IASbaba's Daily Current Affairs Analysis

Archives

(Prelims Focus)

Debt default

Part of: Prelims and GS III – Economy

Context: Sri Lanka has recently announced a debt default on all its foreign debt totalling $51 billion as a “last resort”.

- Despite economic strains in the past, Sri Lanka had maintained an unblemished record of debt servicing that made the country a favourable partner for creditors.

- Meanwhile, the Governor of the Central Bank of Sri Lanka has sought donations of “much-needed foreign exchange” from Sri Lankans living abroad, to augment the country’s reserves as it grapples with severe shortages of food, fuel, and medicines.

What is a Debt Default?

- A debt default happens when a borrower fails to pay his or her loan at the time it is due.

- The time a default happens varies, depending on the terms agreed upon by the creditor and the borrower.

- Some loans default after missing one payment, while others default only after three or more payments are missed.

- In such an event, serious repercussions can happen, such as getting a poor credit rating.

- Credit represents an individual’s ability to borrow money.

- When an individual applies for a loan, whether secured or unsecured, the creditor looks at the person’s credit score because it helps determine if the person is likely to be able to pay back the loan and its interest.

News Source: TH

Retail inflation nears 7%

Part of: Prelims and GS III – Economy

Context: Retail inflation accelerated sharply to 6.95% in March, the fastest pace of price gains in almost a year and a half, and marked the third straight month when inflation exceeded the Reserve Bank of India’s tolerance threshold of 6%.

What is retail inflation?

- Retail inflation tracked by the Consumer Price Index (CPI) measures the changes in prices from a retail buyer’s perspective.

- Wholesale inflation, which is tracked by the Wholesale Price Index (WPI), measures inflation at the level of producers.

What Is the Consumer Price Index (CPI)?

- The Consumer Price Index (CPI) is a measure that examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food and medical care.

- It is calculated by taking price changes for each item in the predetermined basket of goods and averaging them.

- Changes in the CPI are used to assess price changes associated with the cost of living;

- The CPI is one of the most frequently used statistics for identifying periods of inflation or deflation.

News Source: TH

Solar capacity target

Part of: Prelims and GS III – Environment

Context: According to a report by JMK Research and the Institute for Energy Economics and Financial Analysis (IEEFA), India is likely to miss its 2022 target of installing 100 gigawatts (GW) of solar power capacity, largely due to inadequate uptake of rooftop solar.

- Solar capacity is a major part of India’s commitment to address global warming according to the terms of the Paris Agreement, as well as achieving net zero, or no net carbon emissions, by 2070.

Key takeaways

- As of December 2021, India’s cumulative installed solar capacity was 55 GW, with grid-connected utility-scale projects making up 77% of the total and the rest from grid-connected rooftop solar (20%) and mini or micro off-grid projects (3%).

- With just eight months of 2022 remaining, only about 50% of the 100GW target has been met.

- Factors impeding rooftop solar installation include:

- pandemic-induced supply chain disruption

- policy restrictions,

- regulatory roadblocks;

- net metering limits;

- the twin burdens of basic customs duty (BCD) on imported cells and modules and issues with the Approved List of Models and Manufacturers (ALMM);

- unsigned power supply agreements (PSAs) and banking restrictions;

- financing issues and delays in or rejection of open access approval grants;

- The unpredictability of future open access charges.

News Source: TH

(News from PIB)

First ‘Made in India’ Dornier Aircraft Flight: HAL Dornier Do-228; the flight will be operational from Dibrugarh in Assam to Pasighat in Arunachal Pradesh and finally to Lilabari in Assam.

SVANidhi se Samriddhi program

Part of: GS-Prelims and GS-II – Policies and Interventions

About the Program:

- Provides social security benefits to street vendors for their holistic development and socio-economic upliftment

- Under the program, socio-economic profiling of PMSVANidhi beneficiaries and their families is conducted to assess their eligibility for 8 Government of India’s welfare schemes and facilitate sanctions of eligible schemes.

- Considering the success of Phase I, MoHUA launched the program expansion to additional 126 cities with an aim to cover 28 Lakh Street vendors and their families, with a total target of 20 Lakh scheme sanctions for FY 2022-23.

- The program has two-fold achievements:

- One, a central database of Street vendors and their families is created on various socio-economic indicators.

- Second, a first of its kind inter-ministerial convergence platform is established between various Central Ministries to extend safety net of welfare schemes to street vendor households.

Prime Minister Street Vendors AtmaNirbhar Nidhi (PM SVANidhi)

- Implemented by: Ministry of Housing and Urban Affairs

- Objective: To provide affordable working capital loan up to 10 thousand rupees to Street Vendors for facilitating resumption of their livelihoods adversely affected by the COVID-19 pandemic.

News Source: PIB

ADB Financing to Support Urban Development in Nagaland

Part of: GS-Prelims and GS-II – Policies and Interventions

Context: The Government of India and the Asian Development Bank signed a $2 million Project Readiness Financing (PRF) Loan for

- Designing climate resilient urban infrastructure

- Strengthening institutional capacity and improving municipal resource mobilization in 16 district headquarter towns (DHTs) in Nagaland.

- Ensure high readiness of the ensuing project through preparing an urban sector strategy, undertaking feasibility studies and detailed engineering designs of selected subprojects and building capacity of state level agencies in project implementation, resource mobilization and anchoring reforms

Background: Nagaland’s towns and cities face the long-term challenges of climate change, lack of basic amenities, poor connectivity. Major transport routes around urban areas are severely affected by landslides during the monsoon season. Urban roads are in poor condition without proper storm water drainage. Most cities face acute water shortage and except Dimapur have inadequate sewerage or septage management system. All these issues constrain economic development of the state.

News Source: PIB

MISCELLANEOUS

White Spot Syndrome Virus (WSSV)

-

An aquaculture pathogen

-

Scientists have developed a handy diagnostic tool that detects WSSW to boost shrimp cultivation

Significance

- Infection caused by the WSSV to the shrimp Penaeus vannamei results in huge loss of crop.

- This high value super-food is susceptible to a wide range of viral and bacterial pathogens and the probability of occurrence of infections is rather high.

- Improved nutrition, probiotics, disease resistance, quality control of water, seed and feed, immuno-stimulants and affordable vaccines play an important role in enhancing the production.

- Technologies for early and rapid detection of pathogens on the field will help fish and shell-fish farming which provides significant export revenue to the country which is a leading supplier of shrimp to the USA.

(Mains Focus)

ECONOMY/ SCIENCE & TECH

- GS-3: Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment.

- GS-3: Science and Technology- developments and their applications and effects in everyday life.

Cardless cash withdrawals at ATMs

Context: India’s Central bank announced cardless cash withdrawals at ATMs across the country.

- The feature will let consumers use Unified Payment Interface (UPI) on their smartphones to withdraw cash from ATMs.

- RBI stated that all ATMs across the country must enable this feature in their cash-dispensing machines.

How will this system work?

- Cardless cash withdrawals are to be authenticated via UPI.

- ATMs are expected to show an option for withdrawing cash using UPI.

- Once a user selects this option, they can input the amount to be withdrawn and a QR code will be generated on the ATM screen.

- Users will then need to scan that code via their UPI app, and enter the password to withdraw cash from the ATM.

- Until now, only fund transfers between accounts were enabled via UPI. With this option, consumers can also take cash out from ATMs without a card.

What issues does this technology solve?

- According to the RBI Governor, cardless cash withdrawals will enhance security of cash withdrawal transactions.

- Besides, it would help prevent frauds like card skimming and card cloning.

- Currently, only existing customers of a few banks are allowed to withdraw cash without cards, and from specific bank’s ATM networks. However, the RBI’s move to allow interoperability in cardless withdrawals will enable users to take cash from any and all ATMs.

- The RBI’s move will invite more players into the payment ecosystem in India to innovate and solve further problems of customers.

What is card skimming?

- Criminals steal data from credit/ debit cards by tracking a card swiped at ATMs. They pick this information from using a skimming device that reads the card’s magnetic strip. These devices are secretively installed on ATMs.

- These devices are difficult to identify as they appear to be a legitimate part of an existing ATM, or like a regular in-store card reader. It is skilfully fitted into the payment machines.

- Once the device picks up the data, it can be used to gain unauthorised access to the user’s banking records.

- The stolen information can be coded onto a new card, a process called cloning, and be used to make payments and transact with other bank accounts.

- Problematic ATMs that function intermittently, and the ones located in isolated areas are often used to install such skimming devices.

- Fraudsters also install scanning devices on point-of-sale machines. These devices stealthily scan a card before it is swiped at the payment counter at a departmental store.

What are the limitations and challenges of the cardless cash withdrawal feature?

- Currently, ICICI Bank, Kotak Mahindra Bank, HDFC Bank and SBI allow cardless cash withdrawals for their users. But, accessing the feature is cumbersome as it has certain withdrawal limits, and the transaction is charged.

- At the moment, it is not clear whether UPI-based cash withdrawals will have the same restrictions and service fee inclusions.

- Scalability of this feature might be a challenge as it has to be seen how many banks quickly roll it out to their customers.

- In cardless withdrawal, the security vulnerability of a card is minimised, but the risk will soon transfer to a mobile-enabled feature. The mobile can now become the epicentre of transactions, making it the next target for fraudsters.

What is the future of debit cards?

- Issuing cards will not be stopped as they have several other utilities beyond cash withdrawals. They can be used at a restaurant, shop, or for payments in a foreign country.

- A debit card is a very evolved financial product and has already gone through a lot of iterations to reach its current perfection. In its further evolution, there are new use cases for debit cards like having standing instructions or EMI payments.

- Moreover, the debit card will continue to serve some segments of the economy which are not comfortable with pure digital payment solutions like UPI or who want to have higher transaction limits.

Connecting the dots:

GOVERNANCE/ HEALTH

- GS-2: Government policies and interventions for development in various sectors and issues arising out of their design and implementation

- GS-3: Indian Economy and its challenges

Midday meal and supplements

Context: From the next academic session, Karnataka is likely to become the 13th state to provide eggs under the midday meal scheme (MMS).

- The proposal comes on the back of successive surveys pointing out high prevalence of malnutrition, anaemia and low immunity among children in many parts of the state.

- National Family Health Survey-V found 35% children under five stunted, and around 20% wasted in Karnataka State.

What is the history of the Midday meal scheme?

- The current version of the programme, renamed PM Poshan Shakti Nirman or PM Poshan in 2021, traces its roots to 1995;

- It was launched as a centrally sponsored scheme on August 15, 1995 across 2,408 blocks for students up to Class 5. In 2007, the UPA government expanded it to Class 8.

- However, the first initiative to provide meals to children had been taken by the erstwhile Madras Municipal Corporation around 1920.

- In post-Independence India, Tamil Nadu was the pioneer, with Chief Minister K Kamaraj rolling out a school feeding scheme in 1956.

- Kerala had a school lunch scheme run by a humanitarian agency from 1961. The state government officially took over the initiative on December 1, 1984.

- Over the next few years, many other states launched their own versions of the scheme, and finally in 1995, the Centre stepped in.

What is the scale of the scheme today?

- The scheme covers 11.80 crore children across Classes 1 to 8 (age group 6 to 14) in11.20 lakh government and government-aided schools and those run by local bodies.

- In the Budget for 2022-23, the Centre has earmarked Rs 10,233 crore for the scheme, while the states are expected to spend Rs 6,277 crore.

- It is not just a scheme, but a legal entitlement of all school-going children in primary and upper primary classes, through the National Food Security Act (NFSA), 2013, as well as the Supreme Court’s ruling in People’s Union of Civil Liberties vs Union of India and Others (2001).

What is usually on the menu?

- The menu varies from one state or Union Territory to another.

- But the authorities need to ensure that the nutritional component of the meal made up of rice, pulses, vegetables, oil and fat provide at least 450 calories and 12 gm protein to children in primary grades.

- For upper primary children, the requirements are 700 calories and 20 gm protein.

- The variations are in the cases of additional items such as milk, eggs, chikki, or fruits that the states provide as supplementary nutrition, the expenses for which are borne by the state government.

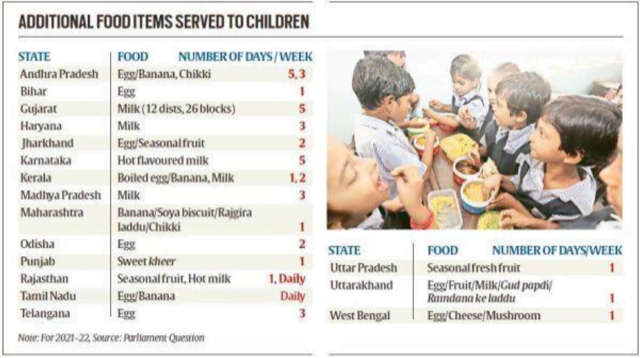

How wide are these variations in supplementary nutrition?

- For instance, eggs, and bananas to vegetarians, are currently provided only by 13 states and three UTs.

- Tamil Nadu provides eggs on all school working days; Andhra Pradesh, at least five days a week; Telangana and Andaman and Nicobar Islands, thrice a week; Jharkhand, Odisha, Tripura and Puducherry, twice a week; etc.

- States and UTs that provide milk include Gujarat, Karnataka, Kerala, Madhya Pradesh, Mizoram, Rajasthan, Uttarakhand, Ladakh and Puducherry.

- Among other food items, West Bengal provides cheese and mushroom on a limited scale, while Andhra Pradesh and Maharashtra provide chikki.

- In Lakshadweep, chicken is provided as well.

Why are eggs part of the menu in so few states and UTs?

- Some states, such as Arunachal Pradesh, find it costly.

- Also, dietary choices are an intensely contested area in India due to caste rigidities, religious conservatism and regional differences. Thus, the debate becomes political too.

- As a result, despite successive scientific studies, including those commissioned by state governments, showing the benefits of giving children eggs, many states have been reluctant about adding eggs to the school lunch menu.

- Chhattisgarh, which found a low quantity of protein in 30-35% of the samples from meals it tested, decided to overcome the problem by giving eggs two days a week but ran into political opposition.

- In Madhya Pradesh, the Congress government’s decision to add eggs to the menu of anganwadis was overturned by the BJP government in 2020.

- In Karnataka, proposals to add eggs have been fiercely resisted in the past by Lingayat and Jain seers.

- But many states have tackled such objections by making fruits available as an alternative to eggs.

Do the Centre and states run the scheme jointly?

- Under the rules, the allocation of Rs 4.97 per child per day (primary classes) and Rs 7.45 (upper primary) are shared in 60:40 ratio with states and UTs with a legislature,

- The sharing is 90:10 with the Northeastern states, Jammu and Kashmir, Himachal Pradesh and Uttarakhand

- However, the Centre bears 100% of the costs in UTs without legislature.

- But the states and UTs that supplement the meals with additional items such as milk and eggs contribute more.

- Components such as payments to cooks and workers are also split in the same ratio between the Centre and states.

- However, the Centre bears the entire cost of foodgrains and their transportation, and also handles the expenditure on management, monitoring and evaluation of the scheme.

Connecting the dots:

(Down to Earth: Economy)

April 13: Quarter-billion people face extreme poverty in 2022 as the rich get richer: Oxfam – https://www.downtoearth.org.in/news/economy/quarter-billion-people-face-extreme-poverty-in-2022-as-the-rich-get-richer-oxfam-82365

TOPIC:

- GS-3: Indian economy

Quarter-billion people face extreme poverty in 2022 as the rich get richer: Oxfam

Context: Over a quarter of a billion people will be pushed into poverty in 2022, according to a new report by Oxfam, a global network of charitable organisations.

- The worldwide financial crisis will be mainly driven by the price inflation due to Russia’s invasion of Ukraine and economic crisis caused by the COVID-19 pandemic, it said.

- The convergence of these two events is also widening the gap between the rich and the poor at an unprecedented rate: Nearly half of the global population (3.3 billion) are living below the poverty line, while a new person becomes a billionaire every 26 hours since the beginning of the pandemic.

The Oxfam estimates are based on World Bank projections and earlier research by the World Bank and Center for Global Development. The report was released April 12, 2022, ahead of the spring meetings of World Bank and the International Monetary Fund.

Insights from the Report

- The combined impact of COVID-19, inequality and food price hikes could result in 263 million more people living in extreme poverty this year, resulting in a total of 860 million people living below the $1.90 (Rs 144.7) a day extreme poverty line. This would be an extraordinarily damaging rise that reverses decades of progress in the fight against poverty.

- The pandemic resulted in people losing their jobs and savings, while they are faced with a greater food price inflation than the 2011 crisis. In comparison, billionaires continue to make money, as they exploit an “inflationary environment to boost profits at consumers’ expense”, the report said.

- Oil companies are making record profits with soaring energy prices and margins while investors expect agriculture companies to rapidly become more profitable as food prices spiral.

- The fortunes of 10 of the richest people in the world have doubled during the pandemic, the Oxfam analysis showed. At the same time, some 2,744 small billionaires have recorded an unprecedented rise in fortunes compared to the last 14 years, the report said. These 14 years were already a bonanza for billionaire wealth, it added.

- The increasing poverty is not spread evenly across geographies, according to the data. Food costs account for 40 per cent of consumer spending in sub-Saharan African nations, while the same figure is half for those living in advanced economies.

- Developing nations, which were already faced with a worrying fiscal condition, are now witnessing debt levels unseen so far. An estimated debt servicing amounting to $43 billion in 2022 for the world’s poorest countries is needed.

The Way Forward

The international body urged world leaders attending the upcoming meeting to follow a five-pronged economic rescue plan to evade what is sure to be a catastrophic:

- First, cuts in value-added taxes on staple food and cash transfers to support income should be implemented to protect the poorest from inflation.

- Second, World Bank and IMF should cancel debt payments for 2022 and 2023 for low and lower-middle-income countries.

- Third, a 2 per cent tax on personal wealth above $5 million, 3 per cent for wealth above $50 million and 5 per cent for wealth above $1 billion should be imposed. This could amount to $2.52 trillion — enough to save 2.3 billion people from poverty.

- Fourth, Special Drawing Rights under the IMF should be reallocated to ensure it is debt- and conditionality-free.

- Fifth, emergency support provided to lower-income countries should be increased.

Can you answer the following question?

- The basket of basic necessities of the poor has expanded in the last two decades. Do you agree? Do you think the current welfare schemes reflect this transformation? Critically examine.

- What are the key challenges in using digital solutions to address poverty and associated issues? Illustrate.

(TEST YOUR KNOWLEDGE)

Model questions: (You can now post your answers in comment section)

Q.1 Which country recently announced a debt default on all its foreign debt totalling $51 billion as a “last resort”?

- Maldives

- Sri Lanka

- Nepal

- Afghanistan

Q.2 According to a report by JMK Research and the Institute for Energy Economics and Financial Analysis (IEEFA), India is likely to miss its 2022 target of installing 100 gigawatts (GW) of solar power capacity. What are the major factors for the same?

- Pandemic-induced supply chain disruption

- Unsigned power supply agreements (PSAs)

- Banking restrictions

- All of the above

Q.3 Consider the following statements regarding Consumer Price Index (CPI):

- The Consumer Price Index (CPI) is a measure that examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food and medical care.

- It is calculated by taking price changes for each item in the predetermined basket of goods and averaging them.

Which of the above is or are correct?

- 1 only

- 2 only

- Both 1 and 2

- Neither 1 nor 2

ANSWERS FOR 13th April 2022 TEST YOUR KNOWLEDGE (TYK)

| 1 | B |

| 2 | D |

| 3 | C |

Must Read

On Universal Healthcare:

On anganwadis:

On CUET: