IASbaba's Daily Current Affairs Analysis

Archives

(PRELIMS & MAINS Focus)

Syllabus

- Prelims –Governance

Context: The Performance Grading Index for Districts (PGI-D) combined reports for 2020-21 and 2021-22 were released recently.

About Performance Grading Index for Districts (PGI-D):-

- Released first: 2017-18. (UPSC CSE: Performance Grading Index)

- By: Department of School Education and Literacy (DoSE&L), Ministry of Education.

- Objective: to help the Districts to prioritize areas for intervention in school education and thus improve to reach the highest grade.

- The report the performance of the school education system at the District level by creating an index for comprehensive analysis.

- 83-indicator-based PGI-D has been designed to grade the performance of all districts in school education.

- Significance: The PGI-D is expected to help the state education departments to identify gaps at the district level and improve their performance in a decentralized manner.

- The indicator-wise PGI score shows the areas where a district needs to improve.

Methodology

- The PGI-D structure comprises of total weightage of 600 points across 83 indicators.

- These are grouped under 6 categories viz., Outcomes, Effective Classroom Transaction, Infrastructure Facilities & Student’s Entitlements, School Safety & Child Protection, Digital Learning and Governance Process.

- These categories are further divided into 12 domains.

- PGI-D grades the districts into ten grades viz., Daksh and Akanshi-3.

- Daksh: it is the Highest achievable Grade for Districts scoring more than 90% of the total points in that category or

- Akanshi-3: The lowest grade in PGI-D, which is for scores up to 10% of the total points.

PGI for districts report – 2020-21 & 2021-22

- The Covid Pandemic has affected the performance of districts during 2020-21 to 2021-22 as compared to 2019-20.

- None of the districts attained the top two grades.

- 79 districts made consistent improvement in PGI-D scores in the last 4 years.

- In spite of the Covid pandemic at its peak in 2021-22, 290 districts have made a notable improvement in their performance when compared to 2019-20 (pre-pandemic) with 2021-22.

- Overall, 194 districts have made grade level improvement in 2021-22 as compared to 2018-19.

MUST READ: Education & Aspiring India

SOURCE: AIR

PREVIOUS YEAR QUESTIONS

Q.1) Consider the following statements in relation to Janani Suraksha Yojana : (2023)

- It is a safe motherhood intervention of the State Health Departments.

- Its objective is to reduce maternal and neonatal mortality among poor pregnant women.

- 3 . It aims to promote institutional delivery among poor pregnant women.

- 4 . Its objective includes providing public health facilities to sick infants up to one year of age.

How many of the statements given above are correct?

- Only one

- Only two

- Only three

- All four

Q.2) What is the purpose of ‘Vidyanjali Yojana’?(2017)

- To enable famous foreign educational institutions to open their campuses in India.

- To increase the quality of education provided in government schools by taking help from the private sector and the community.

- To encourage voluntary monetary contributions from private individuals and organizations so as to improve the infrastructure facilities for primary and secondary schools.

Select the correct answer using the code given below:

- 2 only

- 3 only

- 1 and 2 only

- 2 and 3 only

Syllabus

- Prelims –Governance and Economy

Context: Recently, Delhi High Court dismissed PepsiCo’s plea against a revocation order on its Intellectual Property Rights (IPR) certificate for potato variety.

Background:-

- The Delhi High Court on July 5, 2023, dismissed an appeal filed by PepsiCo India Holdings (PIH) against a 2021 order that had revoked the PVP (plant varietal protection) certificate granted to the company for a potato variety (FL-2027). (UPSC CSE: RSTV IAS UPSC – Pepsico v/s Potato Farmers)

- The FL-2027 variety of potatoes, used in Lays potato chips, came to the limelight in April 2019, when it became the centerpiece for a fight in the potato belt of northern Gujarat.

- Alleging that farmers who were not part of its “collaborative farming programme” were also growing and selling this variety in Gujarat, PepsiCo had filed rights infringement cases against farmers.

About FL2027:-

- It is a for a potato variety.

- Its commercial name is FC-5.

- It has a 5 per cent lower moisture content than other varieties.

- With 80 per cent moisture content, as compared to the usual 85 per cent, this variety is considered more suitable for processing and therefore, for making snacks such as potato chips.

- The variety was first cultivated by Dr Robert W. Hoopes, who holds the most potato patents and potato variety protections in the whole world.

- FL2027 came to be registered in the US in 2005 and was put to commercial use in India in 2009.

- PepsiCo had then granted licenses to some farmers in Punjab to grow the variety on a buyback system.

- Buyback system allows the company to buy all the produce from these farmers at pre-decided rates.

- PepsiCo applied for registration of the potato variety in India in 2011.

- It was granted registration in

- Pepsi’s North America subsidiary Frito-Lay has the patent for the potato plant variety FL-2027 until October 2023.

- For India, Pepsi Co has patented FC-5 until January 2031 under the Protection of Plant Varieties and Farmers’ Rights (PPV&FR) Act, 2001.

PPVFR Act, 2001 has been enacted in India for giving effect to the TRIPS Agreement:-

- The PPVFR Act retained the main spirit of TRIPS.

- The Act also had strong provisions to protect farmers’ rights.

- The act allows farmers to plant, grow exchange & sell patent-protected crops, including seeds, & only bars them from selling it as “branded seed”.

- It recognized three roles for the farmer: cultivator, breeder & conserver.

- As cultivators, farmers were entitled to plant-back rights.

- As breeders, farmers were held equivalent to plant breeders.

- As conservers, farmers were entitled to rewards from a National Gene Fund.

The patent dispute Issue:-

- In 2019, PepsiCo sued nine Gujarat farmers for cultivating the same potato variety, accusing them of infringing its intellectual property rights (IPR).

- It sought over Rs. 1 crore each from the farmers for alleged patent infringement under the Protection of Plant Varieties and Farmers’ Rights Act, 2001.

- However, PepsiCo soon withdrew the suit after discussions with the government.

Arguments by Farmers:

- The farmers stated that as per the agreement, PepsiCo would collect potatoes of diameter greater than 45 mm and those farmers had been storing smaller potatoes for sowing next year.

- They got registered seeds from known groups and farmer communities and had been sowing these for the last four years or so, and had no contractual agreement with anyone.

- According to Section 39(1)(iv) of the PPV&FR Act, a farmer is entitled to save, use, share or sell his farm produce including seed of a variety protected under this Act, provided that he is not entitled to sell branded seed of a variety protected under this Act. Hence, there was no violation.

Arguments by breeder: –

- In the US, if someone has patented a seed, no other farmer can grow it

- However, the same does not apply in India.

The court’s take on the matter:-

- The court observed that PepsiCo India Holdings (PIH) had ticked the variety as ‘New variety’ instead of ‘extant variety’, which is a crop variety that exists in a country.

- The judgment was upheld on the grounds of an ineligible registrant and failure to provide necessary documents under various provisions of the Act.

- Based on these, an order that revoked the PVP (plant varietal protection) certificate granted to the company for a potato variety (FL-2027) was made in 2021.

- Hence, the suing of farmers by PepsiCo was not seen in the public interest.

About Intellectual Property Rights (IPR):-

- Intellectual Property Rights (IPR) are the rights acquired by an owner of intellectual property.

- It refers to creations of the mind, such as:-

- inventions

- literary & artistic works

- designs & symbols,

- Names & images used in commerce.

- IPRs have been outlined in Article 27 of the Universal Declaration of Human Rights.

Objectives of IPR:-

- To encourage the creation of a wide variety of intellectual goods & strike the right balance between the interests of innovators & wider public interest.

- These rights are outlined in Article 27 of the Universal Declaration of Human Rights, which provides for the right to benefit from the protection of moral and material interests resulting from authorship of scientific, literary, or artistic productions. (UPSC MAINS: India’s IPR regime)

MUST READ: Boosting patent ecosystem

SOURCE: DOWN TO EARTH

PREVIOUS YEAR QUESTIONS

Q.1) Consider the investments in the following assets: (2023)

- Brand recognition

- Inventory

- Intellectual property

- Mailing list of clients

How many of the above are considered intangible investments?

- Only one

- Only two

- Only three

- All four

Q.2) Recognition of Prior Learning Scheme’ is sometimes mentioned in the news with reference to (2017)

- Certifying the skills acquired by construction workers through traditional channels.

- Enrolling the persons in Universities for distance learning programmes.

- Reserving some skilled jobs to rural and urban poor in some public sector undertakings.

- Certifying the skills acquired by trainees under the National Skill Development Programme.

Syllabus

- Prelims –Environment and Ecology

Context: Recent reports suggest that Nitrogen dioxide (NO2) exposure can lead to premature death and respiratory & circulatory illness.

Background:-

- The review commissioned by Health and Environment Alliance (HEAL), suggested that Nitrogen dioxide (NO2) can lead to premature death from respiratory and circulatory illness.

- HEAL a European non-profit organization.

- The review, also observed that the knowledge about the health effects of NO2 has increased significantly over the last 10-15 years.

- In addition, studies are now able to distinguish between health impacts caused by NO2 and that by other pollutants, including particulate matter or PM2.5.

- 5: it refers to atmospheric particulate matter (PM) that has a diameter of less than 2.5 micrometers

About Nitrogen dioxide (NO2):-

IMAGE SOURCE: clarity.io

- Nitrogen Dioxide (NO2) is a highly reactive gas.

- Other nitrogen oxides include nitrous acid and nitric acid.

- It is an odourless, acidic, and extremely corrosive gas.

- It can harm our health and the environment. (UPSC CSE: Delhi and Air Pollution)

- Sources:-

- NO2 primarily gets in the air from the burning of fuel.

- It forms from emissions from cars, trucks and buses, power plants, and off-road equipment.

- It is also created by natural sources that include volcanoes and microbes.

- It is also formed during the creation of nitric acid, welding and the usage of explosives, the refining of fuel and metals, commercial manufacturing, and food processing.

Uses of Nitrogen Dioxide

- Nitrogen dioxide is used as an intermediary in the production of nitric acid.

- It is used to make oxidised cellulose molecules.

- It is used as a catalyst in many reactions.

- It is used in the production of sulphuric acid.

- Rocket fuels use it as an

- As a nitrating agent.

- As an oxidising agent.

- It is used to make explosives.

Health effects of Nitrogen dioxide (NO2):-

- NO2 can aggravate respiratory diseases, particularly asthma.

- It increases airway inflammation.

- It decreases lung capacity.

- It increases allergic response.

- It increases the probability of respiratory problems.

- It can cause a burning sensation in the eyes and skin.

- NO2 along with other NOx reacts with other chemicals in the air to form both PM and ozone.

Environmental effects

- Acid Rain: NO2 and other NOx interact with water, oxygen and other chemicals in the atmosphere to form acid rain.

- Acid rain harms ecosystems such as lakes and forests.

- Air Pollution: The nitrate particles that result from NOx make the air hazy and difficult to see through. (UPSC CSE: Air pollution)

- Water Pollution: NOx in the atmosphere contributes to nutrient pollution in coastal waters.

MUST READ: India’s uphill battle to bring down air pollution

SOURCE: DOWN TO EARTH

PREVIOUS YEAR QUESTIONS

Q.1) With reference to green hydrogen, consider the following statements: (2023)

- It can be used directly as a fuel for internal combustion.

- It can be blended with natural gas and used as fuel for heat or power generation.

- It can be used in the hydrogen fuel cell to run vehicles.

How many of the above statements are correct?

- Only one

- Only two

- All three

- None

Q.2) In the Guidelines, statements: the context of WHO consider the Air Quality following (2022)

- The 24-hour mean of PM2.5 should not exceed 15 ug/m³ and the annual mean of PM 2.5 should not exceed 5 µg/m³.

- In a year, the highest levels of ozone pollution occur during periods of inclement weather.

- PM10 can penetrate the lung barrier and enter the bloodstream.

- Excessive ozone in the air can trigger asthma.

Which of the statements given above is correct?

- 1, 3 and 4

- 1 and 4 only

- 2, 3 and 4

- 1 and 2 only

Syllabus

- Prelims –Environment and Ecology

Context: Recently, the Indian Grey Hornbill was sighted in Puducherry for the first time.

Background:-

- A bird enthusiast, M.S. Lara, photographed the hornbill in Koodapakkam, near the Sankarabarani River recently.

- It had been previously sighted in the Jawadhu Hills in Tiruvannamalai district, the Kalvarayan Hills in Dharmapuri district, the Western Ghats, and at the Adyar Estuary in Chennai in the recent past, but this is the first sighting of the bird from Puducherry.

About Indian Grey Hornbill:-

- The Indian grey hornbill (Ocyceros birostris) is the smallest in the Hornbill family. (UPSC CSE: Hornbills)

- Habitat: Foothills of Southern Himalayas.

- It is one of the few hornbill species found in urban areas in many cities where they are able to make use of large trees in avenues.

- Distribution: Indian subcontinent; found from north-east Pakistan and south Nepal east to north-west Bangladesh and south throughout most of India except in Assam.

- It is a common hornbill found on the Indian subcontinent.

- It is commonly sighted in pairs.

- These birds are known to be

- Arboreal: spend most of their time on tall trees.

- They may descend for food and to collect mud pellets for nesting.

- Appearance:-

- It has grey feathers all over the body with a light grey or dull white belly.

, Unlike a lot of other birds, the male and female look similar.

- They play an essential role in the ecosystem as prime dispersers of seeds.

- Conservation status:-

- IUCN: Least Concern. (UPSC CSE: IUCN updates the Red list of species)

Sankaraparani River:

- The Sankaraparani River is a river in Tamil Nadu state.

- It originates on the western slope of the Gingee Hills in Viluppuram District, and flows southeastwards to empty into the Bay of Bengal south of Pondicherry.

- The Sankaraparani is also known as Varahanadi or Gingee River.

MUST READ: Hornbill Festival

SOURCE: THE HINDU

PREVIOUS YEAR QUESTIONS

Q.1) Which one of the following makes a tool with a stick to scrape insects from a hole in a tree or a log of wood? (2023)

- Fishing cat

- Orangutan

- Otter

- Sloth bear

Q.2) Which of the following organisms ·perform the waggle dance for others of their kin to indicate the direction and the distance to a source of their food? (2023)

- Butterflies

- Dragonflies

- Honeybees

- Wasps

Syllabus

- Prelims –Economy

Context: As per recent reports, Sebi’s SCORES platform disposed of 3,079 complaints in June.

Background:-

- At the beginning of June, as many as 3,141 complaints were pending, and 3,967 fresh complaints were received, according to SEBI.

About SEBI’s Complaints Redress System (SCORES )platform:-

- Launched: 2011.

- Launched by: SEBI.

- SEBI’s Complaints Redress System (SCORES) is a grievance redressal system.

- Objective: It enables investors to lodge and follow up on their complaints and track the status of redressal of such complaints online.

- These complaints are related to investment advisers, research analysts, corporate governance/listing conditions, minimum public shareholding, venture capital funds and takeover/restructuring.

- SCORES does not deal with complaints against companies.

- Laws covered: Complaints arising out of issues that are covered under the SEBI Act, Securities Contract Regulation Act, Depositories Act and rules and regulations made there under relevant provisions of the Companies Act, 2013.

- Time limit: The complaint shall be lodged on SCORES within one year from the date of the cause of action.

- Average resolution time for a complaint: 31 days.

About SEBI (The Securities and Exchange Board of India (SEBI)

- Establishment: (UPSC CSE: SEBI)

- The Securities and Exchange Board of India was established as a statutory body in the year 1992.

- HQ: Mumbai, Maharashtra.

- Ministry: Ministry of Finance.

- Function: It monitors and regulates the Indian capital and securities market while ensuring to protect the interests of the investors, formulating regulations and guidelines. (UPSC CSE: Open Offer)

- Chairperson: The chairperson is nominated by the Union Government of India.

MUST READ: Sweat Equity Rules: SEBI

SOURCE: BUISINESS STANDARD

PREVIOUS YEAR QUESTIONS

Q.1) Consider the following statements: (2022)

- In India, credit rating agencies are regulated by the Reserve Bank of India.

- The rating agency popularly known as ICRA is a public limited company.

- Brickwork Ratings is an Indian credit rating agency.

Which of the statements given above is correct?

- 1 and 2 only

- 2 and 3 only

- 1 and 3 only

- 1, 2 and 3

Q.2) With reference to the Indian economy, consider the following statements. (2022)

- An increase in Nominal Effective Exchange Rate (NEER) indicates the appreciation of the rupee.

- An increase in the Real Effective Exchange Rate (REER) indicates an improvement in trade competitiveness.

- An increasing trend in domestic inflation relative to inflation in other countries is likely to cause an increasing divergence between NEER and REER.

Which of the above statements is correct?

- 1 and 2 only

- 2 and 3 only

- 1 and 3 only

- 1, 2 and 3

Syllabus

- Prelims –Economy

Context: Recently, the government has brought the Goods and Services Tax Network (GSTN) under the Prevention of Money-laundering Act (PMLA).

Background:-

- The government has brought the Goods and Services Tax Network (GSTN) under the Prevention of Money-laundering Act (PMLA), as per a notification dated July 7.

- The changes have been made for provisions under Section 66 of the PMLA, which provides for the disclosure of information.

- Under Section 66 of the Act, the 15 entities are bound to disclose case information to the ED if the probe falls under its jurisdiction.

- Based on the information, the ED can file a case under the PMLA, if it deems fit.

- The notification by Finance Ministry has amended an earlier 2006 notification that will facilitate sharing of information between the GSTN, Enforcement Directorate and other investigative agencies.

About Goods and Services Tax Network (GSTN):-

- Establishment: 2013. (UPSC CSE: GST)

- HQ: New Delhi.

- It is a not for profit, non-Government, private limited company incorporated in 2013.

- Objective: The Company has been set up primarily to provide IT infrastructure and services to the Central and State Governments, taxpayers and other stakeholders for implementation of the Goods and Services Tax (GST).

- Shareholding: The Government of India holds 24.5%equity in GSTN.

- All States including NCT of Delhi and Puducherry, and the Empowered Committee of State Finance Ministers (EC), together hold another 5%.

- Balance 51% equity is with non-Government financial institutions.

- GST Council has approved a proposal to convert GST Network (GSTN) into a government entity from its current private entity status by taking over stakes held by private entities.

- GSTN provides a strong IT Infrastructure and Service backbone which enables the capture, processing and exchange of information amongst the stakeholders (including taxpayers, States and Central Governments, Accounting Offices, Banks and RBI.

Mission of GSTN:-

- Provide common and shared IT infrastructure and services to the Central and State Governments, Tax Payers and other stakeholders for implementation of the Goods & Services Tax (GST).

- Provide common Registration, Return and Payment services to the Taxpayers.

- Partner with other agencies for creating an efficient and user-friendly GST Eco-system.

- Encourage and collaborate with GST Suvidha Providers (GSPs) to roll out GST Applications for providing simplified services to the stakeholders.

- Carry out research, study best practices and provide Training and Consultancy to the Tax authorities and other stakeholders.

- Provide efficient Backend Services to the Tax Departments of the Central and State Governments on request.

- Develop Tax Payer Profiling Utility (TPU) for Central and State Tax Administration.

- Assist Tax authorities in improving Tax compliance and transparency of the Tax Administration system.

- Deliver any other services of relevance to the Central and State Governments and other stakeholders on request.

Prevention of Money-laundering Act (PMLA), 2002

- It was enacted in

- It came into force with effect from 1st July 2005.

- The Parliament enacted the PMLA as a result of international commitment to sternly deal with the menace of money laundering.

- Money Laundering: conversion or misrepresentation of money which has been illegally obtained by unlawful sources and methods. (UPSC MAINS: money laundering in India)

- Applicability: The PMLA is applicable to all persons which include individuals, companies, firms, partnership firms, associations of persons or incorporations and any agency, office or branch owned or controlled by any of the above-mentioned persons.

Objectives of PMLA:-

- To prevent and control money laundering.

- To confiscate and seize the property obtained from the laundered money.

- To deal with any other issue connected with money laundering in India.

Provisions of PMLA,2002:-

- Definition of money laundering: 3 of PMLA defines the offence of money laundering

- Prescribed obligation: PMLA prescribes the obligation of banking companies, financial institutions and intermediaries to verification and maintenance of records of the identity of all its clients and also of all transactions and for furnishing information of such transactions in a prescribed form to the Financial Intelligence Unit-India (FIU-IND).

Empowerment of officers:

- PMLA empowers certain officers of the Directorate of Enforcement to carry out investigations in cases involving the offence of money laundering and also to attach the property involved in money laundering.

- It empowers the Director of FIU-IND to impose fines on banking companies, financial institutions or intermediaries if they or any of its officers fail to comply with the provisions of the Act as indicated above.

Setting up of Authority:

- PMLA envisages the setting up of an Adjudicating Authority to exercise jurisdiction, power and authority conferred by it essentially to confirm attachment or order confiscation of attached properties.

- It also envisages the setting up of an Appellate Tribunal to hear appeals against the order of the Adjudicating Authority and the authorities like Director FIU-IND.

