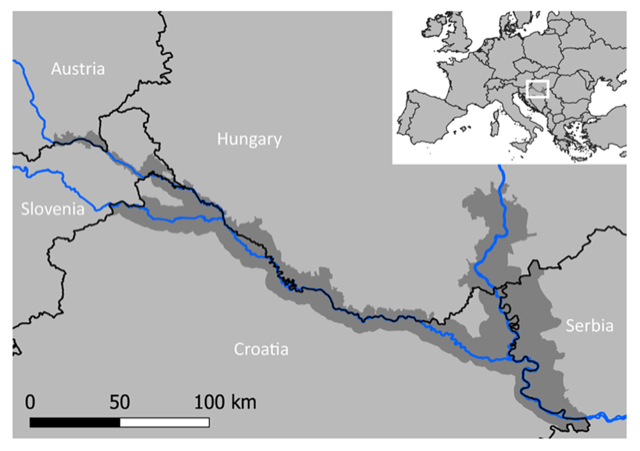

Context Recently, Mura-Drava-Danube (MDD) was declared as the world’s first ‘five-country biosphere reserve’ by the United Nations Educational, Scientific and Cultural Organization (UNESCO).

About MDD:

- The biosphere reserve covers 700 kilometres of the Mura, Drava and Danube rivers and stretches across Austria, Slovenia, Croatia, Hungary and Serbia.

- The total area of the reserve is a million hectares – in the so-called ‘Amazon of Europe’, which is now the largest riverine protected area in Europe.

- The biosphere “represented an important contribution to the European Green Deal (climate action plan) and contributed to the implementation of the EU Biodiversity Strategy in the Mura-Drava-Danube region.”

- The strategy’s aim is to revitalise 25,000 km of rivers and protect 30% of the European Union’s land area by 2030.

Importance of the MDD:

- The area is one of the richest in Europe in terms of species diversity.

- It is home to floodplain forests, gravel and sand banks, river islands, oxbows and meadows.

- The area is home to the highest density in Europe of breeding pairs of white-tailed eagle and endangered species such as the little tern, black stork, otters, beavers and sturgeons.

- It is also an important stepping stone for more than 2,50,000 migratory waterfowls every year.

(News from PIB)

Major Economies Forum on Energy and Climate (MEF)

Part of: GS-Prelims and GS-III – Environment & Climate Change

Context: Major Economies Forum on Energy and Climate (MEF) aims at facilitating candid dialogue among major emitters countries, both developed and developing, to garner political leadership to advance climate action.

- Also aims at enabling dialogue and discussion and building consensus before COP26, which will set a precedent for climate efforts in the years to come.

- Combating climate change is a shared global challenge and our response must be based on the fundamental principles of equity and common but differentiated responsibilities and respective capabilities.

- Though India’s share of world population is 17% but the country’s share in cumulative historical emissions is just 4% and even the current annual emissions are only 5.2% of the global emissions and the per capita emissions are about a third of the global average.

- India’s target is of 450 GW of Renewable Energy by 2030.

- India’s solar capacity, drawing on the collaborative spirit of member countries through the International Solar Alliance, has increased fifteen times in the last six years.

News Source: PIB

Conversion of high ash Indian coal to methanol

Part of: GS-Prelims

In News: India has developed an indigenous technology to convert high ash Indian coal to methanol and established its first pilot plant in Hyderabad.

- Will help the country move towards the adoption of clean technology

- Will promote the use of methanol as a transportation fuel (blending with petrol), thus reducing crude oil imports.

Process and Challenge:

- The broad process of converting coal into methanol consists of conversion of coal to synthesis (syngas) gas, syngas cleaning and conditioning, syngas to methanol conversion, and methanol purification.

- Coal to methanol plants in most countries are operated with low ash coals. Handling of high ash and heat required to melt this high amount of ash is a challenge in the case of Indian coal, which generally has high ask content.

- Currently, the pilot plant is producing methanol with purity of more than 99%. Scaling it up will help in optimum utilization of the country’s energy reserves and accelerate its journey towards self-reliance.

- Methanol could be the most promising option for large-scale market penetration of a natural gas-based fuel for light-duty vehicles because of its low fuel cost and low additional cost relative to powering a vehicle with gasoline. Methanol will cut down India’s oil import bill by an estimated 20 per cent over the next few years.

News Source: PIB

(Mains Focus)

GOVERNANCE/ ECONOMY

- GS-2: Government policies and interventions for development in various sectors and issues arising out of their design and implementation.

- GS-3: Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment.

E-Shram

Context: On August 26, 2021, the Ministry of Labour and Employment (MOLE) launched the E-Shram.

- It is the web portal for creating a National Database of Unorganized Workers (NDUW), which will be seeded with Aadhaar.

- It seeks to register an estimated 398-400 million unorganised workers and to issue an E-Shram card containing a 12-digit unique number.

- Registered workers will be eligible for Rs 2 Lakh on death or permanent disability and Rs 1 lakh on partial disability.

Issues

- Tedious Process: Given the gigantic nature of registering each worker, it will be a long-drawn process.

- Data Security issues: Given the mega-size of the database, there is potential for its misuses especially in the absence of Data Protection legislation. The Union government would have to share data with State governments whose data security capacities vary.

- Definitional issues: By excluding workers covered by EPF and ESI, lakhs of contract and fixed-term contract workers will be excluded from the universe of UW.

- Ever-changing identities: Unorganised may have complex and ever-changing identities where they move between formal and informal sectors.

- Gig workers – Gig workers are included by the Labour ministry while they are excluded by the other three Labour Codes creating legal confusions over the classification of gig/platform workers.

- Federal Challenges: Union chalks out the plan but states have to implement it. Differences in state capacities can create hurdles in the implementation.

- Corruption – Middle service agencies such as Internet providers might charge exorbitant charges to register and print the E-Shram cards.

Way Ahead

- Involvement of surveillance agencies is crucial to address the issues of corruption.

- Government must publish statistics at the national and regional levels of the registrations to assess the registration system’s efficiency.

- Triple linkage of One-Nation-One-Ration Card , E-Shram Card (especially bank account seeded) and the Election Commission Card can be done, for efficient and leakage-less delivery,

Connecting the dots:

- One Nation One Ration Card

- Cooperative Federalism and Competitive Federalism

INTERNATIONAL/ SECURITY

- GS-2: Important International institutions, agencies and fora- their structure, mandate.

- GS-2: Bilateral, regional and global groupings and agreements.

AUKUS

Context: The U.S. has joined with the U.K. and Australia to announce a new trilateral security partnership, the AUKUS.

Significance of AUKUS:

- AUKUS aims to ensure that there will be freedom and openness in the Indo-Pacific region, including the South China Sea.

- It complements several pre-existing similar arrangements for the region like Five Eyes intelligence cooperation initiative, ASEAN and the Quad

- It proposes to transfer technology to build a fleet of nuclear-powered submarines for Australia within 18 month.

- US has clarified that AUKUS was “not talking about nuclear-armed submarines. These are conventionally armed submarines that are powered by nuclear reactors.

- Although no explicit mention was made of China in any of the AUKUS announcements, this group challenges the regional hegemonic ambitions of China.

- The operationalisation of this security partnership lead to closer coordination among the nations concerned in terms of joint military presence, war games and more in the region.

Concerns

- Australia’s domestic challenges: As per Australia’s 1984 nuclear-free zone policy, nuclear-powered submarines would not be allowed into the former’s territorial waters. Hence, there is a political opposition to it.

- Upset France: Australia had struck a deal with France for $90 billion worth of conventional submarines, which stands cancelled now. This has upset political leadership in France

- Battleground: The Indo-Pacific region will emerge as the new geopolitical battle ground posing greater security risk to others.

Connecting the dots:

- QUAD

- China’s Belt and Road Initiative

(AIR Spotlight)

Spotlight Sep 16: Production Linked Incentives in Key Sectors: A Boost To Make In India – https://youtu.be/NzQ2DH_6vEU

ECONOMY

- GS-3: Indian Economy

Production Linked Incentives in Key Sectors – Part 1

Context: Production linked incentive (PLI) scheme aims at boosting domestic manufacturing and exports, is expected to –

- Increase the country’s production by USD 520 billion in the next five years

- Make India self-reliant in manufacturing goods for local and export markets, positioning it as a global manufacturing hub

- Make domestic manufacturing competitive and efficient, build capacity, and benefit from economies of scale, enhance exports, attract investment and create jobs.

Why is the production linked scheme needed?

According to experts, the idea of PLI is important as the government cannot continue making investments in these capital intensive sectors as they need longer times for start giving the returns. Instead, what it can do is to invite global companies with adequate capital to set up capacities in India. The kind of ramping up of manufacturing that we need requires across the board initiatives, but the government can’t spread itself too thin. Electronics and pharmaceuticals themselves are large sectors, so, at this point, if the government can focus on labour intensive sectors like garments and leather, it would be really helpful.

How will it incentivize manufacturing ops?

The production-linked incentive scheme gives eligible manufacturing companies a 4-6% incentive on incremental sales over the base year of 2019-20 for a five-year period. The PLI scheme will incentivize large domestic and global players to boost production, build a competitive ecosystem and lead to more inclusive growth.

A. For Pharmaceuticals: Part of the umbrella scheme for the Development of Pharmaceutical Industry, the objective is to enhance India’s manufacturing capabilities by increasing investment and production in the sector and contributing to product diversification to high value goods in the pharmaceutical sector.

- Benefit domestic manufacturers

- Is expected to contribute to the availability of wider range of affordable medicines for consumers

- Promote the production of high value products in the country and increase the value addition in exports. Total incremental sales of Rs.2,94,000 crore and total incremental exports of Rs.1,96,000 crore are estimated during six years from 2022-23 to 2027-28.

- Generate employment for both skilled and un-skilled personnel, estimated at 20,000 direct and 80,000 indirect jobs as a result of growth in the sector.

- Promote innovation for development of complex and high-tech products including products of emerging therapies and in-vitro Diagnostic Devices as also self-reliance in important drugs.

- Improve accessibility and affordability of medical products including orphan drugs to the Indian population. The Scheme is also expected to bring in investment of Rs.15,000 crore in the pharmaceutical sector.

B. For IT Hardware: The scheme proposes production linked incentive to boost domestic manufacturing and attract large investments in the value chain of IT Hardware.

- The Scheme shall, extend an incentive of 4% to 2% / 1% on net incremental sales (over base year i.e. 2019-20) of goods manufactured in India and covered under the target segment, to eligible companies, for a period of four (4) years.

- Enhance the development of electronics ecosystem in the country. India will be well positioned as a global hub for Electronics System Design and Manufacturing (ESDM) on account of integration with global value chains, thereby becoming a destination for IT Hardware exports.

- Has an employment generation potential of over 1,80,000 (direct and indirect) over 4 years.

- Provide impetus to Domestic Value Addition for IT Hardware which is expected to rise to 20% – 25% by 2025

C. For Telecom Sector: To make India a global hub of manufacturing telecom equipment including core transmission equipment, 4G/5G Next Generation Radio Access Network and Wireless Equipment, Access & Customer Premises Equipment (CPE), Internet of Things (IoT) Access Devices, Other Wireless Equipment and Enterprise equipment like Switches, Routers etc.

- To offset the huge import of telecom equipment worth more than Rs. 50 thousand crores and reinforce it with “Made in India” products both for domestic markets and exports.

- Financial Year 2019-20 shall be treated as the Base Year for computation of cumulative incremental sales of manufactured goods net of taxes.

- Addresses local manufacturing in MSME category because Government desires MSMEs to play an important role in the telecom sector and come out as national champions.

- Lead to incremental production of around ₹2.4 Lakh Crores with exports of around ₹2 Lakh Crores over 5 years. It is expected that scheme will bring investment of more than ₹3,000 crore and generate huge direct and indirect employment and taxes both.

D. For Large Scale Electronics Manufacturing

- The scheme proposes a financial incentive to boost domestic manufacturing and attract large investments in the electronics value chain including electronic components and semiconductor packaging.

- Under the scheme, electronics manufacturing companies will get an incentive of 4 to 6% on incremental sales (over base year) of goods manufactured in India for a period of next 5 years.

- The scheme shall only be applicable for target segments – mobile phones and specified electronic components.

- With the help of the scheme, domestic value addition for mobile phones is expected to rise to 35-40% by 2025 from 20-25%.

- Generate 8 lakh jobs more, both direct and indirect.

E. For Food Processing Industry’(PLISFPI): For implementation during 2021-22 to 2026-27 with an outlay of Rs. 10,900 crore.

- Objective: To support creation of global food manufacturing champions commensurate with India’s natural resource endowment and support Indian brands of food products in the international markets.

- Ministry of Food Processing Industries is inviting applications for availing sales based incentives and grants for undertaking Branding & Marketing activities abroad under the scheme from three categories of Applicants:

- Category-I: Applicant under this category could undertake Branding & Marketing activities abroad also and apply for grant under the scheme with a common application.

- Category-II: SMEs Applicants manufacturing innovative/ organic products who apply for PLI Incentive based on Sales.

- Category-III: Applicants applying solely for grant for undertaking Branding & Marketing activities abroad

Note: Part 2 of the article will cover PIL for Specialty Steel, Textile Sector, Auto Sector, Drone Sector, Battery Storage, Solar PV cells and White Goods.

(TEST YOUR KNOWLEDGE)

Model questions: (You can now post your answers in comment section)

Note:

- Correct answers of today’s questions will be provided in next day’s DNA section. Kindly refer to it and update your answers.

Q.1 Which of the following countries recently launched the Global Methane Pledge?

- USA

- China

- Singapore

- India

Q.2 Which of the following taxes have been subsumed in GST?

- Central Sales Tax

- Central Excise Duty and Service Tax

- Value Added Tax

- All of Above

Q.3 Which One of the Following Is Not a Greenhouse Gas?

- Methane

- Hydrogen

- Nitrous oxide

- Ozone

ANSWERS FOR 17th Sept 2021 TEST YOUR KNOWLEDGE (TYK)

| 1 | C |

| 2 | C |

| 3 | C |

Must Read

On Women in STEM:

On Domestic Tourism:

On Women & data: