IASbaba's Daily Current Affairs Analysis

Archives

(PRELIMS + MAINS FOCUS)

Covaxin cleared for emergency use in 2-18 age group

Part of: Prelims and GS II – Health

Context Bharat Biotech’s COVID-19 vaccine Covaxin (BBV152) has been recommended for emergency use authorisation (EUA) for 2-18-year-olds by the Subject Expert Committee (SEC) of the Central Drugs Standards Control Organisation (CDSCO).

- Once approved, it will emerge as the first COVID-19 vaccine globally to be used for vaccinating children as young as 2 years.

What is the Central Drugs Standards Control Organisation (CDSCO)?

- The Central Drugs Standard Control Organisation (CDSCO)under the Directorate General of Health Services, Ministry of Health & Family Welfare, is the National Regulatory Authority (NRA) of India.

- Under the Drugs and Cosmetics Act, CDSCO is responsible for approval of Drugs, Conduct of Clinical Trials, laying down the standards for Drugs,

- Headquarters: New Delhi

About Covaxin

- Covaxin is India’s first indigenous, whole-virion, inactivated vaccine developed by Bharat Biotech in collaboration with the Indian Medical Research Council (ICMR) and the National Institute of Virology (NIV).

- It has been formulated with ‘Algel-IMDG’, which contains chemically absorbed TLR7/8 as an adjuvant onto aluminium hydroxide gel to generate the requisite type of immune responses without damaging the body.

Yakshagana

Part of: Prelims and GS – I – Art and Culture

Context Yakshagana Bhagavatha (singer-cum-director) Padyana Ganapathi Bhat passed away recently.

About Yakshagana

- Yakshagana is a traditional theater of Karnataka.

- It is also performed in Kasaragod district in Kerala.

- It combines dance, music, dialogue, costume, make-up, and stage techniques with a unique style and form.

- It is believed to have evolved from pre-classical music and theatre during the period of the Bhakti movement

- Yakshagana is traditionally presented from dusk to dawn.

- Its stories are drawn from Ramayana, Mahabharata, Bhagavata and other epics from both Hindu and Jain and other ancient Indic traditions.

Government announces plastic waste recycling targets

Part of: Prelims and GS-III – Pollution

Context The Environment Ministry has issued draft rules that mandate producers of plastic packaging material to collect all of their produce by 2024

- The producers have to ensure that a minimum percentage of it be recycled as well as used in subsequent supply.

Key takeaways

- It has also specified a system whereby makers and users of plastic packaging could collect certificates — called Extended Producer Responsibility (EPR) certificates — and trade in them.

- Only a fraction of plastic that cannot be recycled would be eligible to be sent for end-of-life disposal such as road construction, waste to energy, waste to oil and cement kilns.

- Only methods prescribed by the Central Pollution Control Board (CPCB) would be permitted for their disposal.

- Producers of plastic would be obliged to declare to the government, via a centralised website, how much plastic they produce annually.

- Companies would have to collect at least 35% of the target in 2021-22, 70% by 2022-23 and 100% by 2024.

- If entities cannot fulfil their obligations, they would on a “case by case basis” be permitted to buy certificates making up for their shortfall from organisations that have used recycled content in excess of their obligation.

- The CPCB would develop a “mechanism” for such exchanges on an online portal.

- Non-compliance would not invite a traditional fine. Instead an “environmental compensation” would be levied.

Categories of Plastic packaging

- Plastic packaging shall fall into three categories.

- The first category is “rigid” plastic;

- Category 2 is “flexible plastic packaging of single layer or multilayer, plastic sheets and covers made of plastic sheet, carry bags, plastic sachet or pouches;

- The third category is called multilayered plastic packaging, which has at least one layer of plastic and at least one layer of material other than plastic.

- In 2024, a minimum 50% of their rigid plastic (category 1) would have to be recycled as would 30% of their category 2 and 3 plastic.

- Every year would see progressively higher targets and after 2026-27, 80% of their category 1 and 60% of the other two categories would need to be recycled.

Kunming biodiversity fund

Part of: Prelims and GS II – International relations and GS – III- Climate change

Context China pledged to inject $233 million into a new fund to protect biodiversity in developing countries during the recently held UN biodiversity summit.

- China has called on all parties to contribute to the fund.

Key takeaways

- Beijing — the world’s biggest polluter — has sought to play a more prominent role internationally on biodiversity conservation in recent years.

- Its pledge came as delegates from about 195 countries gathered in the southern Chinese city of Kunming for the first of a two-part summit on safeguarding plants, animals and ecosystems.

- The summit aims to establish a new accord setting out targets for 2030 and 2050.

- China will take the lead in establishing the Kunming biodiversity fund with a capital contribution of 1.5 billion yuan ($233 million) to support the cause of biodiversity conservation in developing countries.

France unveils $35 bn revival plan

Part of: Prelims and GS II – International Relations and GS-III – Economy; Environment

Context French President has unveiled a five-year, €30 billion ($35 billion) investment plan for developing innovative technology and industrial activity.

Key takeaways

- The goal of the state-funded France 2030 plan is to boost France’s economic growth over the next decade amid growing global competition with China and the U.S.

- The plan includes €8 billion to develop energy technology that would help reduce greenhouse gas emissions.

- The funding would finance the building of small, modular nuclear reactors in France, which relies on nuclear power for 70% of its electricity.

- The plan calls for €4 billion to be used to develop about 2 million electric and hybrid cars by the end of the decade.

- France will invest in building its first “low-carbon plane” by 2030.

- The plan also provides money to develop by 2026 a reusable launch system to propel spacecraft.

Carbon-neutral Economy

- EU leaders have agreed that nuclear energy could be part of its commitment to making its economy carbon-neutral by 2050, giving member countries the option of using it in their national energy mixes.

- However, Germany and some other countries argue that nuclear power should not be included in plans to finance greener energy because it requires mining and long-term storage of radioactive waste.

- France has vowed to become “the leader of green hydrogen” power by 2030

- Green hydrogen is a form of energy which does not emit carbon dioxide and can be used in industries such as steel and chemical manufacturing that currently rely on fossil fuels.

Sea rise to continue for centuries

Part of: Prelims and GS-III – Economy; Environment

Context The researchers have warned that even if humanity caps global warming at 1.5 degrees Celsius above pre-industrial levels, seas will rise for centuries to come and swamp cities currently home to half-a-billion people.

Key takeaways

- If temperature rises another half-degree above that benchmark, an additional 200 million of today’s urban dwellers would regularly find themselves knee-deep in sea water and more vulnerable to devastating storm surges.

- Worst hit in any scenario will be Asia, which accounts for nine of the 10 mega-cities at highest risk.

- Land home to more than half the populations of Bangladesh and Vietnam fall below the long-term high tide line.

- Built-up areas in China, India and Indonesia would also face devastation.

- Most projections for sea level rise run to the end of the century. But oceans will continue to swell for hundreds of years beyond 2100 — fed by melting ice sheets, heat trapped in the ocean and the dynamics of warming water — no matter how aggressively greenhouse gas emissions are drawn down.

Do you know?

- Sea Level rise (SLR) takes place by three primary factors:

- Thermal Expansion

- Melting Glaciers

- Loss of Greenland and Antarctica’s ice sheets.

Bioethanol: A reliable aviation fuel

Part of: Prelims and GS-III – Economy; Environment

Context According to the Union Minister for Road Transport and Highways, Bioethanol can be a sustainable fuel for the aviation sector.

- It can provide 80% savings on greenhouse gas emissions and be blended up to 50% with conventional jet fuels without any modification.

- It has already been tested and approved by the Indian Air Force.

- With the roll out of flex-fuel vehicles that run 100% on bioethanol, the demand for ethanol will jump four to five times.

What is Bioethanol?

- The principal fuel used as a petrol substitute for road transport vehicles is bioethanol.

- Bioethanol fuel is mainly produced by the sugar fermentation process, although it can also be manufactured by the chemical process of reacting ethylene with steam.

- Ethanol or ethyl alcohol (C2H5OH) is a clear colourless liquid. Ethanol burns to produce carbon dioxide and water.

- Energy Crops required to produce ethanol:

-

- corn, maize and wheat crops, waste straw, willow and poplar trees, sawdust, reed canary grass, cord grasses, jerusalem artichoke, myscanthus and sorghum plants.

- Benefits:

-

- Renewable; biodegradable

- Less toxic

- Reduced greenhouse gas emissions

- greater fuel security

- Boost to farmers

(News from PIB)

G20 Extraordinary Summit on Afghanistan

Part of: Mains GS-II: Effect of policies and politics of developed and developing countries on India’s interests

In News: India participated virtually in the G20 Extraordinary Summit on Afghanistan

- Convened by Italy (holds the G20 Presidency)

- Issues: related to the humanitarian situation; concerns relating to terrorism; and human rights in Afghanistan.

