IASbaba's Daily Current Affairs Analysis

Archives

(PRELIMS & MAINS Focus)

Syllabus

- Prelims – Governance

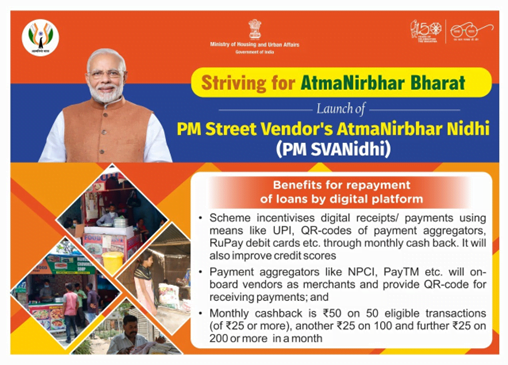

Context: Recently the Government of India has extended the PM Street Vendor’s Atma Nirbhar Nidhi (PM SVANidhi) Scheme beyond March, 2022.

About PM SVANIDHI:

- Ministry of Housing & Urban Affairs launched a scheme PM Street Vendor’s Atma Nirbhar Nidhi (PM SVANidhi) to empower Street Vendors by not only extending loans to them, but also for their holistic development and economic upliftment.

- The scheme intends to facilitate collateral free working capital loans of up to INR10,000/- of one-year tenure, to approximately 50 lakh street vendors, to help resume their businesses in the urban areas, including surrounding peri-urban/rural areas.

The PM SVANidhi scheme offers incentives in the form of:

- interest subsidy @ 7% per annum on regular repayment of loan

- cashback upto INR1200/- per annum on undertaking prescribed digital transactions

- eligibility for enhanced next tranche of loans

- Close to 2 million applications have been received under this scheme, of which 752191 have been sanctioned, and 218751 loans have already been disbursed.

Eligibility Criteria: The PM SVANidhi scheme is available to all street vendors who are engaged in vending in urban areas as on or before March 24, 2020. The eligible vendors are identified as per following criteria:

- Street vendors in possession of Certificate of Vending/Identity Card issued by Urban Local Bodies (ULBs).

- The vendors, who have been identified in the survey but have not been issued Certificate of Vending/Identity Card; Provisional Certificate of Vending would be generated for such vendors through an IT based Platform.

- ULBs are encouraged to issue such vendors the permanent Certificate of Vending and Identification Card immediately and positively within a period of one month

- Street Vendors, left out of the ULB led identification survey or who have started vending after completion of the survey and have been issued Letter of Recommendation (LoR) to that effect by the ULB/Town Vending Committee (TVC).

- The vendors of surrounding development/peri-urban/rural areas vending in the geographical limits of the ULBs and have been issued Letter of Recommendation (LoR) to that effect by the ULB/TVC.

About New Extension:

- Extension of lending period till December 2024;

- Introduction of 3rd loan of upto ₹50,000 in addition to 1st & 2nd loans of ₹10,000 and ₹20,000 respectively.

- To extend ‘SVANidhi Se Samriddhi’ component for all beneficiaries of PM SVANidhi scheme across the country.

Source: PIB

Syllabus

- Prelims – Governance

Context: Recently the Ministry of Environment, Forest and Climate Change has developed web based Geographic Information Systems (GIS) applications like PARIVESH, e-Green Watch and Van Agni Geo-portal.

About e-Green Watch portal:

- e-Green Watch portal is an advanced technology based platform designed to facilitate automation, streamlining and effective management of processes related to plantations and other forestry works taken up under CAMPA fund.

- Forest Survey of India(FSI) carries out analysis of geo-spatial data (polygons) of various plantations uploaded by the State Forest Departments on e-Green Watch portal for accuracy of location, area and year of plantation.

About Van Agni Geo-portal:

- Forest Survey of India has also developed Van Agni Geo-portal to provide user-friendly interactive viewing of the forest fire related data for continuous monitoring and tracking of large forest fires in near real-time basis.

- Van Agni Geo-portal serves as a single point source for the information related to forest fires in India.

About Parivesh portal:

- PARIVESH portal (Pro-Active and Responsive facilitation by Interactive Virtuous and Environmental Single-window Hub) is a single-window integrated environmental management system for online submission and monitoring of the proposals submitted by the proponents for seeking Environment, Forest, Wildlife and Coastal Regulation Zone clearances from Central Government.

- It is a GIS based system and analytics platform that provides information to various stakeholders using Decision Support System functionality.

Source: PIB

Syllabus

- Prelims – Governance

Context: The Union Minister of State for Health and Family Welfare informs Lok Sabha about the progress of Pradhan Mantri Surakshit Matritva Abhiyan.

Key Highlights about progress of the scheme:

- Government of India launched “Pradhan Mantri Surakshit Matritva Abhiyan” (PMSMA) with an aim to provide fixed-day, free of cost, assured, comprehensive and quality antenatal care on the 9th day of every month universally to all pregnant women in their 2nd / 3rd trimesters of pregnancy.

- Since inception, more than 3.6 crore pregnant women have received comprehensive ANC under this programme across all States and UTs. The State/UT-wise fund approvals have been given towards Pradhan Mantri Surakshit Matritva Abhiyan (PMSMA) activities during the last three years.

- As per the report of National Family Health Survey (NFHS), the percentage of mothers who had at least 4 antenatal care visits has increased from 51.2 % in NFHS-4 (2015-16) to 58.1% in NFHS-5 (2019-21) and the percentage of pregnant women with institutional births in public facility has increased from 52.1 % in NFHS-4 (2015-16) to 61.9% in NFHS-5 (2019-21).

- One of the key focus areas during Pradhan Mantri Surakshit Matritva Abhiyan (PMSMA) is to generate demand through Information Education & Communication (IEC), Inter-personal Communication (IPC) and Behavior Change Communication (BCC) activities.

- Extensive use of audio-visual and print media in raising mass awareness is an integral part of IEC/BCC campaign.

- Auxiliary Nurse Midwife (ANM), Accredited Social Health Activist (ASHA) and Anganwadi Worker (AWW) play a pivotal role in mobilization of the community and potential beneficiaries in both rural and urban areas for availing of services during the PMSMA.

Source: PIB

Syllabus

- Prelims – Environment

Context: Recently Union Minister of Rural Development and Panchayati Raj convened a consultation meeting on ‘Cactus Plantation and its Economic Usage’.

- Various options for taking up Cactus plantation on degraded land should be explored for realising the benefits of its usage for bio-fuel, food and bio-fertiliser were discussed in the meeting.

- India has approximately 30% of its geographical area under the category of degraded land.

About Cactus:

- A cactus is a member of the plant family Cactaceae.

- Although some species live in quite humid environments, most cacti live in habitats subject to at least some drought.

- Many live in extremely dry environments, even being found in the Atacama Desert, one of the driest places on Earth.

- Because of this, cacti show many adaptations to conserve water.

- For example, almost all cacti are succulents, meaning they have thickened, fleshy parts adapted to store water.

- Unlike many other succulents, the stem is the only part of most cacti where this vital process takes place.

- Most species of cacti have only spines, which are highly modified leaves.

- Spines help prevent water loss by reducing air flow close to the cactus and providing some shade.

- In the absence of true leaves, cacti’s enlarged stems carry out photosynthesis.

Conservation:

- All cacti are included in Appendix II of the Convention on International Trade in Endangered Species of Wild Fauna and Flora (CITES).

- Control is exercised by making international trade in most specimens of cacti illegal unless permits have been issued, at least for exports.

- Some cacti, such as all Ariocarpus and Discocactus species, are included in the more restrictive Appendix I.

Uses:

- Cactuses are known for their nutrients as well as their medicinal value.

- Both cactus pads and cactus fruit can help fight infections and ease the symptoms of anything from hangovers to high cholesterol.

- Both the cactus pad and the cactus fruit are high in fiber, which can lower cholesterol levels in the blood.

- used as ornamental plants

- used for fodder or forage,

- Cactus fruits in particular are an excellent source of vitamin C, which is one of the best immune boosters.

- Regular doses of vitamin C increase the production of white blood cells, which can make us less likely to catch an illness — and help your body fight off viruses if infected.

- Nutrition: Cactus fruits and pads offer a dose of vitamins and nutrients that have anti-inflammatory properties and can help reduce the risk of serious health conditions like diabetes and heart disease.

Source: PIB

Previous Year Question

Q.1) With reference to “Gucchi” sometimes mentioned in the news, consider the following statements:

- It is a fungus.

- It grows in some Himalayan forest areas.

- It is commercially cultivated in the Himalayan foothills of north-eastern India.

Which of the statements given above is/are correct?

- 1 only

- 3 only

- 1 and 2

- 2 and 3

Q,2) If a particular plant species is placed under Schedule VI of The Wildlife Protection Act,1972, what is the implication? (2020)

- A licence is required to cultivate that plant

- Such a plant cannot be cultivated under any circumstances

- It is a Genetically Modified crop plant

- Such a plant is invasive and harmful to the ecosystem

Syllabus

- Prelims – Economy

Context: Recently, Asian Development Bank has approved a USD 780 million multi-tranche financing facility (MFF) to build new lines and improve the connectivity of the metro rail system in Chennai with the city’s existing bus and feeder services.

- This project will expand Chennai’s metro rail system to provide better transport solution to improve urban mobility.

About Multi-tranche financing facility:

- MFF is a longer-term partnership between Asian Development Bank (ADB) and client country.

- It provides funds for complex project which would need a longer commitment than a typical ADB investment loan could offer.

- Like a wide-range road network or energy program.

- It can finance multiple projects under investment program in a sector or in various sectors.

Source: The Hindu

Previous Year Question

Q.1) “Rapid Financing Instrument” and “Rapid Credit Facility” are related to the provisions of lending by which of the following: (2022)

- Asian Development Bank

- International Monetary Fund

- United Nations Environment Programme Finance Initiative

- World Bank

Syllabus

- Prelims: Policies and Interventions

Aim of the Scheme: To empower and enhance confidence among minority women by generating awareness about women rights and interventions for ‘Leadership Development’.

- A six-day non-residential/five-day residential training programme conducted

- For women belonging to minority community between the age group of 18 years to 65 years.

- The training modules cover areas related to: Health and Hygiene, Legal Rights of Women, Financial Literacy, Digital Literacy, Swachch Bharat, Life Skills, and Advocacy for Social and Behavioural changes.

- Impact: Since inception, about 4.35 lakh beneficiaries have been trained under the ‘Nai Roshni’ scheme.

- Implementation: The selected PIAs are required to implement the project directly through their organizational set-up in the locality/ village/ area in which training is conducted.

Do you know?

- In Seekho Aur Kamao (Learn & Earn) Scheme, 33% of the total beneficiaries are women.

- Similarly in the Nai Manzil scheme, 30% of the total beneficiaries are women.

These schemes help in the economic empowerment of the Minority women.

Source: PIB

Syllabus

- Prelims: Elections

What is a national party?

- That has a presence ‘nationally’, as opposed to a regional party whose presence is restricted to only a particular state or region.

- National parties are usually India’s bigger parties, such as the Congress and BJP. However, some smaller parties, like the communist parties, are also recognised as national parties.

- A certain stature is sometimes associated with being a national party, but this does not necessarily translate into having a lot of national political clout.

- Some parties, despite being dominant in a major state — such as the DMK in Tamil Nadu, BJD in Odisha, YSRCP in Andhra Pradesh, RJD in Bihar, or TRS in Telangana — and having a major say in national affairs, remain regional parties.

Technical Criterion for a party to be recognised as a national party by the EC

As per the ECI’s Political Parties and Election Symbols, 2019 handbook, a political party would be considered a national party if:

- It is ‘recognised’ in four or more states; or

- If its candidates polled at least 6% of total valid votes in any four or more states in the last Lok Sabha or Assembly elections and has at least four MPs in the last Lok Sabha polls; or

if it has won at least 2% of the total seats in the Lok Sabha from not less than three states.

To be recognised as a state party, a party needs:

- At least 6% vote-share in the last Assembly election and have at least 2 MLAs; or have 6% vote-share in the last Lok Sabha elections from that state and at least one MP from that state; or

- At least 3% of the total number of seats or three seats, whichever is more, in the last Assembly elections; or

- At least one MP for every 25 members or any fraction allotted to the state in the Lok Sabha; or

- Have at least 8% of the total valid votes in the last Assembly election or Lok Sabha election from the state.

As of now, the ECI has recognised eight parties as national parties — the BJP, Congress, Trinamool Congress, CPI(M), CPI, Nationalist Congress Party (NCP), Bahujan Samaj Party (BSP), and Conrad Sangma’s National People’s Party (NPP), which was recognised in 2019. Once the official results of the Gujarat elections are announced, AAP will become the ninth party to be recognised as a national party.

Must Read: Registration of political parties + Political Parties reforms in India

Source: The Indian Express

Syllabus

- Prelims: Judiciary

Context: The Supreme Court has suggested a less cumbersome and even “out-of-the-box” thinking, including roping in senior lawyers to act as ad hoc judges in High Courts, to meet the rising tide of pendency.

- Senior advocates in High Courts may not be willing to give up their lucrative legal practices permanently but may be interested in joining the Bench as ad hoc judges under Article 224A of the Constitution for a limited period of may be two years.

- Retired judges who were willing to come back to the Bench as ad hoc judges would bring their experience in dealing with arrears.

Background: In April 2021, the court had identified five situations in which the judiciary could seek the aid of ad hoc judges:

- If the vacancies are more than 20% of the sanctioned strength.

- The cases in a particular category are pending for over five years.

- More than 10% of the backlog of pending cases are over five years old.

- The percentage of the rate of disposal is lower than the institution of the cases either in a particular subject matter or generally in the Court.

- Even if there are not many old cases pending, but depending on the jurisdiction, a situation of mounting arrears is likely to arise if the rate of disposal is consistently lower than the rate of filing over a period of a year or more.

The Way Forward

- The ad-hoc judges to be appointed to the High Court are not being appointed for the first time. They have served previously and thus have the expertise to deal with the heavy workload. Therefore, the process for their appointment ought to be simpler than regular appointments.

- If the appointment is not made within a few days of the commendation of the Chief Justices of the High Courts, then meritorious candidates end up losing interest and the justice delivery system faces a huge loss.

NOTE:

Article 224A of Indian Constitution

- Deals with the appointment of ad hoc judges in High Courts.

- It is used rarely

- It says “the Chief Justice of a High Court for any State may at any time, with the previous consent of the President, request any person who has held the office of a Judge of that Court or of any other High Court to sit and act as a Judge of the High Court for that State”.

- The Chief Minister will forward his recommendation to the Union Minister of Law and Justice after consultation with the Governor.

Pendency of cases

- Over 59 lakh cases were pending in the High Courts until July 22.

- Allahabad High Court has the highest number of pending cases at over 10 lakh.

- Next are the High Courts of Rajasthan (just over 6 lakh) and Bombay (just under 6 lakh).

Source: The Hindu

Syllabus

- Mains – GS 2 (Governance) and GS 3 (Economy and Environment)

Context: Efforts are being made by Governments, civil societies, corporates, businesses and even the common people towards net-zero emissions to nullify climate change and global warming. India is in the driver’s seat in these efforts and can explore a new dimension of taxing emissions which will augment the government revenues.

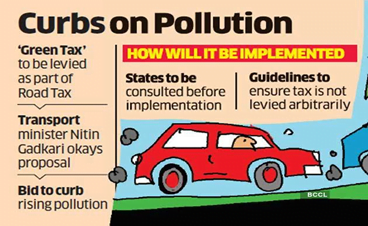

About Green Tax:

- A Green Tax is a type of tax levied by the government for the purpose of environmental conservation.

- It is believed charging taxes on emissions that cause pollution will lower environmental impairment in a cost-effective manner by encouraging behavioural changes in households and firms that need to decrease their pollution.

- The revenue collected through such tax can be used to create green energy infrastructure, combat environmental pollution, afforestation and other such purposes which help in conserving the environment.

- In India, many state governments such as Goa and Gujarat have provision for green tax or cess.

- The Ministry of Road Transport and Highways (MoRTH) had introduced a similar tax called Green Tax / Eco Tax on older vehicles.

Need for a Green tax

- The government has been looking at different ways of augmenting its revenues because tax buoyancy cannot rely upon mere growth levels which can vary and abnormal situations (e.g., COVID-19) may affect them.

(Tax buoyancy is an Economic theory concept that explains the relationship between the changes in the government’s tax revenue growth and the changes in GDP. It refers to the responsiveness of tax revenue growth to changes in GDP.)

- Usually faulty taxing policies of governments led to existing taxpayers being taxed even more in the name of environmental taxes or otherwise.

- As the country goes digital and most business units are GST-registered, we have records of activities of each firm and we can consider taxing companies that pollute the environment.

- This universe of companies can serve as the taxable base on which a green tax can be levied.

- Even a rudimentary activity like farming causes pollution and this tax can be imposed at the mandi level, the official point of sale.

Potential of revenue generation through green taxing in India:

- India’s top 4,000 odd companies had a combined turnover of roughly ₹100 trillion in 2021-22.

- Intuitively, if a small green tax is imposed on the sales of these companies linked to pollution it may fetch large revenues.

- For example an average green tax at 0.5% of the turnover will generate ₹50,000 crores annually for the government.

- This can be used to finance budget spending and it will complement the government’s efforts of issuing green bonds for projects that are environmentally compliant.

- The green tax need not be uniformly applied, and its rate could vary from 0.1% to 2%, depending on the industry concerned.

- As the sales of these companies/ industries grow, they would automatically yield higher revenues to the government.

Methods of calculating pollution emitted by individual business activity and taxing it: There are different ways of arriving at the amount of pollution emitted by every business activity.

- The current data shows that the industries/ sectors based on fossil fuels are most polluting such as manufacturing and construction, services, transport, chemicals and fertilizers etc.

- Services with no factories add to ecological atrophy with their buildings (fancy glass-front edifices of modern commercial complexes and cooling emissions) and servers that add to global warming.

- The Centre can commission research agencies to independently evaluate the emissions of all industries and set standards for the same.

- Once these standards are in place these industries can be taxed on the basis of the pollution caused by their business activity.

- Using broad industry averages emission as the norm:

- Initially the companies can be slotted into industry groups based on how their production or sales are classified.

- A cut-off level of 50% of product sales or production can be used for classification.

- The product with the largest share in a company’s overall production or sales can determine its industry assignment.

- Assessment of pollutant emissions can be reviewed periodically, as firms would be expected to do their utmost to induct new technologies and reduce their emissions over time.

- This would ensure that the businesses pay for the damage caused to the environment.

- Hence the Green Tax would be a levy based on the status of the company and defined by the industry to which it belongs.

Challenges of imposing Green Tax on all business:

- Assessing individual firm’s emissions with accuracy and proportional tax rate is a difficult process and presently there is no such robust technology in existence.

- Companies may pass the tax cost onto the customers which may lead to inflation and a rise in prices, such steps are not desirable for vulnerable sections.

- Lack of enforcement at the grassroots plagued by corruption may lead such initiatives to become just one more tax among the many.

- It may hamper the small and local industries, MSMEs as their costs will increase which will reduce their competitiveness.

- Some companies have been observed to indulge in ‘greenwashing’ just to meet CSR obligations and may find such loopholes for the Green taxing as well.

Way Forward:

A Green Tax could be a right step on the lines of single taxing for emissions but it poses many challenges such as passing of costs onto the customers but it would not be very significant and can be absorbed. Moreover, consumers of products and services that are environmentally unfriendly would also be made accountable to the world at large. All in all the cost has to be borne by somebody but the government is sure to be a big beneficiary.

Source: LiveMint

Previous Year Question

Q.1) Which one of the following best describes the term “greenwashing”? (2022)

- Conveying a false impression that a company’s products are eco-friendly and environmentally sound

- Non-inclusion of ecological/ environmental costs in the Annual Financial Statements of a country

- Ignoring the consequences disastrous ecological while infrastructure development undertaking

- Making mandatory provisions for environmental costs in a government project/programme

Syllabus

- Mains – GS 2 (Governance)

Context: Expanding Public Distributing System coverage to account for the increase in population since 2011 is a no-brainer; the Government’s resistance to implementing a Supreme Court of India direction is baffling.

- India has ranked 101 among the 116 countries on the Global Hunger Index, 2021. According to the Food and Agriculture Organisation, the Food Price Index has increased by 30% in the year 2021-22.

About Food Security:

- Food security is the measure of the availability of food and individuals’ ability to access it; meaning that all people, at all times, have physical, social, and economic access to sufficient, safe, and nutritious food that meets their food preferences and dietary needs for an active and healthy life.

- It has following dimensions:

- Availability: It means food production within the country, food imports and the stock stored in government granaries.

- Accessibility: It means food is within reach of every person without any discrimination.

- Affordability: It implies that having enough money to buy sufficient, safe and nutritious food to meet one’s dietary needs.

- Thus, Food security is ensured in a country only when sufficient food is available for everyone, if everyone has the means to purchase food of acceptable quality, and if there are no barriers to access.

Impact of the pandemic on Food Security: Recently, the Food and Agriculture Organization (FAO) has released the State of Food Security and Nutrition in the World 2021 report. The key findings are,

- Loss of income and rise in food prices: The primary reason for a dip in affordability is the loss of income. But food price rise has made the situation more acute. By the end of 2020, global consumer food prices were the highest in six years. In the first four months of 2021, they continued to rise.

- Dip in people’s affordability of healthy food: There is a significant dip in people’s affordability for healthy food due to a loss in income. The pandemic led to an additional 141 million people being unable to afford a healthy diet in the countries studied.

- Healthy diet costs more: The cost of a healthy diet was 60% more than a diet that just meets “requirements for essential nutrients” and almost five times as much as a diet that just meets “the minimum dietary energy needs through a starchy staple”.

- Undernourishment: The increase in the number of undernourished during the pandemic was more than five times greater than the highest increase in undernourishment in the last two decades.

Current Framework for Food Security in India:

- Constitutional Provision: Though the Indian Constitution does not have any explicit provision regarding right to food, the fundamental right to life enshrined in Article 21 of the Constitution can be interpreted to include the right to live with human dignity, which may include the right to food and other basic necessities.

- Buffer Stock: Food Corporation of India (FCI) has the prime responsibility of procuring the food grains at minimum support price (MSP) and stored in its warehouses at different locations and from there it is supplied to the state governments in terms of requirement.

- Public Distribution System: Over the years, Public Distribution System has become an important part of Government’s policy for management of the food economy in the country. PDS is supplemental in nature and is not intended to make available the entire requirement of any of the commodity.

- Under the PDS, presently the commodities namely wheat, rice, sugar and kerosene are being allocated to the States/UTs for distribution.

- Some States/UTs also distribute additional items of mass consumption through the PDS outlets such as pulses, edible oils, iodized salt, spices, etc.

- National Food Security Act, 2013 (NFSA): It marks a paradigm shift in the approach to food security from welfare to rights based approach.

- The introduction of the One Nation One Ration Card (ONORC) scheme is an innovation that can be a game-changer, allowing beneficiaries to access their food entitlements from anywhere in the country.

NFSA covers 75% of the rural population and 50% of the urban population under:

- Antyodaya Anna Yojana: It constitute the poorest of-the-poor, are entitled to receive 35 kg of foodgrains per household per month.

- Priority Households (PHH): Households covered under PHH category are entitled to receive 5 kg of foodgrains per person per month.

- The eldest woman of the household of age 18 years or above is mandated to be the head of the household for the purpose of issuing ration cards.

- In addition, the act lays down special provisions for children between the ages of 6 months and 14 years old, which allows them to receive a nutritious meal for free through a widespread network of Integrated Child Development Services (ICDS) centres, known as Anganwadi Centres.

Challenges to food security in India:

- Climate change will continue to affect agriculture and food security, and the impact on the poor and vulnerable can be devastating.

- A third of all food produced is wasted. Lost or wasted energy used for food production accounts for about 10% of the world’s total energy consumption.

- Further, the annual greenhouse gas emissions associated with food losses and food waste reach around 3.5 gigatonnes of the CO2 equivalent.

- The scale of India’s public food distribution systems is immense and has gone through constant navigation and improvement, which is commendable.

- But more needs to still be done to improve access and inclusion among the missing vulnerable population.

- Such as single women-led households, transgender persons, HIV-affected persons, displaced persons, refugees, and orphan children, etc.

- The Comprehensive National Nutrition Survey 2016-18 revealed that over 40 million children are chronically malnourished, and more than half of Indian women aged 15-49 years are anaemic.

- In India, more than 86% of farmers have less than two hectares of land contributing around 60% of the total food grain production and over half the country’s fruits and vegetables.

- Intensified food production systems with excessive use of chemicals and unsustainable farming practices cause soil degradation, fast depletion of groundwater table and rapid loss of agro-biodiversity.

Way Forward:

- Revitalising Aadhaar Seeding of Ration Cards: To speed up the process of Aadhaar linking to ration cards, ground monitoring measures must be taken that will ensure no valid beneficiary is left out of their share of food grains that can give thrust to the aim of zero hunger (Sustainable Development Goal- 2).

- Direct Benefit Transfer (DBT) Through JAM: There is a need to streamline food and fertiliser subsidies into direct benefit transfers to accounts of identified beneficiaries through the JAM trinity platform (Jan Dhan, Aadhaar, and Mobile) that will reduce huge physical movement of foodgrains, provide greater autonomy to beneficiaries to choose their consumption basket and promote financial inclusion.

- Moving Towards Sustainable Farming : For ensuring Food Security in India , improvement in productivity through greater use of biotechnology, intensifying watershed management, use of nano-urea and access to micro-irrigation facilities and bridging crop yield gaps across States through collective approach should be at priority.

- There is also a need to look forward towards establishing Special Agriculture Zones through ICT based crop monitoring.

- Towards Precision Agriculture: There is need to increase the use information technology (IT) in agriculture to ensure that crops and soil receive exactly what they need for optimum health and productivity.

- Ensuring Transparency in Food Stock Holdings : Using IT to improve communication channels with farmers can help them to get a better deal for their produce while improving storage houses with the latest technology is equally important to deal with natural disasters.

- Further, foodgrain banks can be deployed at block/village level, from which people may get subsidised food grains against food coupons ( that can be provided to Aadhar linked beneficiaries).

- Addressing Issues With an Umbrella Approach: By looking at diverse issues from a common lens, such as inequality, food diversity, indigenous rights, and environmental justice, India can look forward to a sustainable green economy.

Source: The Hindu

Baba’s Explainer – Religious conversions and Laws

Syllabus

- GS-2: Government policies and interventions for development in various sectors and issues arising out of their design and implementation.

- GS-2: Statutory, regulatory and various quasi-judicial bodies.

- GS-2: Fundamental Rights

Context: The Supreme Court’s recent remarks on religious conversions cast a spotlight on the long-standing debate about what the fundamental right to “propagate” one’s religious faith entails.

- SC Bench led by Justice M.R. Shah said acts of charity or good work to help a community or the poor should not cloak an intention to religiously convert them as payback.

- SC had remarked that religious conversions by means of force, allurement or fraud may “ultimately affect the security of the nation and freedom of religion and conscience of citizens”.

Read Complete Details on Religious conversions and Laws

Practice MCQs

Q.1) With reference to Indian judiciary, consider the following statements:

- The Chief Justice of a High Court for any State may at any time, with the previous consent of the President can appoint ad hoc judges in high court

- Article 236 of the Indian Constitution deals with the appointment of ad hoc judges to the high courts

Which of the statements given above is/are correct?

- 1 only

- 2 only

- Both 1 and 2

- Neither 1 nor 2

Q.2) The term Multi-tranche financing facility is often mentioned in news is an Initiative of

- World Bank

- International Monetary Fund

- Asian Infrastructure Investment Bank

- Asian Development Bank

Q.3) Consider the following:

- e-Green Watch portal serves as a single point source for the information related to forest fires in India.

- Van Agni Geo-portal is an advanced technology based platform designed to facilitate automation, streamlining and effective management of works taken up under CAMPA fund.

- PARIVESH portal is a single-window integrated environmental management system for online submission and monitoring of the proposals submitted by the proponents for seeking Environment, Forest, Wildlife and Coastal Regulation Zone clearances from Central Government.

Which of the statements given above is/are correct?

- 1 and 2 only

- 2 only

- 3 only

- 1 and 3 only

Comment the answers to the above questions in the comment section below!!

ANSWERS FOR ’ 10th December 2022 – Daily Practice MCQs’ will be updated along with tomorrow’s Daily Current Affairs.st

ANSWERS FOR 9th December – Daily Practice MCQs

Q.1) – c

Q.2) – d

Q.3) – c