IASbaba's Daily Current Affairs Analysis

Archives

(PRELIMS & MAINS Focus)

Syllabus

- Prelims – Geography

In News: Anang Tal lake declared monument of national importance through a gazette notification by the Ministry of Culture.

- In exercise of the powers conferred by section 4 of the Ancient Monuments and Archaeological Sites and Remains Act, 1958, the central government declared ancient site and remains to be of national importance.

Anang Tal lake

- The lake is situated in Mehrauli, Delhi and is claimed to be created by Tomar King, Anangpal II, in 1,060 AD.

- He is known to have established and populated Delhi in the 11th century.

- The millennium old Anang Tal signifies the beginning of Delhi.

- Anang Tal has a strong Rajasthan connection as Maharaja Anangpal is known as nana (maternal grandfather) of Prithviraj Chauhan .

Who was Anangpal II?

- Anangpal II, popularly known as Anangpal Tomar, belonged to the Tomar dynasty.

- He was the founder of Dhillika Puri, which eventually became Delhi.

- Multiple inscriptions and coins suggest Anangpal Tomar was the ruler of present-day Delhi and Haryana in between the 8th-12th centuries.

- He had built the city from ruins and under his supervision, Anang Tal Baoli and Lal Kot were constructed.

- Anangpal Tomar II was succeeded by his grandson Prithviraj Chauhan.

- Delhi Sultanate was established in 1192 after Prithviraj Chauhan’s defeat in the Battle of Tarain (present-day Haryana) by the Ghurid forces.

About the Tomar Dynasty

- Tomara dynasty is one of the minor early medieval ruling houses of northern India.

- Puranic evidence gives its early location in the Himalayan region, the dynasty was one of the 36 Rajput tribes.

- The history of the family spans the period between the reign of Anangpal, and the incorporation of Delhi within the Chauhan (Chahamana) kingdom in 1164.

- Although Delhi subsequently became decisively a part of the Chauhan kingdom, numismatic and late literary evidence indicates that Tomara kings such as Anangapal and Madanapal continued to rule as feudatories, presumably until the final conquest of Delhi by the Muslims in 1192–93.

Source: Indian Express

Previous Year Question

Q.1) Which one of the following is an artificial lake? (2018)

- Kodaikanal (Tamil Nadu)

- Kolleru (Andhra Pradesh)

- Nainital (Uttarakhand)

- Renuka (Himachal Pradesh)

Syllabus

- Prelims – Economy

In News: Bloomberg, quoting CreditSights, a unit of the credit ratings agency Fitch, reported that the Adani Group is “deeply over leveraged”, and may, “in the worst-case scenario”, spiral into a debt trap and possibly a default.

- The report noted that the Group has been making aggressive investments that are predominantly funded with debt, putting pressure on its credit metrics and cash flow.

When is a company ‘over leveraged’?

- A company or business is said to be “over leveraged” if it has unsustainably high debt against its operating cash flows and equity.

- Such a company would find it difficult to make interest and principal repayments to its creditors, and may struggle to meet its operating expenses.

- In the latter case, the company may be forced to borrow even more just to keep going, and thus enter a vicious cycle.

- This situation can ultimately lead to the company going bankrupt.

What happens when a company is over leveraged?

- Being over leveraged constraints companies’ growth plans.

- If payments are not paid in time, it may lose assets, which may be taken over by creditors, who may also launch legal proceedings to recover their money.

- The inability to repay existing debts puts limitations on future borrowing by the company.

- Also, an over leveraged company will find it extremely difficult to get in new sets of investors, all of which will add up to further diminish its financial present and future.

Source: Indian Express

Previous Year Question

Q.1) Which one of the following situations best reflects “Indirect Transfers” often talked about in media recently with reference to India? (2022)

- An Indian company investing in a foreign enterprise and paying taxes to the foreign country on the profits arising out of its investment

- A foreign company investing in India and paying taxes to the country of its base on the profits arising out of its investment

- An Indian company purchases tangible assets in a foreign country and sells such assets after their value increases and transfers the proceeds to India

- A foreign company transfers shares and such shares derive their substantial value from assets located in India

Syllabus

- Prelims – Economy

In News: Food delivery start-up Swiggy recently announced an “industry-first” policy of allowing its employees to take up gigs or projects outside of their regular employment at the company, during the hours away from work.

- Swiggy calls these new norms the “moonlighting” policy.

What is moonlighting?

- Moonlighting is the act of working at an extra job beyond regular working hours, usually without the knowledge of the employer.

- Since the side job was mostly at nighttime or on weekends, it was referred to as moonlighting.

- The term gained popularity when workers in the US started seeking a second job beyond their regular 9-to-5 work for additional income.

Why do people moonlight, and is it legal?

- The main reason for going above and beyond an existing job is earning more money.

- Also, working in a different role can allow a person to develop new skills, explore related domains and connect with more people.

Concerns

- Employers are suspicious of this practice because it can mean that a worker may not give their organisation the time it needs, and not give any extra time to either organisation.

- Holidays and time-off are also meant to rest a worker and improve their efficiency, but taking on another job could make this difficult.

In India, private companies usually do not allow holding multiple jobs. Shops and Establishment Acts of various states restrict double employment.

Has moonlighting increased recently?

- In the last two years, coronavirus-induced lockdowns increased the tendency to moonlight among workers in certain industries.

- This was because apart from financial insecurity at the time, working from home allowed a few categories of workers to get more work done, freeing up time for a second job.

- Also the gig economy concept has gained greater legitimacy in recent years, too.

Source: Indian Express

Syllabus

- Prelims – Current Affairs

In news: The South Korea-United States drills, called the Ulchi Freedom Shield, are scheduled. They are tri-service drills involving thousands of troops as well as live-fire exercises.

- These joint military drills are designed to test readiness against North Korea’s missile tests.

- The drills, called the Ulchi Freedom Shield, are tri-service drills involving thousands of troops as well as live-fire exercises.

- The drills will include a rehearsal of “scenarios, such as responding to North Korea’s attacks on key industrial facilities including an airport, a semiconductor factory, or a nuclear power plant

- These joint drills come after North Korea rejected South Korea’s proposals that Pyongyang give up its nuclear capabilities in phases, in return for economic benefits.

Source: Indian Express

Syllabus

- Prelims – Current Affairs

- Mains – GS 3 (Economy – Food Security)

In News: The Supreme Court has directed the Centre to increase coverage under the National Food Security Act (NFSA) so that “more and more needy persons and citizens get the benefit” under the act.

- Bench asks Centre to re-determine NFSA coverage after considering population increase between 2011-2021.

- The Supreme Court noted that “Right to Food is a fundamental right available under Article 21 of the Constitution”.

National Food Security Act (NFSA), 2013

Objective:

- To provide for food and nutritional security in the human life cycle approach, by ensuring access to adequate quantities of quality food at affordable prices to people to live a life with dignity.

Coverage:

- The Act provides coverage for nearly 2/3rd of the country’s total population, based on Census 2011 population estimates.

- 75% of rural and 50% of urban population is entitled to receive highly subsidized food grains under two categories i.e Antyodaya Anna Yojana(AAY) households and Priority Households (PHH).

- The Act entitles 35 kg of food grains as per Antyodaya Anna Yojana Households per month, whereas 5kg of food grains per Priority Households per person.

- The eldest woman of the beneficiary household (18 years or above) is considered ‘Head of Family’ for the purpose of issuing ration cards.

National Food Security Act: Provisions

- The NFSA assigns joint responsibilities to the federal and state governments.

- The NFSA mandates the centre with the responsibility of allocating and transporting food grains to designated depots in the states and UTs.

- The centre must provide central assistance to states/UTs for the distribution of food grains from authorized FCI godowns to the doorsteps of Fair Price Shops.

- States and union territories are responsible for identifying eligible households, issuing ration cards, distributing foodgrain entitlements through fair price shops, licensing and monitoring Fair Price Shop (FPS) dealers, establishing an effective grievance redress mechanism, and strengthening the Targeted Public Distribution System (TPDS).

- The NFSA also includes provisions for TPDS reforms, such as cash transfers for food entitlement provisioning.

- Direct Benefit Transfer involves the cash equivalent of the subsidy being transferred directly into the bank accounts of eligible households.

Significance

- It is beneficial to the agricultural sector.

- It also helps the government control food prices.

- Creation of job opportunities: Because agriculture is a labor-intensive industry, a boost in the agricultural sector would result in more job opportunities. This would boost economic growth and lead to a reduction in poverty.

- Health benefits: Access to nutritious food would improve the public’s overall health.

- Food security is important for the nation’s global security and stability.