India’s Views on Afghanistan

- Over the last two decades, India has contributed to promoting socio-economic development and capacity building of youth and women in Afghanistan (over 500 development projects)

- Emphasized the need for the international community to ensure that Afghanistan has immediate and unhindered access to humanitarian assistance.

- There’s a need to enhance our joint fight against the nexus of radicalization, terrorism and the smuggling of drugs and arms in the region.

- Conveyed support for the important role of the United Nations in Afghanistan and called for renewed support of the G20 for the message contained in UN Security Council Resolution 2593 on Afghanistan.

What is G20?

- The G20 is the international forum that brings together the world’s major economies.

- Its members account for more than 80% of world GDP, 75% of global trade and 60% of the population of the planet.

- The G20 comprises 19 countries and the European Union. The 19 countries are Argentina, Australia, Brazil, Canada, China, Germany, France, India, Indonesia, Italy, Japan, Mexico, Russia, Saudi Arabia, South Africa, South Korea, Turkey, the United Kingdom and the United States

- The forum has met every year since 1999 and includes, since 2008, a yearly Summit, with the participation of the respective Heads of State and Government.

News Source: PIB

Swachh Bharat Mission (Urban)

Part of: Prelims and Mains GS-II: Government policies and interventions for development in various sectors and issues arising out of their design and implementation

In News: Cabinet approved the continuation of Swachh Bharat Mission (Urban) till 2025-26, with focus on

- Sustainability of Open Defecation Free (ODF) outcomes,

- Achieving scientific processing of Solid Waste in all cities, and

- Managing Wastewater in cities with less than 1 lakh population in Census 2011 [cities not covered under (AMRUT)].

Key Components

Sustainable Sanitation:

- Ensuring complete access to sanitation facilities to serve additional population migrating from rural to urban areas in search of employment and better opportunities over the next 5 years.

- Complete liquid waste management in cities in less than 1 lakh population –ensure that systems and processes are set up in every city so that all wastewater is safely contained, collected, transported and treated and no wastewater pollutes our water bodies.

Sustainable Solid Waste Management:

- 100 percent source segregation of waste along with functional Material Recovery Facilities (MRFs) in every city, with a focus on phasing out single use plastic

- Setting up of construction & demolition (C&D) waste processing facilities and deployment of mechanical sweepers in National Clean Air Programme (NCAP) cities and in cities with more than 5 lakh population

- Remediation of all legacy dumpsites, so that 14,000 acres of locked up land lying under 15 crore tonnes of legacy waste are freed up.

Objectives of SBM(U)

- Eradication of open defecation in all statutory towns

- 100% scientific management of municipal solid waste in all statutory towns

- Effecting behaviour change through Jan Andolan

News Source: PIB

AMRUT 2.0

Part of: Prelims and Mains GS-II: Governance

In News: Cabinet has approved the Atal Mission for Rejuvenation and Urban Transformation 2.0 (AMRUT 2.0) till 2025-26, with aim of making the cities ‘water secure’ and ‘self-sustainable’ through circular economy of water.

This will be achieved by

- Providing functional tap connections to all households,

- Undertaking water source conservation/ augmentation,

- Rejuvenation of water bodies and wells,

- Recycle/re r use of treated used water and rainwater harvesting

Key features:

- Mission will be monitored on a robust technology based portal.

- The projects will be geo-tagged.

- Cities will assess their water sources, consumption, future requirement and water losses through a city water balance plan. Based on this, city water action plans will be prepared which will be summed up as State Water Action Plan and will be approved by the Ministry of Housing and Urban affairs.

- Pey Jal Survekshan which will encourage competition among cities for benchmarking urban water services.

- Mission will also encourage mobilization of market finance by mandating implementation of 10% of worth of projects in cities with population above ten lakh through Public Private Participation.

- Mission will also bring in the leading technologies in water sector in world through technology sub-Mission.

- Entrepreneurs/ start-ups will be encouraged in water eco-system. Information Education and Communication (IEC) campaign will be undertaken to spread awareness among masses about water conservation.

- Mission has a reform agenda focussed towards financial health and water security of ULBs. Meeting 20% of water demand through recycled water, reducing non-revenue water to less than 20% and rejuvenation of water bodies are major water related reforms.

- Reforms on property tax, user charges and enhancing credit worthiness of ULBs are other important reforms.

News Source: PIB

(Mains Focus)

INTERNATIONAL/ ECONOMY

- GS-2: International Institutions & their workings

Controversy over Ease of Doing Business Rankings

Context: Recently, there were allegations of data tampering by Kristalina Georgieva (Former WB Chief & currently MD of IMF) in the World Bank’s Ease of Doing Business rankings in favour of China.

What is the controversy around Georgieva?

- Georgieva is a Bulgarian economist who held several high-profile positions in European politics. In January 2017, she was appointed the chief executive of the World Bank group.

- In January 2019, she took over as the interim president of the WB group.

- In October 2019, she took over as Managing Director of the IMF.

- The trouble started when in January 2018, Paul Romer, then the chief economist of the World Bank told The Wall Street Journal that the World Bank’s Ease of Doing Business (EoDB) rankings were tweaked for political reasons.

- Soon Romer resigned. Incidentally, Romer was awarded the Nobel Prize in Economics later that year for showing how knowledge can function as a driver of long-term growth.

- Romer’s comments and resignation kick-started a series of queries both inside and outside the World Bank about the integrity of EoDB rankings.

- In particular, it was alleged that the EoDB rankings were tweaked to inflate the ranks for China (in EoDB 2018) and Saudi Arabia, UAE and Azerbaijan (EoDB 2020).

What has happened since the controversy broke out?

- In August 2020, the World Bank suspended its EoDB rankings after finding some “data irregularities”.

- The World Bank initiated a full review and an independent investigation. One such effort was to engage WilmerHale, a law firm, in January 2021.

- In its report, submitted September 2021, Wilmerhale’s investigations found that the World Bank staff did indeed manipulate data to help China’s ranking and they did so under pressure from Georgieva.

- The WilmerHale report states that at one point, when Georgieva took direct control of China’s ranking and was looking for ways to raise it, it was suggested to just take the average of the two best performing cities — Beijing and Shanghai — as they do for several other countries (such as India) instead of taking a weighted average of several cities. By cherry-picking the top two cities, China’s ranking would go up.

- These findings are particularly damning because China is the third-largest shareholder in the World Bank after the US and Japan, and it is being seen as manipulating its way to higher rankings.

- The investigation report did not find any evidence of wrongdoing with respect to the rankings of Saudi Arabia, UAE and Azerbaijan.

What are the EoDB rankings, and why do they matter?

- The EoDB rankings were started in 2002 to rank countries on a number of parameters to indicate how easy or difficult it is for anyone to do business in a country.

- Given the apparently extensive nature of rankings and that the World Bank was doing it, the EoDB soon became the go-to metric for international investors to assess risk and opportunity across the globe.

- Billions of dollars of investments started becoming predicated on where a country stands on EoDB and whether it is improving or worsening.

- It also acquired massive political significance as leaders in different countries started using EoDB rankings to either claim success for their policies.

How can the ranking methodology be improved?

On September 1, the World Bank also published the findings of an external panel review of its EoDB methodology. It stated that “the current methodology should be significantly modified, implying a major overhaul of the project.

Some of the key recommendations are:

- Any ranking based on such a small sample ignored the ease of doing business in other cities & regions of the country. Thus, there is a need for broad basing the data collection from a larger representative samples of “actual” business owners and operators.

- Not to ignore the government functions that provide essential public goods to the private sector: transport and communications infrastructure, a skilled workforce, law and order, etc.

- Do not rank countries on their tax rates. From a societal standpoint, collecting taxes is necessary, and thus lower tax rates are not necessarily better.

- Eliminate the indicators “Protecting Minority Shareholders” and “Resolving Insolvency.”

- Make the “Contracting with Government” indicator more relevant.

- Restore and improve the “Employing Workers” indicator, but do not rank countries based on this information.

- Improve the transparency and oversight of Doing Business.

Is this the first time the head of the IMF and/or World Bank has been in a controversy?

- No. In recent years, several heads of the World Bank and IMF have been found guilty of some wrongdoing or the other.

- In 2011, Dominique-Strauss Kahn, then the MD of IMF, had to resign after he was arrested in the US following allegations of sexual assault.

- Rodrigo Rato, IMF’s MD between 2004 and 2007, was jailed in Spain for a credit card scandal in 2017.

- Christine Lagarde, who was IMF MD between 2011 and 2017, has been found guilty of negligence in allowing the misuse of public funds in 2016 for a case dating back to 2011.

- Paul Wolfowitz, president of the World Bank between 2005 and 2007, had to resign following ethical violations and his romantic links with a World Bank employee.

- The role of Jim Yong Kim, who was World Bank president until 2019, is also being questioned in the rankings controversy.

INTERNATIONAL/ ECONOMY

- GS-2: Effect of policies and politics of developed and developing countries on India’s interests

Pandora Papers

What is Pandora Papers?

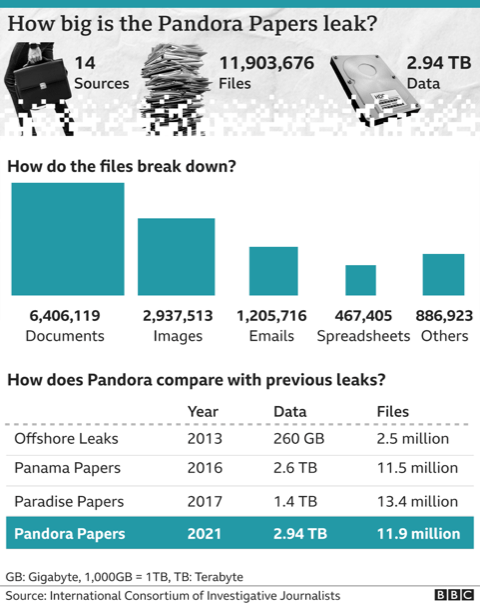

- The Pandora Papers is a leak of almost 12 million documents and files that reveals hidden wealth, tax avoidance and, in some cases, money laundering by some of the world’s rich and powerful.

- The data was obtained by the International Consortium of Investigative Journalists in Washington DC, which has been working with more than 140 media organisations and more than 600 journalists from 117 countries on its biggest ever global investigation.

- The ICIJ has also said that the “data trove covers more than 330 politicians and 130 Forbes billionaires, as well as celebrities, drug dealers, royal family members and leaders of religious groups around the world”.

Is this the first time that such financial papers have been leaked?

- Since at least 2008, files indicating the manipulations by the rich have been stolen from financial institutions.

- In 2008, a former employee of the LGT Bank of Liechtenstein offered information to tax authorities.

- Again in 2008, Hervé Falciani obtained confidential data on HSBC bank accounts from remote servers and gave the data to then French Finance Minister Christine Lagarde, who then passed it on to the various governments, including India.

- In 2017, the Paradise Papers were leaked out mostly from the more than 100-year-old offshore law firm, Appleby, which operates globally.

- In 2016, the Panama Papers were obtained by hacking the server of the Panamanian financial firm, Mossack Fonseca.

- The leaked documents from Luxembourg, the “Luxembourg Leaks”, appeared in 2014.

The modus operandi

- The leaked papers now and even earlier have exposed the international financial architecture and illicit financial flows.

- For instance, Panama Papers highlighted the template used in other tax havens. The Pandora Papers once again confirm this pattern.

- Tax havens enable the rich to hide the true ownership of assets by using: trusts, shell companies and the process of ‘layering’.

- The process of layering involves moving funds from one shell-company in one tax haven to another in another tax haven and liquidating the previous company. This way, money is moved through several tax havens to the ultimate destination.

- Since the trail is erased at each step, it becomes difficult for authorities to track the flow of funds.

- Financial firms offer their services to work this out for the rich. They provide ready-made shell companies with directors, create trusts and ‘layer’ the movement of funds. Only the moneyed can afford these services.

- It appears that most of the rich in the world use such manipulations to lower their tax liability even if their income is legally earned. Even citizens of countries with low tax rates use tax havens.

Implications

- Rise of Tax Havens: Over the three decades, tax havens have enabled capital to become highly mobile, forcing nations to lower tax rates to attract capital. This has led to the ‘race to the bottom’,

- Impairs Welfare Provision of Government: Layering of money through tax havens results in a shortage of resources with governments to provide public goods, etc., in turn adversely impacting the poor.

- Legally correct but morally wrong: Strictly speaking, not all the activity being exposed by the Pandora Papers may be illegal, however, it is morally wrong for the rich to evade taxes which could have otherwise the poor people.

- Complex Legal Process: The authorities will have to prove if the law of the land has been violated in each of these revelations. Each country will have to conduct its investigations and prove what part of the activity broke any of their laws.

- In the United Kingdom, the laws regarding financial dealings are very favourable to the rich and their manipulations.

- Misplaced Focus on Unorganised Sector: Indian Government’s focus on the unorganised sector as the source of black income generation is also misplaced since data indicate that it is the organised sector that has been the real culprit and also spirits out a part of its black incomes through Tax Havens & layering.

Conclusion

- An interesting recent development (October 8) has been the agreement among almost 140 countries to levy a 15% minimum tax rate on corporates. Though it is a long shot, this may dent the international financial architecture.

- Other steps needed to tackle the curse of illicit financial flows are ending banking secrecy and a Tobin tax on transactions.

Connecting the dots:

- Global Minimum Corporate Tax

- Base Erosion and Profit Sharing (BEPS)

(Sansad TV – Perspective)

Oct 11: Global Tax Reforms – https://youtu.be/JQYdB01MMw8

INTERNATIONAL/ ECONOMY

- GS-2: Effect of policies and politics of developed and developing countries on India’s interests

- GS-3: Indian Economy and issues relating to planning, mobilization, of resources

Global Tax Reforms

Context: After years of intensive negotiations to bring the international tax system into the 21st century, 136 countries have reached an agreement on the Two-Pillar Solution to Address the Tax Challenges Arising from the Digitalisation of the Economy. This will ensure big companies pay a minimum tax rate of 15%, making it harder for them to avoid taxation.

What is the global minimum tax deal?

The global minimum tax agreement does not seek to eliminate tax competition but puts multilaterally agreed limitations on it.

- Under Pillar One of the agreements, taxing rights on more than 125 billion US Dollars of profit are expected to be reallocated to market jurisdictions each year.

- Pillar Two of this agreement introduces a global minimum corporate tax rate at 15%. The new minimum tax rate will apply to companies with revenue above 750 million Euros and is estimated to generate around 150 billion US dollars in additional global tax revenues annually.

- Further benefits are also expected from the stabilisation of the international tax system and the increased tax certainty for taxpayers and tax administrations.

Why a global minimum tax?

- With budgets strained after the COVID-19 crisis, many governments want to discourage multinationals from shifting profits and tax revenues to low-tax countries regardless of where their sales are made.

- Increasingly, income from intangible sources such as drug patents, software and royalties on intellectual property has migrated to these jurisdictions, allowing companies to avoid paying higher taxes in their traditional home countries.

- The minimum tax and other provisions aim to put an end to decades of tax competition between governments to attract foreign investment.

The Impact

- The OECD, which has steered the negotiations, estimates the minimum tax will generate $150 billion in additional global tax revenues annually.

- Taxing rights on more than $125 billion of profit will be additionally shifted to the countries were they are earned from the low tax countries where they are currently booked.

- The deal will encourage multinationals to repatriate capital to their country of headquarters, giving a boost to those economies.

- However, various deductions and exceptions included in the deal are at the same time designed to limit the impact on low tax countries like Ireland, where many US groups base their European operations.

Can you answer the following questions?

What is the global minimum tax deal and what will it mean for developing countries like India?

(TEST YOUR KNOWLEDGE)

Model questions: (You can now post your answers in comment section)

Note:

- Correct answers of today’s questions will be provided in next day’s DNA section. Kindly refer to it and update your answers.

Q.1 Which of the following is India’s first indigenous, whole-virion, inactivated vaccine against COVID-19?

- Covishield

- Covaxin

- Sputnik

- India has not been able to develop any vaccine so far

Q.2 The Environment Ministry has issued draft rules that mandate producers of plastic packaging material to collect all of their produce by 2024. Which of the following is incorrect about the rules?

- It has specified a system whereby makers and users of plastic packaging could collect Extended Producer Responsibility (EPR) certificates and trade in them.

- Only methods prescribed by the Central Pollution Control Board (CPCB) would be permitted for disposal of the plastics.

- Companies would have to collect at least 35% of the target in 2021-22, 70% by 2022-23 and 100% by 2024.

- Non-compliance would not invite a traditional fine. Instead an “environmental compensation” would be levied

Q.3 Which of the following Energy Crops can be grown to produce ethanol?

- Reed canary grass

- Cord grasses

- Jerusalem artichoke

- All of the above

ANSWERS FOR 12th Oct 2021 TEST YOUR KNOWLEDGE (TYK)

| 1 | D |

| 2 | A |

| 3 | A |

Must Read

On India-US and CAATSA:

On Boosting Tourism:

On Gati Shakti: