IASbaba's Daily Current Affairs Analysis

Archives

(PRELIMS & MAINS Focus)

Syllabus

- Prelims – History and Geography

Context: As Sikhs across India and the rest of the world observe the 356th birth anniversary of Guru Gobind Singh, a rivulet in north India associated with a key moment in his life is gasping for breath.

- The Sarsa was where the Guru Gobind Singh’s family got separated in 1704, never to be together again.

- Pharmaceutical waste being discharged either directly or indirectly into the Sarsa from nearby Industries.

About Sarsa river:

- The river rises in the Shiwalik foothills of Southern Himachal Pradesh.

- It flows in the western part of Solan district, then enters into Punjab near Diwari village.

- Sarsa joins the river Sutlej at the eastern part of Punjab.

- A Gurudwara named Parivar Vichora is situated near the bank of river Sirsa in the village Majri.

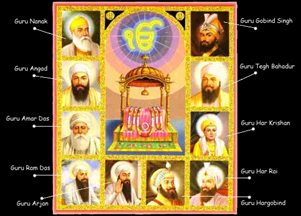

About Guru Gobind Singh:

- Guru Gobind Singh was the 10th Sikh guru.

- He was born in Patna, Bihar in 1666.

- He became the Sikh guru at the age of nine, following the demise of his father, Guru Tegh Bahadur, the ninth Sikh Guru.

- He founded the Sikh warrior community called Khalsa in 1699.

- He introduced the turban to cover the hair along with the principles of Khalsa or the five ‘K’s.

- He laid the rules of Khalsa warriors, like abstaining from tobacco, alcohol, halal meat, and imbibing the duty of protecting innocent people from prosecution.

- He named Guru Granth Sahib as the religious text of the Khalsa and the Sikhs.

- He fought against the Mughals in the Battle of Muktsar in 1705.

- He also wrote the Zafarnama which was a letter to the Mughal Emperor Aurangzeb.

Source: DownToEarth

Previous Year Question

Q.1) The world’s second tallest statue in sitting pose of Ramanuja was inaugurated by the Prime Minister of India at Hyderabad recently. Which one of the following statements correctly represents the teachings of Ramanuja? (2022)

- The best means of salvation was devotion.

- Vedas are eternal, self-existent and wholly authoritative.

- Logical arguments were meant for the highest bliss.

- Salvation was to be obtained through meditation.

Q.2) According to Portuguese writer Nuniz, the women in the Vijayanagara empire were expert in which of the following areas?

- Wrestling

- Astrology

- Accounting

- Soothsaying

Select the correct answer using the code given below:

- 1, 2 and 3 only

- 1, 3 and 4 only

- 2 and 4 only

- 1, 2, 3 and 4

Syllabus

- Prelims – Science and Technology

Context: Born on January 1, 1894, Satyendra Nath Bose collaborated with Einstein to develop what we now know as the Bose-Einstein statistics. We take a look at the Indian physicist’s illustrious legacy and stellar achievements.

About Satyendra Nath Bose:

- Satyendra Nath Bose was born on January 1, 1894 in Calcutta.

- His father Surendranath Bose was employed in the Engineering Department of the East India Railway.

- Satyendra Nath Bose is known for his work in Quantum Physics.

- He is famous for “Bose-Einstein Theory” and a kind of particle in atom has been named after his name as Boson.

- Satyendra Nath Bose had his schooling from Hindu High School in Calcutta.

- He passed the ISc in 1911 from the Presidency College, Calcutta securing the first position.

- Satyendra Nath Bose did his BSc in Mathematics from the Presidency College in 1913 and MSc in Mixed Mathematics in 1915 from the same college.

- In 1916, the Calcutta University started M.Sc. classes in Modern Mathematics and Modern Physics. S.N. Bose started his career in 1916 as a Lecturer in Physics in Calcutta University from 1916 to 1921.

- He joined the newly established Dhaka University in 1921 as a Reader in the Department of Physics.

- In 1924, Satyendra Nath Bose published an article titled Max Planck’s Law and Light Quantum Hypothesis.

- This article was sent to Albert Einstein. Einstein appreciated it so much that he himself translated it into German and sent it for publication to a famous periodical in Germany – ‘Zeitschrift fur Physik’.

- The hypothesis received a great and was highly appreciated by the scientists. It became famous to the scientists as ‘Bose-Einstein Theory’.

- In 1926, Satyendra Nath Bose became a Professor of Physics in Dhaka University.

- Though he had not completed his doctorate till then, he was appointed as professor on Einstein’s recommendation.

- In 1929 Satyendra Nath Bose was elected chairman of the Physics of the Indian Science Congress and in 1944 elected full chairman of the Congress.

- In 1945, he was appointed as Khaira Professor of Physics in Calcutta University. He retired from Calcutta University in 1956.

- The University honored him on his retirement by appointing him as Emeritus Professor.

- Later he became the Vice Chancellor of the Viswabharati University.

- In 1958, he was made a Fellow of the Royal Society, London.

- Satyendra Nath Bose was honored with ‘Padmabhusan’ by the Indian Government in recognition of his outstanding achievement.

- He died in Kolkata on February 4, 1974.

Source: Indian Express

Previous Year Questions

Q.1) Consider the following statements:

- Other than those made by humans, nanoparticles do not exist in nature.

- Nanoparticles of some metallic oxides are used in the manufacture of some cosmetics.

- Nanoparticles of some commercial products which enter the environment are unsafe for humans.

Which of the statements given above is/are correct?

- 1 only

- 3 only

- 1 and 2

- 2 and 3

Q.2) With reference to the carbon nanotubes, consider the following statement :

- They can be used as the carriers of drugs and antigens in the human body.

- They can be made into artificial blood capillaries for an injured part of the human body.

- They can be used in biochemical sensors.

- Carbon nanotubes are biodegradable.

Which of the statements given above are correct ? (2020)

- 1 and 2 only

- 2, 3 and 4 only

- 1, 3 and 4 only

- 1, 2, 3 and 4

Syllabus

- Prelims – Science and Technology

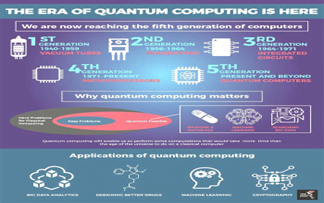

Context: Recently, a draft research paper claimed Google researchers have achieved a long sought- after goal in physics called “quantum supremacy”. But a team from IBM has published their own paper claiming they can reproduce the Google result on existing supercomputers.

About Quantum Supremacy:

- The phrase “quantum supremacy” was coined in 2011 by John Preskill, Professor of Theoretical Physics at the California Institute of Technology in a talk he delivered on the benefits of using quantum hardware over traditional computers.

- Quantum computing is the use of quantum-mechanical phenomena such as superposition and entanglement to perform computation.

- A quantum computer is used to perform such computation, which can be implemented theoretically or physically.

- Quantum supremacy refers to a quantum computer solving a problem that cannot be expected of a classical computer in a normal lifetime.

- This relates to the speed at which a quantum computer preforms.

- Quantum supremacy is the point at which quantum computers can solve problems that are practically unsolvable for “classical” (nonquantum) computers to complete in any reasonable timeframe.

- In principle, even the simplest universal computer can solve anything that is computable given infinite time to do so.

- It is generally believed that at least 49 qubits are required to cross the quantum supremacy line.

- Qubits behave very differently to bits in classical computers.

- Bits represent either a “1” or a “0,” and computers read and perform operations on one bit at a time.

- In contrast, qubits can represent a combination state made up of both “1” and “0,” due to the peculiar quantum effects in which properties like particle position, direction, and momentum are not well-defined.

- This allows for a system to be in multiple states at the same time, called quantum indeterminacy.

Application of Quantum Computing:

- Artificial Intelligence (AI): Quantum computers could empower machine learning by enabling AI programs to search through these gigantic datasets concerning medical research, consumer behavior, financial markets, etc—and make sense of them.

- Computational Chemistry: Today’s digital computers can analyze only the simplest molecules. But quantum computers can do precision modelling of complex molecular interactions and also find the optimum configurations for chemical reactions.

- Google has already made inroads in this field by simulating the energy of hydrogen molecules.

- The implication of this is – more efficient products, from solar cells to pharmaceutical drugs, and particularly fertilizer production; since fertilizer accounts for 2 percent of global energy usage, the consequences for energy and the environment would be profound.

- Financial services: Quantum computers can be used for complex financial modelling and risk management in the financial industry by finding new ways to model financial data and isolating key global risk factors.