Drawbacks

- The Act fundamentally talks about hunger and its eradication but fails to take into account the evils of undernutrition and removing the same. Thus, the Act should strive to include both, Right to Food as well Right to Nutrition.

- The Act also faced opposition from the Farmer’s Union, contending that the Act would nationalize agriculture, making the Government buy, sell and hoard the majority of agricultural production.

- Furthermore, it would reduce farmers’ bargaining power and minimize the support extended to marginal and small farmers.

- The Act also allows private entities in the supply chain, which allows room for profit-making and unfair trade practices.

- The leakages and corrupt practices in the Public Distribution System and supply chain also stand as an obstacle to the efficient functioning of the Act.

The National Food Security Act of 2013 is an important step toward addressing the country’s food insecurity and hunger, but it requires restructuring and the incorporation of new changes in various areas in order to achieve its goal.

eShram portal

- The Court also directed States which were not able to register unorganised workers in the eShram portal to do so within six weeks.

- The Union Labour Ministry has developed a National Database of Unorganised Workers (NDUW) portal and the eShram portal for registration of labourers spread over 400 occupations including in constructions, agriculture, fishing, dairy, self-employed and even ASHA and anganwadi workers.

Must Read: eshram portal

Source: The Hindu

Previous Year Question

Q.1) With reference to the provisions made under the National Food Security Act, 2013, consider the following statements: (2018)

- The families coming under the category of ‘below poverty line (BPL)’ only are eligible to receive subsidised food grains.

- The eldest woman in a household, of age 18 years or above, shall be the head of the household for the purpose of issuance of a ration card.

- Pregnant women and lactating mothers are entitled to a ‘take-home ration’ of 1600 calories per day during pregnancy and for six months thereafter.

Which of the statements given above is/are correct?

- 1 and 2 only

- 2 only

- 1 and 3 only

- 3 only

Syllabus

- Mains – GS 3 (Money Laundering)

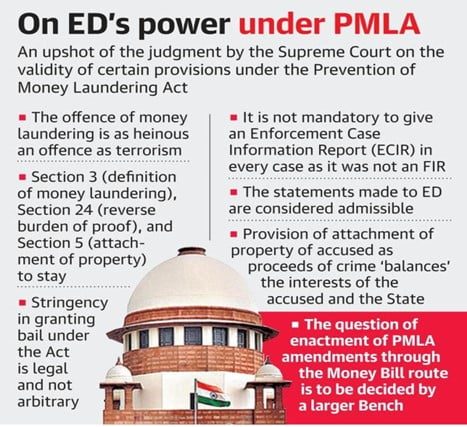

Context: The Supreme Court will hear a review of its judgment upholding key provisions of the Prevention of Money Laundering Act (PMLA), 2002.

What was the Supreme Court ruling on PMLA?

- In Vijay Madanlal Choudhary & Ors v Union of India, the Supreme Court upheld the key provisions of the PMLA.

How is a judgment reviewed?

- A ruling by the Supreme Court is final and binding.

- However, Article 137 of the Constitution grants the SC the power to review its judgments or orders.

- A review petition must be filed within 30 days of pronouncement of the judgment.

- Except in cases of death penalty, review petitions are heard through “circulation” by judges in their chambers, and not in an open court.

- The judges who passed the verdict decide on the review petition as well.

- The SC rarely entertains reviews of its rulings.

- A review is allowed on narrow grounds to correct grave errors that have resulted in a miscarriage of justice.

- “A mistake apparent on the face of record” is one of the grounds on which a case for review is made. This mistake, the court has said, must be glaring and obvious — such as relying on case law that is invalid.

Why is the PMLA verdict under review?

The key grounds on which review is sought are:

Amendments introduced as Money Bills: In 2015, 2016, 2018, and 2019, amendments including on bail and classification of predicate offences were made to the PMLA through the Finance Act.

- The PMLA amendments do not qualify as a Money Bill as defined under Article 110 of the Constitution.

- While the Court agreed that this could be a valid contention, it did not decide on the issue since the question of what qualifies as a Money Bill has been referred to a larger seven-judge Bench in another case.

Interpretation of Section 3 of the PMLA:

Section 3 of the law defines the offence of money laundering in terms of who is punishable.

- It states: “Whosoever directly or indirectly attempts to indulge or knowingly assists or knowingly is a party or is actually involved in any process or activity connected with the proceeds of crime and projecting it as untainted property shall be guilty of offence of money-laundering.”

- The SC in its verdict, accepted the government’s submission that a drafting error had crept in, and said that the expression “and” should be read as “or” in Section 3.

- This interpretation would expand the scope of the provision.

Retrospective application of the offence of money laundering:

- In its ruling, the SC said the offence of money laundering, i.e., enjoying the “proceeds of crime”, is a “continuous one”, and can be acted upon independent of when the scheduled offence was committed.

- This means holding property that is derived from an offence which may not have been a scheduled offence at the time of commission of the offence, will also be defined as money laundering.

- This is a retrospective reading of the law, and violates the fundamental right under Article 20(1) of the Constitution.

Enforcement Directorate distinct from “police”:

- The SC verdict upheld Section 50 of PMLA that empowers ED officials to record statements on oath from any person.

- This is admissible in court, unlike statements or confessions made to the police.

- The SC also said that the ED need not supply a copy of the Enforcement Case Information Report (ECIR) with an arrested person.

- This gives penal powers to the ED.

Bail provisions:

- The SC verdict, citing a compelling interest in imposing stringent bail conditions for economic offences, upheld the bail provisions under PMLA that impose a reverse burden of proof on the accused.

- But in the absence of an FIR (or equivalent), Complaint and documents relied upon by the prosecution, no accused can present facts and submissions to persuade the Special Court to believe that he is not guilty of such offence.

Must Read: Supreme Court upholds PMLA

Source: Indian Express

Syllabus

- Prelims – Current Affairs

- Mains – GS 2 (Governance); GS 3 (Internal Security – Money Laundering)

In News: The Supreme Court has ruled that Section 3(2) of the Benami Transactions (Prohibition) Act, 1988 is unconstitutional as it is manifestly arbitrary.

- It further said that the Benami Transactions (Prohibition) Amendment Act, 2016 can be applied only prospectively and not retrospectively.

Judgment

- A three-judge Bench, declared as unconstitutional Sections 3(2) and 5 introduced through the Benami Transactions (Prohibition) Amendment Act, 2016.

- The 2016 law amended the original Benami Act of 1988, expanding it to 72 Sections from a mere nine.

- Section 3(2) mandates three years of imprisonment for those who had entered into benami transactions between September 5, 1988 and October 25, 2016.

- That is, a person can be sent behind bars for a benami transaction entered into 28 years before the Section even came into existence.

- The bench held that the provision violated Article 20(1) of the Constitution.

Article 20: Protection in Respect of Conviction for Offences

- Article 20 grants protection against arbitrary and excessive punishment to an accused person, whether citizen or foreigner or legal person like a company or a corporation.

- It contains three provisions in that direction:

- No ex-post-facto law: No person shall be (i) convicted of any offense except for violation of a law in force at the time of the commission of the act, nor (ii) subjected to a penalty greater than that prescribed by the law in force at the time of the commission of the act.

- No double jeopardy: No person shall be prosecuted and punished for the same offense more than once.

- No self-incrimination: No person accused of any offense shall be compelled to be a witness against himself.

What is Benami Transaction?

- Benami literally means ‘without a name’. Therefore, an asset without a legal owner or a fictitious owner is called benami.

- It can be a property of any kind, whether movable or immovable, acquired by way of benami transaction.

Benami Transaction (Prohibition) Act, 1988:

- Benami transactions were first prohibited in India under Section 2(a) of the Benami Transactions (Prohibition) Act, 1988.

- The legislative intent behind the prohibition on benami transactions was to deter people from engaging in such transactions for dishonourable purposes, such as money laundering, tax evasion, etc.

- However, no rules were enacted to govern the procedural execution of the legislation.

- As a result, until the changes made by the Benami Transactions (Prohibition) Amendment Act 2016, the original Act’s practical application was ineffective.

Benami Transactions (Prohibition) Amendment Act 2016:

- In July 2016, “The Benami Transactions (Prohibition) Amendment Act, 2016″ was enacted.

Defined Benami Transactions

- Where a property is transferred to or is held by a person and the consideration for such property has been provided by another person.

- Transaction or arrangement in respect of a property carried out or made in a fictitious name.

- Transaction or arrangement in respect of a property where the owner of the property is not aware of or denies knowledge of such ownership.

- Transaction or an arrangement in respect of a property where the person providing the consideration is not traceable or is fictitious.

Defined the Benamidar –

- ‘Benamidar’ implies a person or a fictitious person, in whose name a benami property is transferred or held.

- Law provides that a Benamidar cannot re-transfer the benami property held by him to the beneficial owner.

Scope of the term ‘Property’ –

- It may be movable or immovable, tangible or intangible, and corporeal or incorporeal.

Power of Authorities –

- Provides for an Appellate Tribunal to hear appeals against any orders passed by the Adjudicating Authority.

- Appeals against orders of the Appellate Tribunal will lie to the high court.

- The special court should conclude the trial within six months from the date of filing of the complaint.

The prescribed authorities under the Act have very wide powers –

- Discovery and inspection.

- Enforcing the attendance of any person, including officers of banking, financial institution, any other intermediary or reporting entity.

- Authority to instruct to produce the books of accounts.

- Receiving evidence on affidavits.

- Confiscation of benami property – The Act empowers the authorities to provisionally attach properties.

- Once it is adjudicated that a property is benami, it can be confiscated by the Central government.

Penal consequences –

- A person found guilty of the offence of benami transaction can face rigorous imprisonment from one to seven years.

- Fine is also levied up to 25% of the fair market value of the property.

Source: Indian Express

Syllabus

- Prelims- Current affairs

- Mains-GS 3 (Economy – Development)

Context:

- It took the COVID-19 pandemic to expose the precariousness of human society across the world. As the importance of social security came into focus after the major waves of the pandemic, the debate on universal basic income (UBI) began to resurface in policy circles across the globe.

What is UBI?

- Universal basic income (UBI) is a government program in which every adult citizen receives a set amount of money regularly.

- The goals of a basic income system are to alleviate poverty and replace other need-based social programs.

- Economic Survey of India 2016-17 has advocated the concept of UBI as an alternative to the various social welfare schemes to reduce poverty.

Arguments in Favour of UBI:

- UBI will treat the beneficiaries as agents, and will allow them to use the money in the manner they see best, for their benefits. The Government will stand to respect, rather than dictate, individuals’ choices.

- According to NSS 2011-12, there is a shortfall of allocation of welfare to poorer regions, and hence, there is lower per capita income in these regions as compared to other districts.

- These direct transfers will ensure that there is no encroachment by the intermediaries and bureaucrats on the grants to be received by people.

- An increase in income will help financially instable people to gain access to credit provided by banks, which was earlier constrained due to low levels of income.

- It will release them from the sufferings produced by the moneylenders.

- The JAM (Jan-Dhan, Aadhaar and Mobile)infrastructure can supplement the implementation of UBI and lead to greater efficiency and transparency.

- The Pradhan Mantri Jan Dhan Yojana has been successful in opening more than 26 Crore bank accounts which will ease the procedure for direct transfer of the grant.

- The Aadhaar and Mobile infrastructure can assist in maintaining identity records and easing transactions for individuals respectively.

- The current labour market is terribly un-free because it relies on coercion, workfare, sanctions, draconian anti-labour legislation The introduction of Universal Basic Income would create a much freer labour market.

- UBI will ensure that the people achieve basic capabilities in terms of health, education, and minimum income.

- When government intervenes in the market to influence the prices, as in PDS, the outcomes are either unintended or less than optimal.

- It is also expected that UBI will lead to expansion of economy’s output. Most existing welfare schemes in India are part of government’s transfer payments to the public.

- the Pradhan Mantri Kisan Maan-Dhan Yojana (PM-KMY) and the PM-KISAN scheme is availed by about 120 million farmers. Atal Pension Yojana (APY) benefits 40 million people.

- Pradhan Mantri Shram Yogi Maandhan Yojana (PM-SYM) has about five million beneficiaries while there are about 50,000 beneficiaries under the National Pension Scheme for Traders and Self-Employed Persons (NPS-Traders) scheme.

- The largest unorganised sector income security programme is the scheme under the Mahatma Gandhi National Rural Employment Guarantee Act/ NREGS which has about 60 million beneficiaries.

Arguments against Universal Basic Income:

- The major concern with UBI is its fiscal implications.

- It is estimated that a transfer of 10000 per capita per annum under UBI will cost around 10%of GDP to the exchequer whereas all current welfare schemes putting together costs only 5.2% of GDP.

- There is a grave concern that UBI will distort the labor markets, as an easy income in hand received regularly by workers will discourage them to work.

- The Patriarchal stereotype further highlights that the grant received will be spent by men on temptation goods such as tobacco, alcohol, etc.

- This becomes crucial because where earlier the welfare programs allocated funds for different utilities, UBI will end up substituting utilities with temptation goods.

- One unnoticed issue is that of inflation. While food subsidies are not subject to fluctuations in the market prices, the basic income is highly vulnerable to inflationary pressures.

- In addition, the banking infrastructure density in the rural areas is very poor. Reports say that less than 60% of the Jan Dhan Accounts are linked with Aadhaar, which can lead to inconsistency in identification of individual.

- There is also a fear that the scheme might be abused by the political class to win elections.

India’s Pilot Project, Madhya Pradesh

- In 2011, SEWA, funded by UNICEF, conducted a pilot study of Universal Basic Income in 8 villages of Madhya Pradesh for 18 months.

- Most villagers did not prefer subsidies (covering rice, wheat, kerosene, and sugar) as a result of the basic income experience. They chose cash transfers over subsidies.

- Many people used the money to improve their housing infrastructure by building roofs and walls, toilets, etc.

- This meant reduced number of diseases emanating from dirty surroundings, which indirectly reduces their expenditure on fighting such diseases. It was also reported that nutrition level improved, particularly among the Scheduled Castes (SCs) and the Scheduled Tribes (STs).

Though there are many valid concerns but with superseding benefits of better implementation, reduced corruption, reduced leakages, less administrative costs, less red-tapism, better targeting, improved social well-being, the UBI concept can certainly flourish in the Indian economy.

The practical difficulties need to be addressed first before policymakers try to implement the complete UBI policy. As a solution, the introduction of UBI should be done in a gradual manner.

The policymakers must, therefore, evaluate all its pros and cons with accurate measures and statistics, before bringing this paradigm shift.

Note:

Universal Basic Insurance

- The other UBI, i.e. universal basic insurance, is also important.

- The insurance penetration (premium as a percentage of GDP) in India has been hovering around 4% for many years compared to 17%, 9% and 6% in Taiwan, Japan and China, respectively.

- Though the economy largely remains informal, data of that informal sector are now available both for businesses (through GSTIN) and for unorganised workers (through e-Shram).

- This data can be effectively utilized until the Indian economy grows to have adequate voluntary insurance, thus social security can be boosted through the scheme of universal basic insurance.

Source: The Hindu

Syllabus

- Prelims-Current Affairs

- Mains-GS 2(Governance); GS 3 (Economy)

Context: The Competition (Amendment) Bill, 2022 aims to improve regulatory set-up by increasing the Competition Commission of India (CCI)’s accountability, giving it flexibility and enforcement efficiency.

- It seeks to amend the Competition Act, 2002

The key changes proposed by the Bill include:

Regulation of combinations based on transaction value:

- The Act prohibits any person or enterprise from entering a combination which may cause an appreciable adverse effect on competition. Combinations imply mergers, acquisitions, or amalgamation of enterprises.

- The Bill expands the definition of combinations to include transactions with a value above Rs 2,000 crore.

Definition of control for classification of combination:

- For classification of combinations, the Act defines control as control over the affairs or management by one or more enterprises over another enterprise or group.

- The Bill modifies the definition of control as the ability to exercise material influence over the management, affairs, or strategic commercial decisions.

Time limit for approval of combinations:

- The Act specifies that any combination shall not come into effect until the CCI has passed an order or 210 days have passed from the day when an application for approval was filed, whichever is earlier. The Bill reduces the time limit in the latter case to 150 days.

Anti-competitive agreements:

- Under the Act, anti-competitive agreements include any agreement related to production, supply, storage, or control of goods or services, which can cause an appreciable adverse effect on competition in India.

Settlement and Commitment in anti-competitive proceedings:

- Under the Act, CCI may initiate proceedings against enterprises on grounds of: (i) entering into anti-competitive agreements, or (ii) abuse of dominant position.

- The Bill permits CCI to close inquiry proceedings.

- The manner and implementation of settlement and commitment may be specified by CCI through regulations.

Relevant product market:

- The Act defines relevant product market as products and services which are considered substitutable by the consumer. The Bill widens this to include the production or supply of products and services considered substitutable by the suppliers.

Appointment of Director General:

- The Act empowers the central government to appoint a Director General to CCI. The Bill amends this to empower the CCI to appoint the Director General, with prior approval of the government.

Qualification of members of CCI:

- As per the Act, the chairperson, and members of CCI should have professional experience of at least 15 years in fields such as: (i) economics, (ii) competition matters, (iii) law, (iv) management, or (v) business. The Bill expands this to include experience in the field of technology.

Decriminalisation of certain offences:

- The Bill changes the nature of punishment for certain offences from imposition of fine to penalty. These offences include failure to comply with orders of CCI and directions of Director General about anti-competitive agreements and abuse of dominant position.

The Bill introduces certain new concepts into the field of Indian competition law, including Deal Value Thresholds, the changes to the definition of ‘control’, and mechanisms to settle certain violations of the Competition Act.

To increase the ease of doing business in India within the regulatory framework of the Competition Act, the CCI will need to provide timely guidance on the various concepts introduced in the Bill, and work together with all stakeholders to implement it.

Competition Commission of India

- Competition Commission of India (CCI) is a statutory body of the Government of India responsible for enforcing the Competition Act, 2002, it was duly constituted in March 2009.

- Competition Act prohibits anti-competitive agreements, abuse of dominant position by enterprises and regulates combinations, which causes an appreciable adverse effect on competition within India.

- In accordance with the provisions of the Amendment Act, the Competition Commission of India and the Competition Appellate Tribunal have been established.

- The government replaced the Competition Appellate Tribunal (COMPAT) with the National Company Law Appellate Tribunal (NCLAT) in 2017.

Composition

- The Commission consists of one Chairperson and six Members who shall be appointed by the Central Government.

- The commission is a quasi-judicial body which gives opinions to statutory authorities and also deals with other cases. The Chairperson and other Members shall be whole-time Members.

Functions and Role of CCI

- To eliminate practices having adverse effects on competition, protect the interests of consumers and ensure freedom of trade in the markets of India.

- To give opinion on competition issues on a reference received from a statutory authority

- To undertake competition advocacy, create public awareness and impart training on competition issues.

- Consumer Welfare: To make the markets work for the benefit and welfare of consumers.

- Ensure fair and healthy competition in economic activities in the country for faster and inclusive growth and development of the economy.

- Implement competition policies with an aim to effectuate the most efficient utilization of economic resources.

Source: The Hindu

Syllabus

- Mains – GS 3 (Economy – Infrastructure)

In News: Annual installation of new wind power projects in India will peak by 2024 and likely decline thereafter, according to a report released by the Global Wind Energy Council (GWEC) and MEC+, a consulting firm that specialises in renewable energy.

About:

- As part of its transition away from fossil fuels, India has committed to sourcing half its electricity in 2030 from non-fossil fuel sources and installing 60 gigawatt (GW, or 1000 MW) of wind power by 2022.

- So far, only 40 GW of wind power capacity has been established.

- Wind industry installations have been slowing down in India since 2017.

- Only 1.45 GW of wind projects were installed in 2021 with many delayed due to the second wave of COVID-19 and supply chain-related disruptions.

Source: The Hindu

Daily Practice MCQs

Q.1) He was one of the founding members of Ghadar party, reached out to Bhikaji Cama in Paris, and met with Vladimir Lenin in Russia seeking support for the Indian cause.He was inspired by Bala Gangadhara tilakandwas an ardent admirer of the French Revolution and of the American War of Independence.

He was?

- Aurobindo Ghosh

- Pandurang Khankhoje

- Bipin Chandra Pal

- Motilal Nehru

Q.2) Per and polyfluoroalkyl substances (PFAs),suspected to cause decreased fertility, developmental effects in children, increased cholesterol levels and increased risk of some cancers, are generated as environmental pollutants from which of the following?

- Making of non-stick cookware

- Textile Industries

- Cosmetic industries

- Paper Industries

Select the correct answer using the code given below:

- 1, 2 and 3 only

- 1, 2 and 4 only

- 2, 3 and 4 only

- 1, 2, 3 and 4

Q.3) Consider the following pairs:

Ports and countries

- Qingdao – South Korea

- Chabahar – Iran

- Shenzhen – China

- Jebel Ali -UAE

How many pairs given above is/are correctly matched?

- One pair only

- Two pairs only

- Three pairs only

- All four pairs

Comment the answers to the above questions in the comment section below!!

ANSWERS FOR ’25th August 2022 – Daily Practice MCQs’ will be updated along with tomorrow’s Daily Current Affairs.

ANSWERS FOR 24th August 2022 – Daily Practice MCQs

Q.1) – d

Q.2) – c

Q.3) – b