Special Courts:-

- It envisages the designation of one or more courts of sessions as Special Courts or Special Courts to try the offences punishable under PMLA and offences with which the accused may, under the Code of Criminal Procedure 1973, be charged at the same trial. (UPSC CSE: Supreme Court verdict on PMLA)

MUST READ: GST- Critical analysis of its working

SOURCE: THE INDIAN EXPRESS

PREVIOUS YEAR QUESTIONS

Q.1) Consider the following markets : (2023)

- Government Bond Market

- Call Money Market

- Treasury Bill Market

- Stock Market

How many of the above are included in capital markets?

- Only one

- Only two

- Only three

- All four

Q.2) What is/are the most likely advantages of implementing ‘Goods and Services Tax (GST)’? (2017)

- It will replace multiple taxes collected by multiple authorities and will thus create a single market in India.

- It will drastically reduce the ‘Current Account Deficit’ of India and will enable it to increase its foreign exchange reserves.

- It will enormously increase the growth and size of the economy of India and will enable it to overtake China in the near future.

Select the correct answer using the code given below:

- 1 only

- 2 and 3 only

- 1 and 3 only

- 1, 2 and 3

National Green Hydrogen Mission

Syllabus

- Mains – GS 3 (Environment and Ecology).

Context: As part of its quest towards energy transition, the government has brought together stakeholders in order to explore how we can establish a Green Hydrogen ecosystem.

Hydrogen Fuel:

- Hydrogen fuel is a zero-emission fuel burned with oxygen.

- It can be used in fuel cells or internal combustion engines.

- It can be manufactured by

- Electrolysis of water by using direct current.

- Natural Gas Reforming/Gasification: Natural Gas on reaction with steam produces Synthesis gas. Synthetic gas is a mixture of hydrogen, carbon monoxide, and a small amount of carbon dioxide.

- Fermentation: Biomass is converted into sugar-rich feedstocks that can be fermented to produce hydrogen.

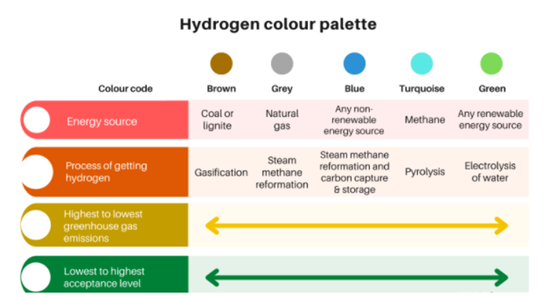

Types of Hydrogen Fuel

Source: https://enerdatics.com/blog/types-of-hydrogen/

About National Green Hydrogen Mission?

- It is a program to incentivise the commercial production of green hydrogen and make India a net exporter of the fuel.

- The Mission will facilitate demand creation, production, utilization and export of Green Hydrogen.

Sub Schemes:

- Strategic Interventions for Green Hydrogen Transition Programme (SIGHT):

- It will fund the domestic manufacturing of electrolysers and produce green hydrogen.

Green Hydrogen Hubs:

- States and regions capable of supporting large scale production and/or utilization of hydrogen will be identified and developed as Green Hydrogen Hubs.

Objective:

- Developing green hydrogen production capacity of at least 5 MMT (Million Metric Tonne) per annum, alongside adding renewable energy capacity of about 125 GW (gigawatt) in India by 2030.

- It aims to entail over Rs 8 lakh crore of total investments and is expected to generate six lakh jobs.

- It will also lead to a cumulative reduction in fossil fuel imports by over Rs 1 lakh crore and an abatement of nearly 50 MT of annual greenhouse gas emissions.

Nodal Ministry: Ministry of New and Renewable Energy

Significance:

- It will help entail the decarbonisation of the industrial, mobility and energy sectors; reducing dependence on imported fossil fuels and feedstock; developing indigenous manufacturing capabilities; creating employment opportunities; and developing new technologies such as efficient fuel cells.

Significance/Intended outcomes of the NGHM

- Renewable Energy Capacity Enhancement: Development of green hydrogen production capacity of at least 5 MMT (Million Metric Tonne) per annum.

- An associated renewable energy capacity addition of about 125 GW in the country

- Investment boost

- Employment generation

- Cumulative reduction in fossil fuel imports.

- Green House Gases Emission Reduction: Abatement of nearly 50 MMT of annual greenhouse gas emissions and help government in achievement the commitments made at COP 26

- Under the Paris Agreement of 2015, India is committed to reducing its greenhouse gas emissions by 33-35% from the 2005 levels.

- It is a legally binding international treaty on climate change with the goal of limiting global warming to below 2°C compared to pre-industrial levels.

Possible Challenges in harnessing Green Hydrogen

- Lack of fuel station infrastructure: India will need to compete with around 500 operational hydrogen stations in the world today which are mostly in Europe, followed by Japan and South Korea.

- Energy-intensive nature of Hydrogen generation process: The technology is in an infant stage and the energy requirement for splitting water or Methane is high. Besides, the whole process is costly at present.

- High R and D requirement for the newer technology for making the process cheap and operational and scalable.

- Multiplicity of regulatory authorities: Involvement of multiple Ministries and Departments causes red tape in government functioning.

- Risks associated with the transportation of hydrogen: Hydrogen in gaseous form is highly inflammable and difficult to transport, thereby making safety a primary concern.

Indian Initiatives for Promoting Clean Fuel Transition

- The India-led International Solar Alliance (ISA) is a coalition of solar-rich countries aiming at promoting solar energy globally. India aims to reach net zero emissions by 2070 and to meet fifty percent of its electricity requirements from renewable energy sources by 2030.

- Initiatives such as Faster Adoption and Manufacturing of (Hybrid) Electric Vehicles (FAME) India Scheme and Atal Jyoti Yojana promote the adoption of electric and hybrid vehicles and solar-powered lighting to rural areas, a move which reduces emission footprint.

- The ‘National Policy on Biofuels’ notified by the Government in 2018 envisaged an indicative target of 20% ethanol blending in petrol by year 2030.

- A “Roadmap for Ethanol Blending in India 2020-25” which lays out a detailed pathway for achieving 20% ethanol blending.

Way Forward:

There is a need to announce incentives to convince enough users of industrial hydrogen to adopt green hydrogen. India needs to develop supply chains in the form of pipelines, tankers, intermediate storage and last leg distribution networks as well as put in place an effective skill development programme to ensure that lakhs of workers can be suitably trained to adapt to a viable green hydrogen economy.

Source: PIB

Syllabus

- Mains – GS 3 (Economy)

Context: The Reserve Bank of India’s (RBI) inter-departmental group (IDG) recently said that India remaining one of the fastest-growing countries and showing remarkable resilience in the face of major headwinds and the rupee has the potential to become an internationalised currency.

The Internationalisation of the Rupee:

- Internationalisation is a process that involves increasing the use of the rupee in cross-border transactions.

- These are all transactions between residents in India and non-residents.

- It involves –

- Promoting the rupee for import and export trade and then other current account transactions (measures imports and exports of goods and services, etc),

- Followed by its use in capital account transactions – measures cross-border investments in financial instruments, etc.

- Currently, the US dollar, the Euro, the Japanese yen and the pound sterling are the leading reserve currencies in the world.

- China’s efforts to make its currency renminbi has met with only limited success so far.

- India has allowed only full convertibility on the current account as of now.

Current Status for the Rupee’s Internationalization:

- Limited Progress in Internationalisation: The rupee is far from being internationalized, the daily average share for the rupee in the global foreign exchange market hovers around 1.6%, while India’s share of global goods trade is mere 2%.

- Steps Taken to Promote Internationalisation: India has taken some steps to promote the internationalisation of the rupee (e.g., enable external commercial borrowings in rupees), with a push to Indian banks to open Rupee Vostro accounts for banks from Russia, the UAE, Sri Lanka and Mauritius and measures to trade with about 18 countries in rupees instituted.

- However, such transactions have been limited, with India still buying oil from Russia in dollars.

Benefits of Internationalization of rupee

- Increased global acceptance: Internationalization of the rupee can increase its global acceptance, which can lead to more international transactions being conducted in the rupee, thereby reducing the demand for foreign currencies and reducing exchange rate risks.

- Reduced transaction costs: Internationalization of the rupee can reduce transaction costs for Indian businesses as they will not have to incur exchange rate fees for converting rupees into foreign currencies for international transactions.

- Boost to trade and investment: Internationalization of the rupee can promote trade and investment by making it easier for foreign businesses to invest in India and for Indian businesses to invest abroad.

- Enhanced competitiveness: A more freely traded rupee can enhance India’s competitiveness in global markets by allowing the currency to reflect the country’s economic fundamentals and reducing the need for the Reserve Bank of India to intervene in currency markets.

- Diversification of reserves: Internationalization of the rupee can diversify India’s foreign exchange reserves away from a concentration in US dollars, reducing the risks associated with holding a single currency.

Challenges associated with Internationalizing the Rupee:

- Exchange Rate Volatility: Internationalising the rupee exposes it to greater exchange rate volatility. Fluctuations in the value of the rupee can impact trade competitiveness, foreign investment flows, and financial market stability.

- Managing exchange rate risks becomes crucial in order to mitigate potential adverse effects.

- Capital Flight and Financial Stability: Opening up the rupee to international markets may lead to capital flight if investors lose confidence in the currency or anticipate unfavourable economic conditions.

- This can strain the country’s foreign exchange reserves, impact financial stability, and create challenges for monetary policy management.

- Capital Controls: India still has capital controls in place that limit the ability of foreigners to invest and trade in Indian markets.

- These restrictions make it difficult for the rupee to be used widely as an international currency.

- Competing Currencies: The rupee faces competition from established international currencies like the US dollar, euro, and yen, which enjoy widespread acceptance and liquidity.

- Gaining market share and displacing these dominant currencies can be a significant challenge.

- Confidence and Perception: The credibility and stability of India’s economic and monetary policies play a crucial role in building confidence in the rupee.

- Any perception of policy uncertainty, lack of transparency, or geopolitical risks can impede the internationalisation process.

- Adoption by Market Participants: Convincing market participants, including businesses, individuals, and financial institutions, to adopt the rupee for international transactions requires trust, familiarity, and confidence in the currency.

- Building awareness and promoting the benefits of using the rupee globally is a significant challenge.

Way Forward: The RBI’s Recommendations:

For the short term:

- Adoption of a standardised approach for examining the proposals on bilateral and multilateral trade arrangements.

- Encouraging the opening of the rupee accounts for non-residents both in India and outside India and integrating Indian payment systems with other countries for cross-border transactions.

- Strengthening the financial market by fostering a global 24×5 rupee market and recalibration of the FPI (foreign portfolio investor) regime.

- A review of taxes on masala (rupee-denominated bonds issued outside India by Indian entities) bonds, international use of Real Time Gross Settlement (RTGS) for cross-border trade transactions, etc.

For the long term:

- Efforts should be made for the inclusion of the rupee in International Monetary Fund’s (IMF) special drawing rights (SDR).

- The SDR is an international reserve asset created by the IMF to supplement the official reserves of its member countries.

- The value of the SDR is based on a basket of five currencies [the U.S. dollar, the euro, the Chinese renminbi, the Japanese yen, and the British pound sterling].

Source: Indian Express

Practice MCQs

Q1) Consider the following statements

Statement-I:

Nitrogen Dioxide causes water pollution

Statement-II:

Volcanoes and microbes create Nitrogen Dioxide.

Which one of the following is correct in respect of the above statements?

- Both Statement-I and Statement-II are correct and Statement-11 is the correct explanation for Statement-I

- Both Statement-I and Statement-II are correct and Statement-II is not the correct explanation for Statement-I

- Statement-I is correct but Statement II is incorrect

- Statement-I is incorrect but Statement II is correct

Q2) Q2) Consider the following pairs:

Horbill species IUCN Status

- Great Hornbill: Near threatened.

- Narcondam Hornbill: Endangered

- Indian Grey Hornbill: Near Threatened

How many of the above pairs are correctly matched?

- Only one

- Only two

- Only three

- None

Q3) Consider the following statements

Statement-I:

GSTN was established in 2015.

Statement-II:

GSTN Provide common Registration, Return and Payment services to Taxpayers.

Which one of the following is correct in respect of the above statements?

- Both Statement-I and Statement-II are correct and Statement-II is the correct explanation for Statement-I

- Both Statement-I and Statement-II are correct and Statement-II is not the correct explanation for Statement-I

- Statement-I is correct but Statement II is incorrect

- Statement-I is incorrect but Statement-II is correct

Comment the answers to the above questions in the comment section below!!

ANSWERS FOR ’ 10th July 2023 – Daily Practice MCQs’ will be updated along with tomorrow’s Daily Current Affairs.st

Mains practice questions

Q.1) Hydrogen is being dubbed as the alternative fuel. However, there are many problems associated with the leveraging of hydrogen technology. Discuss (250 words)

Q.2) Discuss the potential benefits and challenges associated with the Internationalisation of Rupee for India’s economy. (250 words)

ANSWERS FOR 8th July – Daily Practice MCQs

Q.1) – d

Q.2) – a

Q.3) -a