Q1) Consider the following pairs:

| National Park |

Location |

| 1.Eravikulam National Park |

Tamil Nadu |

| 2.Similipal National Park |

Madhya Pradesh |

| 3.Silent Valley National Park |

Karnataka |

How many of the above pairs are correctly matched?

- Only one

- Only two

- All three

- None

Q2) Consider the following statements

Statement-I:

UN Convention on the International Effects of Judicial Sales of Ships was adopted in 2022.

Statement-II:

The convention is also known as the Beijing Convention on the Judicial Sale of Ships.

Which one of the following is correct in respect of the above statements?

- Both Statement-I and Statement-II are correct and Statement-II is the correct explanation for Statement-I

- Both Statement-I and Statement-II are correct and Statement-II is not the correct explanation for Statement-I

- Statement-I is correct but Statement II is incorrect

- Statement-I is incorrect but Statement II is correct

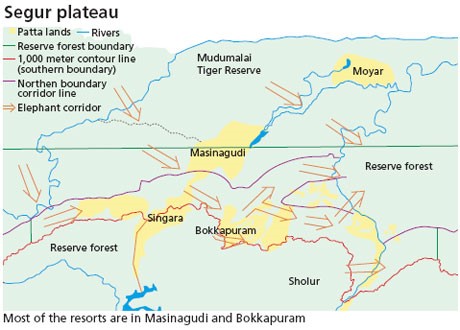

Q3) With reference to the Segur elephant corridor, consider the following statements:

- It connects the Western and the Eastern Ghats.

- It has the Nilgiri Hills on its northeastern side.

- Moyar River Valley is on its southwestern side.

How many of the statements given above are correct?

- 1 only

- 1, 2 and 3 only

- 2 and 3 only

- 1 and 3 only

Mains Practice Questions

Q.1) How does Al help clinical diagnosis? Do you perceive any threat to privacy of the individual in the use of Al in healthcare? (250 words)

Q.2) What are the key reasons behind India’s low global ranking in terms of women’s political participation? Explain how the Women’s Reservation Bill could address these challenges and empower women in Indian politics. (250 words)

Comment the answers to the above questions in the comment section below!!

ANSWERS FOR ’ 20th September 2023 – Daily Practice MCQs’ will be updated along with tomorrow’s Daily Current Affairs.st