- Cryptography: Online security depends on the factoring large numbers into primes which can be done by digital computers themselves, however, it would consume an immense amount of time that makes “cracking the code” expensive and impractical.

- Quantum computers can perform such factoring more efficiently than digital computers = Quantum computing can soon replace those obsolete methods.

- Weather Forecasting: The ability to better predict the weather would have enormous benefits to many fields, not to mention more time to take cover from disasters.

- Conventional computers would take longer than it takes for the actual weather to evolve. Equations governing the weather possess a hidden wave nature which can be analysed by quantum computers = better weather prediction.

- Climate modelling: Quantum computers could help build better climate models that could give us more insight into how humans are influencing the environment.

- Particle Physics Simulation: Models of particle physics are often extraordinarily complex which require vast amounts of computing time for numerical solution.

- This makes them ideal for quantum computation, and researchers have already taken advantage of this.

- Logistics and Scheduling: Quantum computing can make significant strides in the logistics sector.

- Although classical computing is used heavily to do these tasks, some of them may be too complicated for a classical computing solution whereas a quantum approach may be able to do it.

Source: DownToEarth

Previous Year Question

Q.1) Which one of the following is the context in which the term “qubit” is mentioned? (2022)

- Cloud Services

- Quantum Computing

- Visible Light Communication Technologies

- Wireless Communication Technologies

Syllabus

- Prelims – Economy

Context: Recently, the RBI’s latest Financial Stability Report (FSR) indicated that India’s banks and non-bank lenders can withstand even the worst of macro-economic stress. RBI’s stress testing models have been criticised in the past for a significant upward bias.

Highlights of the report:

- Financial stability has been maintained.

- Domestic financial markets have remained stable and fully functional.

- The banking system is sound and well-capitalised.

- The non-banking financial sector has also withstood these challenges.

- Banks have enough capital to maintain the ratio above the minimum requirement till September 2023.

- The decline in the capital adequacy ratio was on account of higher risk-weighted assets as lending activity picked up recently.

- The decrease in slippages, increase in write-offs and an improvement in loan growth brought the gross non-performing assets (NPA) ratio of banks further down to a seven-year low of 5%.

- The net NPA ratio stood at a 10 year low of 1.3%.

- Banks will be able to maintain a common equity tier-I capital ratio above the minimum requirement of 8%.

- There is a 41% increase in the net profit of the banks and a 10% growth in net interest income (NII).

- India along with other emerging economies is facing several risks of:

- Rising borrowing costs.

- Debt distress.

- Elevated levels of inflation.

- Volatile commodity prices.

- Currency depreciation.

- Capital outflows.

Source: Indian Express

Previous Year Question

Q.1) With reference to the Indian economy, consider the following statements:

- If the inflation is too high, Reserve Bank of India (RBI) is likely to buy government securities.

- If the rupee is rapidly depreciating, RBI is likely to sell dollars in the market.

- If interest rates in the USA or European Union were to fall, that is likely to induce RBI to buy dollars.

Which of the statements given above are correct? (2022)

- 1 and 2 only

- 2 and 3 only

- 1 and 3 only

- 1, 2 and 3

Syllabus

- Prelims – Economy

In News: Government has increased interest rate on various small savings schemes for the fourth quarter of the current Financial Year starting from 1st January, 2023.

About Small Saving Schemes/Instruments

- Small Savings Schemes are a set of savings instruments managed by the central government with an aim to encourage citizens to save regularly irrespective of their age.

- They are popular as they not only provide returns that are generally higher than bank fixed deposits but also come with a sovereign guarantee and tax benefits.

- They are the major source of household savings in India and comprises 12 instruments.

- The depositors get an assured interest on their money.

- Collections from all small savings instruments are credited to the National Small Savings Fund (NSSF).

- The rates on these small savings schemes are calculated on the yields on government securities (G-secs).

- Small savings have emerged as a key source of financing the government deficit.

Small savings instruments can be classified as

- Postal Deposits comprising savings account, recurring deposits, time deposits of varying maturities and monthly income scheme.

- Savings Certificates: National Small Savings Certificate (NSC) and Kisan Vikas Patra (KVP).

- Social Security Schemes: Sukanya Samriddhi Scheme, Public Provident Fund (PPF) and Senior Citizens‘ Savings Scheme (SCSS).

The Sukanya Samriddhi Account

- It was launched in 2015 under the Beti Bachao Beti Padhao campaign

- It is exclusively for a girl child.

- The account can be opened in the name of a girl child below the age of 10 years.

- The scheme guarantees a return of 7.6% per annum and is eligible for tax benefit under Section 80C of the Income Tax Act.

- The tenure of the deposit is 21 years from the date of opening of the account and a maximum of Rs 1.5 lakh can be invested in a year.

Source: News on air

Previous Year Question

Q.1 ) Regarding ‘Atal Pension Yojana’, which of the following statements is/are correct? (2016)

- It is a minimum guaranteed pension scheme mainly targeted at unorganized sector workers.

- Only one member of a family can join the scheme.

- Same amount of pension is guaranteed for the spouse for life after subscriber’s death.

Select the correct answer using the code given below.

- 1 only

- 2 and 3 only

- 1 and 3 only

- 1, 2 and 3

Syllabus

- Prelims – Governance

In News: The Centre will provide foodgrains to states under the National Food Security Act (NFSA) free for one year from today.

The New Integrated Scheme:

Aim:

- Government of India has social & legal commitment to the people of the nation- a dignified life by ensuring them access to food and nutritional security through availability of adequate quantity of quality foodgrains.

- Bringing uniformity and clarity on food security under NFSA at beneficiary level.

- To fulfil the vision of One Nation – One Price – One Ration

About the scheme:

- It is to begin on 1 January 2023 for a period of 1 year.

- It would provide free food grains to 81.35 crore beneficiaries under NFSA including Antyodaya Ann Yojana households and Priority Household persons.

- The new integrated scheme will subsume two current food subsidy schemes of the Department of Food and Public Distribution- a) Food Subsidy to FCI for NFSA, and b) Food Subsidy for decentralized procurement states, dealing with procurement, allocation and delivery of free foodgrains to the states under NFSA.

- Free foodgrains will concurrently ensure uniform implementation of portability under One Nation One Ration Card (ONORC) across the country and will further strengthen this choice-based platform.

- Central Government will bear the food subsidy of more than Rs. 2 Lakh crore for the year 2023.

- The foodgrains will be provided through the widespread network of over five lakhs Fair Price Shops across the country.

Significance:

- The Scheme would ensure effective and uniform implementation of National Food Security Act (NFSA).

- This will strengthen the provisions of NFSA, in terms of accessibility, affordability and availability of foodgrains for the poor.

Must Read: NFSA

Must Read: One nation one ration card

Source: News on air

Previous Year Question

Q1.) With reference to the provisions made under the National Food Security Act, 2013, consider the following statements: (2018)

- The families coming under the category of ‘below poverty line (BPL)’ only are eligible to receive subsidised food grains.

- The eldest woman in a household, of age 18 years or above, shall be the head of the household for the purpose of issuance of a ration card.

- Pregnant women and lactating mothers are entitled to a ‘take-home ration’ of 1600 calories per day during pregnancy and for six months thereafter.

Which of the statements given above is/are correct?

- 1 and 2 only

- 2 only

- 1 and 3 only

- 3 only

Syllabus

- Prelims – Disaster management

In News: In Maharashtra, atleast 2 women workers were killed and 19 workers injured in a massive fire that broke out at Jindal Group’s polythene manufacturing unit in Mundegaon village of Nashik this morning.

- Maharashtra Fire Prevention and Life Safety Measures Rules, 2009, were adopted under the Maharashtra Fire Prevention and Life Safety Measures Act, 2006.

- These legislation required building owners and inhabitants to undertake half-yearly fire safety audits and submit the results to the fire service.

- However, leaving the fire safety audit to “Licensed Agencies” has produced some confusion, because the same agency is responsible for I installing firefighting systems

About fire safety in India:

- As per National Crime Records Bureau, India’s dismal fire safety record was reflected in the deaths of 17,700 persons in fires in both public and private buildings across the country in 2015.

- According to Article 243W of the Constitution, municipalities in India are responsible for completing the activities stated in the 12th schedule.

- Currently, the concerned states, Union Territories (UTs), and Urban Local Bodies offer fire prevention and firefighting services (ULBs).

- Municipal corporations manage fire services in several states, such as Gujarat and Chhattisgarh. It is controlled by the Home Ministry’s department in the remaining states.

- Part 4 of the National Building Code of India deals with Fire and Life Safety.

National Building Code of India:

- Created by the Bureau of Indian Standards.

- The NBC published its debut issue in 1970.

- NBC’s primary purpose is to outline practises that provide a practical and reasonable degree of fire safety.

- The Code mandates that building occupants and users comply with the basic minimum of fire safety regulations.

- To guarantee that fire protection equipment/installations satisfy the set quality criteria, it is preferable to use those that have been officially certified under the BIS Certification Marks Scheme.

- Building constraints in each fire zone are mentioned, as well as building classification based on occupancy, fire zone demarcation, height limitations, kinds of structure construction based on fire resistance of structural and non-structural components, and other restrictions and regulations essential to reduce the risk of death from fire, smoke, gases, or panic before the building is constructed.

- The Code recognises that life safety is about more than only escape and includes requirements concerning egress, such as exit access, exit, and exit discharge, among other things.

- It also provides guidelines for deploying portable and fixed firefighting equipment to protect various occupancies from fire.

Source: News on air

Syllabus

- Prelims – Science and Technology

In News: Prime Minister Shri Narendra Modi will address the 108th Indian Science Congress (ISC) via video conferencing.

- The focal theme of this year’s ISC is “Science and Technology for Sustainable Development with Women Empowerment”.

- Children’s Science Congress will also be organised to help stimulate scientific interest and temperament among children.

- Farmer’s Science Congress will provide a platform to improve the bio-economy and attract youth to agriculture.

- Tribal Science Congress will also be held, which will also be a platform for scientific display of indigenous ancient knowledge system and practice, along with focusing on the empowerment of tribal women.

Indian Science Congress Association:

- Indian Science Congress Association (ISCA) is a premier scientific organisation of India with headquarters at Kolkata, West Bengal.

- The association started in the year 1914 in Kolkata and it meets annually in the first week of January.

- It has a membership of more than 30,000 scientists.

- The first Indian Science Congress was held in 1914 at the Asiatic Society in Calcutta.

- Several prominent Indian and foreign scientists, including Nobel laureates, attend and speak in the congress.

Source PIB

Syllabus

- Mains – GS 1 (Governance) and GS 3 (Economy)

Context: As we are in 2023, we are reminded of the government’s failed ambition of doubling the farmers’ income by 2022. Although recently, an expert committee headed by Ashok Dalwai submitted a report on Doubling Farmers’ Income (DFI) in 14 volumes.

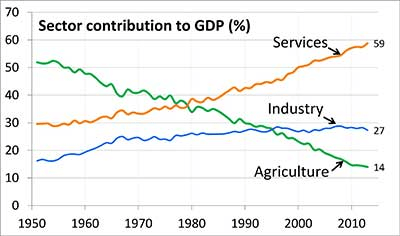

India’s Agri Sector At a Glance:

- Contribution of India’ Agriculture and allied sector in Gross Domestic Product stood at about 55% in 1951.

- According to the Economic Survey, the share of Agriculture and allied sectors in total Gross Value Added (GVA) in 2020-21 stood at about 20%.

- Share of Agriculture and Allied Activities in Agriculture GVA

- Crops – 60%

- Livestock – 27%

- Forestry & Logging – 7%

- Fishing & Aquaculture – 6%

- Agriculture sector was the only sector to have clocked a positive growth of 3.4% in 2020-21 (during COVID lockdown).

- According to the World Bank, about 42 % of India’s workforce was employed in the Agriculture sector in 2018-19.

- More than two-third of the total workforce was employed in the agriculture sector in 1951.

- About 16 crore Indian workers are engaged in agriculture and allied sectors in 2018-19.

- In 1951 more than two-third of the unorganized workforce was involved in Agriculture and allied sectors.

Significance of doubling farmers’ income:

- Fluctuations in farmers’ income: The low and highly fluctuating farm income is causing a detrimental effect on the interest in farming and farm investments.

- It is also forcing more and more cultivators, particularly younger age groups, to leave farming.

- Agrarian distress: There has been a large disparity between the income of a farmer and non-agricultural worker since long and this coupled with low level of absolute income has led to emergence of agrarian distress in the country, particularly in late 1990s.

- In recent times it has gotten severe and been impacting almost half of the population of the country that is dependent on farming for livelihood.

- Poverty and farmer suicides: Poverty coupled with natural disasters and other such reasons caused country a sharp increase in the number of farmer suicides in late 1990s to 2000s.

- Promotes farmers welfare: Farmers’ increased income may address agrarian distress and promote farmers welfare.

- Thus the goal of doubling farmers’ income by 2022-23 is central to bring parity between the income of farmers and those working in non-agricultural professions.

- Faulty policy decisions: Past strategy for the development of the agriculture sector in India has focused primarily on raising agricultural output and improving food security.

- This has been a reason for farmers’ low income and which is evident from the incidence of poverty among farm households.

Ashok Dalwai panel farm income estimations:

- Methodology: The Dalwai panel adopted a broader definition of ‘farmer’ used by the Situation Assessment Survey (SAS) of the National Statistical Office (NSO).

- It used all the income of such households for defining the target of doubling farmers’ incomes.

- This included non-farm incomes from businesses and the labour wages of farmer households.

- Issues with the methodology: Lack of latest data as the most recent NSO survey of farmers is for 2018-19 and prior to that was in 2012-13.

- There is no way to estimate farmers’ incomes in 2022, as there have been no surveys after 2018-19 and it is unlikely in near future as these are generally decennial.

- Even the older data also shows that the income of farmer households from crop cultivation declined 1.5% per annum between 2012-13 and 2018-19.

- Possibility of data manipulation as the income of farmers does rise barely by 0.6% per annum, when livestock income is included.

- On adding non-farm income, it shows a growth of 2.8% per annum and based on the non-farm intake of farmer households.

- Differential definitions and criterion if another source of data on income of agricultural households are used such as the survey of rural households as part of the NABARD All India Financial Inclusion Survey (NAFIS).

- Also its definition of agricultural households and income differs from the SAS’s and only provides data on income for 2015-16.

However, it found that the income of agricultural households from all sources increased 1.7% per annum between 2015-16 and 2018-19, less than half the 3.8% growth rate of the prior period between 2012-13 and 2015-16.

Government of India initiatives to improve farmer’s income:

- Wide range of Agri- schemes such as crop insurance under Pradhan Mantri Fasal Bima Yojna (PMFBY), supplementary income support under PM-KISAN, new procurement policy under PM-AASHA in addition to FCI operations, better access to irrigation under Pradhan Mantri Krishi Sinchayi Yojana (PMKSY) etc.

- Smart Agriculture through adoption of drone technologies in agriculture which has a potential to revolutionize Indian agriculture.

- Increase in Minimum Support Price (MSPs) for all Kharif and Rabi crops ensuring a minimum of 50 percent of profit margin on the cost of production

- Formation and promotion of 10,000 Farmer Producer Organisations (FPOs) along with necessary financial support under Aatmanirbhar Package (Agriculture).

- National Mission for Sustainable Agriculture (NMSA), which aims to evolve and implement strategies to make Indian agriculture more resilient to the changing climate.

- Range of schemes and programmes for Agri allied services such Bee-Keeping Mission, Rashtriya Gokul Mission, Blue Revolution, Interest Subvention Scheme, agroforestry, restructured bamboo mission etc.

Way Forward:

From the above information, given our lack of data there is little possibility of concrete and robust estimates of farmers’ income in the last 5 years. Although based on the available sources we can infer that, there has been a deceleration in farmer incomes after 2015-16, irrespective of the source or method.

Not only the farmers’ income but rural real wages are also declining in the last five years, even wage workers have not seen any growth in their incomes. Three-fourths of rural workers are witnessing a decline in income, likely to deepen the rural stress. While this has an impact on lives and livelihood, given spiralling inflation in recent times and a demand deficiency will deepen the crisis in our economy.

The problem with respect to Agriculture in India is deep-rooted. It requires systemic solutions with a well-thought-out strategy and policy reforms. Therefore, for any meaningful plan aimed at an economic revival in the future, prioritizing the revival of India’s rural economy is not just desirable, but a necessity.

Source: Indian Express

Syllabus

- Mains – GS 3 Environment

Context:

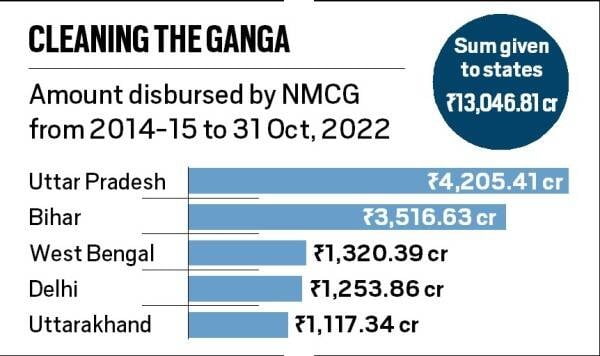

- The Union government spent more than Rs 13,000 crore on cleaning the Ganga since 2014, with Uttar Pradesh receiving the largest outlay among states, the National Mission for Clean Ganga (NMCG) is learnt to have informed the National Ganga Council.

- As per the details available, the Centre has released a total of Rs 13,709.72 crore to the NMCG from the financial year 2014-15 till October 31, 2022

- United Nations Recognizes Namami Gange Initiative As One Of The Top 10 World Restoration Flagships To Revive The Natural World.

Significance of Ganga

- The Ganges River carries nutrient rich sediment as it flows, depositing fertile soil along its shores.

- This has allowed civilizations to develop and thrive along the waterway for centuries.

- The river is used for fishing, irrigation, and bathing, and it is worshiped in the Hindu religion as the Mother Ganga.

- The Ganga has medicinal properties that can treat skin infections. These properties come due to medicinal plants on the path of Ganga

- The Ganga is very rich in minerals and has bacteriophages which kill the bacteria.

National Mission for Clean Ganga (NMCG)

- NMCG is responsible for implementation of the government’s ambitious Namami Gange programme

- NMCG is registered as a society in 2011 under the Societies Registration Act 1860.

- The aims of NMCG is to ensure effective control of pollution and rejuvenation of the river Ganga by adopting a river basin approach to promote inter-sectoral coordination for comprehensive planning and management.

- Further, to maintain minimum ecological flows in the river Ganga with the aim of ensuring water quality and environmentally sustainable development.

- About 1,100 km of the Ganga’s 2,525-km length falls in Uttar Pradesh.

- The expenditure to Uttar Pradesh makes up around two-thirds of the budget allocated for the programme.

Namami Gange program

- The government had launched Namami Gange in 2014-15 for a period up to March 31, 2021 to “rejuvenate” the Ganga and its tributaries. The programme was later extended for another 5 years till March 31, 2026.

- With a total budgetary outlay of Rs.20,000 crore.

- A corpus of Rs 198.14 crore (as of March 31, 2017) was available in the Clean Ganga Fund – It is a fund under which entities or a commoner can contribute for the Ganga clean up.

Challenges of the program:

- Development projects

- 16 existing, 14 ongoing and 14 proposed hydroelectric projects on the Bhagirathi and Alaknanda river basins have turned the upper stretch of the Ganga “ecological deserts” – report published by Wildlife Institute of India in May 2018

- Sewage treatment

- As far as sewage infrastructure projects are concerned, 68 projects were sanctioned after the Namami Gange was approved by the cabinet and only six were completed till August.

- Restoring the flow

- If the flow in the river is maintained it can solve the problem of 60-80 per cent of organic pollutants

- IIT-Kharagpur said – baseflow amount of the river has decreased by 56 per cent in 2016 as compared to the 1970s.

- The decrease in flow has led to an increase in groundwater extraction for various uses.

- Sludge control

- The objective of making villages lying in the Ganga basin to be ODF was to reduce the faecal coliform levels in the Ganga

- About 180 MLD sludge would be generated in five Ganga basin states when they become ODF

- While the BOD of sewage is 150-300 mg/l, that of faecal sludge would be 15,000-30,000 mg/l

- poor financial management

- CAG December 2017 report said – Only eight to 63 per cent of the funds were utilised during 2014-15 to 2016-17 for the river clean-up programme

- NMCG could not utilise any amount out of the Clean Ganga Fund and the entire amount was lying in banks due to non-finalisation of action plan.

- Cost overruns

- The UP SAAP 2016 says that the Ganga basin towns would require Rs 5,794 crore just for the creation of sewerage networks in the state—more than one-fourth of the entire outlay of Namami Gange.

- Governance glitches

- No detail is available as to how or whether water resources and other ministries are functioning in coordination for better convergence.

- The Empowered Task Force led by Union minister of water resources has met only thrice; while it was supposed to meet once every three months.

Suggestions for future:

- Establish a 4-battalion Ganga EcoTask Force to spread awareness about pollution and protecting the river.

- Watershed management approach – a report by Ganga Rejuvenation Basin Management Programme (GRBMP) says that the whole river basin—that is all the states coming under the main stem of Ganga and its tributaries—must come under the ambit of the programme.

- Promote only decentralised sewage treatment plants (dSTP) at the colony level.

- Reuse treated wastewater for irrigation and empty into natural drains.

- For all upcoming cities, smart cities and for those, whose master plans are not in place, earmark land for dSTPs. dSTPs below 10 MLD should be encouraged and incentivised under urban development schemes and real estate development.

- The existing and planned STPs need to be verified on efficiency, reliability and technology parameters by independent agencies (tech-efficiency-reliability verification).

- Develop and restore local storages (ponds, lakes, wetlands) as permanent solutions to both floods and droughts.

- Only 10 per cent of water received during monsoon rainfall is harvested.

- Bring back glory to all natural drains that empty into rivers, and transform and rejuvenate them into healthy water bodies — they have been converted to sewage carrying drains by our municipalities and planning bodies.

- Start restoring lower order streams and smaller tributaries in the Ganga Basin.

- The Ganga has eight major tributaries (Yamuna, Son, Ramganga, Gomti, Ghaghra, Gandak, Kosi and Damodar).

- Identify, define and protect ‘river-corridors’ as areas for no cement-concrete structures — know that rivers have been formed after thousands of years of nature’s work.

- Map the entire looped length of each and every tributary of the Ganga and correct the land records – This will ensure that active flood plains and river-corridors are free from encroachments.

- Restore base flows through groundwater recharge

- Groundwater contributes to base flows in the order of 40- 55 per cent

- Define the desired ecological flow regime(s) in the Ganga main stem and its tributaries to allow the rejuvenation of the river.

- According to the Central Water Commission, all the existing hydroelectric projects have provision for releasing the mandated environmental-flow through controlled gated spillways or water ways.

- Old dams should be decommissioned once irrigation efficiencies are improved.

- Evolve new and innovative ways to generate sufficient revenues for operation and maintenance (O&M) of water and wastewater infrastructure through pricing and valuing water.

Way forward:

- Cleaning of the Ganga needs a strategy where the NGC has to find effective solutions to the challenges that the previous programmes have failed to address.

- This would entail addressing untreated waste that flows into the river, restoring the flow of the river, sludge management in Ganga basin towns, cost overruns in execution of projects and governance glitches.

- Tourism Ministry to develop comprehensive plan for developing tourism circuits along the Ganga in line with Arth Ganga, organic farming and cultural activities; exhibitions and fairs have been planned in 75 towns along the main stem of the river.

Source: Indians express

Practice MCQs

Q.1) With reference to ‘Sukanya Samriddhi Scheme”, consider the following statements

- It applies to girl child only.

- It was launched in 2008.

Which of the following statements are correct?

- 1 only

- 2 only

- Both 1 and 2

- Neither 1 nor 2

Q.2) With reference to ‘National Building Code of India’, it has been created by which of the following?

- National Disaster Management Authority

- National Council for Cement and Building Materials,

- Bureau of Indian Standards

- Indian Institute of Technology, Madras

Q.3) Consider the following statements regarding Guru Gobind Singh:

- He was the 5th Sikh guru.

- He founded the Sikh warrior community called Khalsa in 1699

- He laid the rules of Khalsa warriors, like abstaining from tobacco, alcohol, halal meat, and imbibing the duty of protecting innocent people from prosecution.

Which of the statements given above are correct?

- 1 and 2 only

- 2 and 3 only

- 1 and 3 only

- 1 2 and 3

Comment the answers to the above questions in the comment section below!!

ANSWERS FOR ’ 2nd January 2023 – Daily Practice MCQs’ will be updated along with tomorrow’s Daily Current Affairs.st

ANSWERS FOR 30th December – Daily Practice MCQs

Q.1) – a

Q.2) – d

Q.3) – a